Chinese influence in Latin America will increase

China has played an important role in Latin America’s response to the COVID-19 pandemic and its economic fallout

When COVID-19 hit Latin America in late March, Chinese actors from the public and private sector mobilised a wave of donations of medical supplies and equipment across much of the region. This robust response, which contrasts with low-key and smaller-scale US reactions, is a testament to China’s economic and diplomatic standing, which in recent years has become more generalised in the region.

What next

China will look to capitalise on the goodwill generated in recent months to advance its strategic objectives in Latin America. While the immediate economic fallout of COVID-19 has forced cuts in Chinese lending and investment, China views Latin America as a critical market for digital technology and will remain a major player in its large infrastructure projects. Both sectors are critical for the region’s medium-term recovery.

Subsidiary Impacts

- China’s regional footprint will continue to transform towards technology-intensive sectors and private-sector-driven engagement.

- Governments will need to be more strategic to seize opportunities while limiting environmental, social and security risks.

- Latin American countries will increasingly find themselves caught in the middle of US-China tensions.

Analysis

Until the early 2000s, Chinese trade and investment played a marginal role in Latin American economies, and political and diplomatic relations were an afterthought.

Two decades later, China is the number one trade partner for six Latin American countries, including economic powerhouses Brazil and Chile, and a key source of foreign direct investment (FDI) and financing for major infrastructure projects (see LATIN AMERICA/CHINA: US policy shifts create openings - March 3, 2017). On the diplomatic front, China's influence rivals that of the United States in much of the region, and 19 countries have signed Belt and Road Initiative (BRI) agreements.

It is therefore no surprise that China has been a factor in many aspects of the region's pandemic response and recovery.

Medical diplomacy

As COVID-19 cases spiked in Latin America, Chinese actors -- ranging from the foreign ministry to municipal governments, state-owned enterprises and private firms and foundations -- announced donations or shipments of medical supplies and equipment.

As of August, China had made over 250 such commitments across the region, according to the think tank Inter-American Dialogue. China's foreign minister also promised USD1bn in loans for regional governments to secure eventual Chinese-made vaccines.

Chinese officials also engaged in a coordinated campaign of public diplomacy to trumpet their support.

Trade, investment and financing

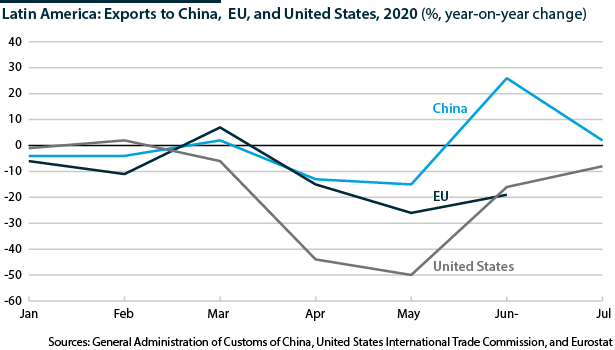

Driven by China's quick return to economic activity, Latin America's exports to China have been resilient during the pandemic, in contrast with those to the United States and EU. In June, the region's sales to China were up 25% year-on-year, providing a much-needed boost to the region's ravaged economies.

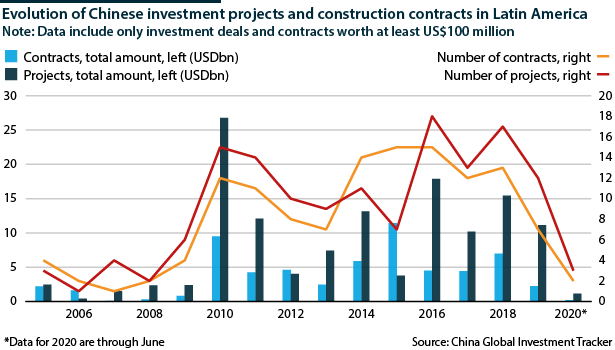

Chinese lending and investment, on the other hand, has been more affected by the economic fallout of the pandemic. In the first half of the year, China only invested in two greenfield projects above USD100mn in the region compared to six such projects in the first half of 2019.

