Greek debt deal will bring fresh elections soon

The government has won the vote in parliament on its bailout but now faces a confidence vote after August 20

Parliament this morning approved a third bailout package worth 85 billion euros (95 billion dollars) over three years. The new programme will support recapitalisation of the banking system, allow orderly -- rather than fire-sale -- divestment of state-owned assets and promote liberalisation of the energy market. In exchange, Greece must implement 'prior actions', which include extensive changes to the tax system (already itemised) and to pensions and labour law (yet to be finalised). The rigour of the reforms makes it almost certain that the government will call fresh elections to reinforce its mandate.

What next

Greece's euro-area partners are expected to approve the deal today, although there have been mutterings from senior German politicians that the process has been rushed and Greece should be offered another bridging loan to meet the ECB repayment, while the package is nailed down in minute detail. Acceptance is also expected to trigger efforts to tackle the issue of Greek debt, currently around 320 billion euros. The deal has caused a rupture within ruling Syriza, likely precipitating elections as early as September.

Subsidiary Impacts

- Germany wants no write-down in Greek debt's face value but longer maturities and lower interest rates, which could have comparable effect.

- It also wants IMF involvement in the deal, but the Fund will not make up its mind until after the first programme review in October.

- If a 20-billion-euro first tranche is released by August 19, it will meet outstanding obligations, including an ECB repayment on August 20.

Analysis

The size of the loan package is ten times that sought by the Greek government in July, after it abandoned months of manoeuvring to evade euro-area financial oversight and acquiesced in negotiating a new programme (see GREECE: Syriza is likely to win autumn elections - July 17, 2015). It is accompanied by a 39-point list of contentious economic reforms, not all of which have been detailed in full.

This flies in the face of a July 5 referendum, in which 61.3% of the Greek electorate voted for an end to austerity (see GREECE: Government to seek end of austerity, not euro - July 6, 2015). Yet early today, the government easily carried a motion to accept the new deal, by 222 votes in the 300-seat house. This required the support of the three main opposition parties -- conservative New Democracy, centre-left Pasok and centrist To Potami, which command 106 votes between them.

Syriza rebellion

Of Syriza members, 43 either voted against, abstained or failed to attend. This reduced the level of support for the coalition government from 149 Syriza and 13 Independent Greeks to just 116. A government needs at least 120 votes to win a confidence motion. Last time, some three-dozen deputies dissented.

Syriza's rebellion was greater than anticipated

The Syriza central committee will hold a party congress in September. It was widely assumed that, after this effort at party consolidation, fresh elections would be held to take advantage of Syriza's high standing in opinion polls before disgruntlement sets in among the electorate as new austerity measures begin to bite.

Since the elections would take place in less than a year after last ones in January, party leader Alexis Tsipras could compile the party's candidate lists himself -- allowing him to get rid of dissenters. The size of the rebellion has made this difficult.

A group of 13 left-wing deputies, headed by former Energy Minister Panayiotis Lafazanis, has signed a memo adumbrating a breakaway 'Unionist movement for democracy and justice'.

Economic assumptions

The agreement foresees GDP contracting, not by up to 4.0% as estimated earlier, but by just 2.1-2.3% in 2015 and 0.5% in 2016.

Agreement's economic assumptions are optimistic

Preliminary estimates of second-quarter growth produced yesterday by state statistical agency Elstat showed quarter-on-quarter real growth of 0.8% (1.4% year-on-year), with first-quarter results inching up over an earlier projection of minus 0.02% to 0.0%. This has prompted suggestions of an annual contraction of as little as 2% year-on-year.

However, the data relate to the quarter before the closure of Greece's banks (see GREECE: Terms of third bailout will depress economy - July 20, 2015). The closure's effect has not yet been properly assessed, but it will have had a dire effect on an economy driven by consumption.

The agreement expects a subsequent return to growth, depending upon the amount of resources that can be directed towards development by the state and the banking sector. The government stresses that this will be aided by its insistence on narrower fiscal surpluses over the next four years, amounting to a cumulative 11% of GDP.

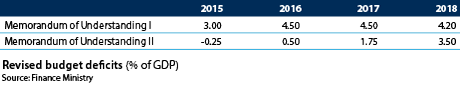

The previous agreement had foreseen a primary surplus of 3% of GDP this year, rising above 4% in 2016 and remaining at that level until the decade's end. The new agreement posits a 0.25% deficit this year, climbing to 3.5% by 2018.

Details of agreement

There are four main headings to the agreement:

Tax reform

Tax changes will affect such hitherto-protected sectors as farming, tourism and shipping. Farmers, who have received privileged treatment by governments of all persuasions, will feel the biggest bite:

- Income tax rates will rise next year to 20% (from 13%) and in 2017 to 26%.

- Advance payments (according to deemed income) will double to 55.0% from 27.5%.

- The tax on farm diesel, now heavily subsidised, will rise to 330 euros/1,000 litres by October 2016 from 66 euros.

Among other tax changes, there will be:

- an end to reduced value-added tax rates for island communities by 2017, with an overhaul of the collection methodology for the rest of the country;

- a doubling to 4% of the tonnage tax on Greek-registered vessels by 2020;

- a hike in corporation tax to 28% from 26% (with a view to an increase to 29% in the event of shortfalls); and

- a 100% advance payment of deemed tax liabilities for the self-employed with an end to a discount for paying tax all at once instead of by instalment.

Banks

Banks will be recapitalised by 25 billion euros -- 10 billion immediately and 15 billion as soon as an asset-quality review is completed and new business plans drafted. The Hellenic Financial Stability Fund will hold the new shares, with the right to appoint three independent directors but not to intervene in daily operations.

The government is anxious to complete this process before year-end, when the Bank Restructuring and Resolution Directive takes effect, requiring depositors to be bailed in under any restructuring process.

Energy

The state-controlled Public Power Corporation (DEI) must cut its nearly 98% market share in wholesale and retail electricity consumption to no more than 50% by end-decade. This is to allow independent power producers, currently supplying only heavy-industry users, to compete on a broader front.

Privatisation

A sovereign wealth fund is to be created holding 50 billion euros in state assets. These will either be privatised or managed to generate better value for the state. Three major assets are to be sold: Piraeus Port Authority (October), rail company TrainOSE (December) and Thessaloniki Port Authority (February 2016). Their sales are to raise at least 6.4 billion euros by 2017.

Fund proceeds are to be split between funding bank recapitalisation (50%), growth-inducing investments (25%) and paying down debt (25%).

_350.jpg)