Stock market moves will not shake Beijing's resolve

Moves to put a floor under the stock market do not take economic reforms off the table

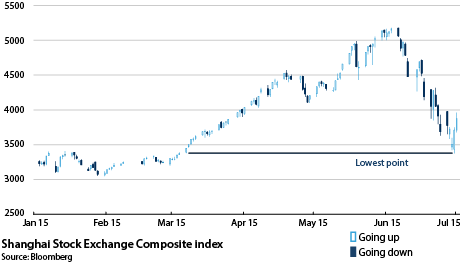

The Shanghai Composite Index rose 4.5% today, continuing a 5.8% rise yesterday, in response to a raft of government measures to support falling stock prices. Yet the volatile index is still 24.9% down on its June 12 peak. Beijing's supportive policies are likely to stabilise the market, and structural tailwinds will probably reflate it eventually. Stock market volatility is likely to have limited ramifications for the wider economy unless it is prolonged.

What next

Beijing's moves to shore up the stock market show that the top priority is avoiding a hard landing. Such aggressive state intervention reflects 'stability bias', but does not signify that the longer-term economic reform agenda has been abandoned.

Subsidiary Impacts

- Downward pressure will last until margin traders have unwound their positions, a mechanical process over which Beijing has little control.

- Foreign-listed Chinese firms may reconsider plans to de-list abroad and re-list in China.

- Capital account and currency liberalisation will resume, in pursuit of Beijing's goal of achieving IMF reserve currency status.

Analysis

On June 12 China's main equity market, the Shanghai Composite Index (SCI), peaked at 5,166, a 152% increase from a year earlier. This had made the SCI the best-performing bourse in the world and encouraged many new investors to jump into the market.

45mn

New trading accounts created in the first five months of 2015

According to official data, nearly 45 million new trading accounts were created in the first five months of 2015, compared with 16 million new accounts created in the whole of 2014.

The bull run was felt to be encouraged by the government, which viewed a surging stock market as strengthening confidence in the economy as GDP growth slows.

Increased equity funding was also seen as positive in helping to alleviate financing difficulties for heavily indebted firms. Articles in the People's Daily and other official media praising the market's performance helped to encourage speculation that the government backed the market.

No tie to fundamentals

The performance of China's stock market has never been closely tied to economic or corporate fundamentals (see CHINA: Stock exchanges will resist market forces - August 22, 2013) and (see INTERNATIONAL: Central banks will drive equity markets - June 5, 2015).

It is dominated by retail investors, who make up approximately 85% of the market by value, a much higher percentage than in other major markets where professional investors play a much greater role.

85%

Retail investors' share of market by value

Most retail investors are relatively new to the market and have little financial acumen. As such, it has been subject to sharp swings as investors pile in when the market rises and jump off quickly when prices start to drop.

Margin mayhem

Volatility has increased in the past year as margin financing, which allows investors to buy stocks with borrowed money, has become more prominent. Margin financing may account for as much as one-fifth of all money in the market -- and this may understate the amount of borrowed money in the market, as many companies are thought to have taken out loans to buy equities.

The build-up in margin financing meant that any downturn in the market had the potential to spiral quickly out of control because as prices fall, lenders demand that investors pay back their debts. The easiest way for most investors to do this is to sell the shares that they had purchased, which then further depresses prices and increases calls for investors to cover their debts.

On June 15, the SCI lost 2%. Prices fell quickly and by the June 19 had fallen 13.3% compared to June 12.

Reluctant response

At first the authorities did little to halt the slide, but after two weeks, with the SCI down 18.1% in two weeks and anxieties mounting, the central bank on June 28 cut its one-year benchmark lending and deposit rates by 25 basis points each to 4.85% and 2.00% and reduced reserve ratio requirements for most financial institutions.

In the week following, regulators cut transaction fees and further relaxed rules on margin lending in an effort to get more money into the market.

These measures had little effect, in part because they could do little to combat the dynamic on margin investors described above. The SCI tumbled another 12%.

Second strike

Premier Li Keqiang called an emergency meeting on July 4-5, at which the government decided on aggressive actions to shore up the market. These included:

- suspending initial public offerings;

- relaxing rules for insurance companies buying stocks;

- prohibiting state-owned companies from selling their shareholdings; and

- forbidding shareholders holding more than 5% of a company's stock from selling their shares for at least six months.

The central bank would also lend 260 billion renminbi (42 billion dollars) to the China Securities Finance Corporation, which would funnel it into 21 brokerages so that they could purchase equities.

These measures appear to have soothed investor sentiment. The SCI by June 8 surpassed where it had been before the government announced the measures.

Striking a balance

The government's response to the sharp decline in equity prices sheds light on its approach to economic management. The minimal response over the first two weeks was evidence of commitment to liberalising the financial system, and preference for not intervening in markets.

However, the government is also risk-averse and values stability above all. As fears mounted that falling stock prices could cause wider economic disruption, it took action to shore them up. Having vowed to arrest the freefall, government credibility was on the line, which is why more aggressive measures followed.

Economic fallout

There are several reasons to think the impact of the stock market volatility on the wider economy will be limited:

- The SCI has now fallen back to what it was in March; long-term investors have still made money on shares bought before then.

- Just 5-10% (or less) of the population are exposed to the market (compared to 54% of the population in the United States).

- Most Chinese retail investors are relatively wealthy and it seems very unlikely that most will have invested their 'life savings'.

- Meanwhile, companies mostly depend on bank financing, with equities accounting for only around 5% of private sector fundraising.

5%

Share of private-sector financing supplied by equities

Deeper drivers

Despite the recent downturn, structural factors ultimately bode well for a reflation of China's stock market. Since the proportion of the public who currently invest is so small, the number of domestic retail investors is likely to increase as the middle class grows. Global institutional investors, meanwhile, are still underweight in Chinese equities given the size of the Chinese market.

Reform resolve

The recent volatility is also unlikely to hinder financial sector reforms seriously. Assuming that markets stabilise soon, economic technocrats will be able to fend off arguments from conservative elements that reforms are too destabilising.

Furthermore, Beijing has made inclusion in the IMF's special drawing rights (SDR) currency basket a public goal, tying it to efforts to promote China's global standing. This will only be possible if China further liberalises its financial system (see CHINA: Renminbi internationalisation will gather pace - May 20, 2015).

As such, unless is there is a much sharper economic slowdown, progress on capital account liberalisation and renminbi convertibility is still likely later this year.

_350.jpg)