Similarly, construction contracts awarded to Chinese firms, an important pillar of China's activities in Latin America, fell from four contracts worth USD1.22bn in the first half of 2019 to two contracts worth US220mn in the first half of this year.

To some extent, this drop continues a multiyear trend: the number and total amount of construction contracts, in particular, have been on the decline since 2016.

This trend is also evident in Chinese lending. Loans to Latin America from China's two major policy banks -- the Export-Import Bank of China and the China Development Bank (CDB) peaked in 2015 at an estimated USD21.5bn and then declined precipitously, falling to USD1.1bn in 2019. Around 90% of financing from these institutions is tied to specific energy, mining and infrastructure projects.

This decline can be explained partly by the shift in Chinese engagement away from state-to-state relations with ideologically friendly governments such as Venezuela -- by far Latin America's largest recipient of CDB and Export-Import Bank loans -- in favour of more market-driven ties with a broader range of countries.

In recent years, technology firms such as Alibaba, Tencent and Didi Chuxing, as well as carmaker JAC, have been major investors in the region.

Potential backlash

At the same time, China has faced heightened scrutiny of its lending practices in developing countries, especially surrounding BRI projects. Officials from participating countries in Africa and Asia and China-watchers have called for debt relief as the pandemic ravaged public finances and cut off capital flows to developing regions.

Ecuador, the Latin American country with the largest Chinese debt burden in relative terms, announced the restructuring of nearly US900mn of debt with Chinese banks earlier this month.

While Chinese officials have rejected calls for debt forgiveness, further restructuring of loans to some Latin American countries will surely be on the table.

Pandemic medium-term impacts

As the acute economic effects of the pandemic subside, China will emerge well-positioned to deepen its economic and diplomatic ties in the region.

Digital technologies

The pandemic has shone a spotlight on the region's deficit in digital connectivity, where China aims to play a leading role building out network infrastructure and developing cutting-edge digital tools for governments and firms.

Huawei already has a major presence in Brazil, Uruguay, Argentina and other Latin American countries, thanks to its lower-cost, cutting-edge technology. Huawei views Latin America as a key market to deploy its 5G technology, which remains relatively undeveloped in the region: only five networks using 5G technology were deployed there as of June 2020.

US warnings will not prevent deepening Chinese ties even with US allies

US warnings over security risks in Chinese infrastructure have not swayed regional governments. Even the Brazilian government, a staunch ally of the Trump administration, has thus far resisted US pressure to exclude Huawei from a major 5G auction scheduled for 2021 (see BRAZIL: Huawei 5G role prompts diplomatic pressures - April 23, 2020).

Infrastructure and construction

Many countries in the region are also betting on the infrastructure and construction sectors to pull their economies out of deep recessions.

Despite a drop in recent years, China remains an important partner in this area. Its footprint is also expanding to countries traditionally oriented towards the United States such as Mexico and Colombia, where Chinese firms have won a string of major contracts in the last two years. Headline examples include the first line of Bogota's metro system and a high-profile tourism train line through the Yucatan peninsula (see MEXICO: Maya Train poses major challenges - August 15, 2019).

Growing US-China tensions

The sharpening of tensions between the United States and China, exacerbated during the pandemic, will increasingly force regional actors into difficult decisions. Geopolitical pressure surrounding digital infrastructure is one example. Another is the controversial recent election of a US citizen focused on countering Chinese influence as the next president of the InterAmerican Development Bank (IDB) (see LATIN AMERICA: IDB leadership vote may break tradition - July 20, 2020).

US efforts to promote the reshoring or nearshoring of production -- in which Latin American governments may be recruited as allies -- could also put the region in the middle of the Sino-American rivalry.

There is still much room for China-Latin America economic and political relations to grow

Still, China's coordinated diplomatic and economic strategies in the region offer benefits the United States has been unable or unwilling to match. At the same time, growing hostility towards Chinese investment in Washington and Europe makes Latin America increasingly attractive for Chinese firms looking to expand globally.