Iran nuclear deal uncertainty may deter EU investors

The reimposition of US sanctions would have a modest impact on US businesses but hurt European investors

Iran is complying with the terms of the 2015 nuclear deal, the International Atomic Energy Agency said in a report published yesterday. US President Donald Trump declined to certify on October 13 that continued sanctions relief for Iran under the Joint Comprehensive Plan of Action (JCPOA) is in the US national interest. Reintroducing nuclear-related sanctions targeting third-country companies doing business with Iran -- ‘secondary sanctions’ -- could have a significant impact on European investments in Iran.

What next

Congress is unlikely to reimpose nuclear-related sanctions at this stage but US economic and diplomatic pressure on Tehran will increase. European diplomats and business executives will lobby Congress and the White House to maintain the deal while devising contingency plans for its demise. A key question is what Trump does when the waivers of statutory sanctions next fall due.

Subsidiary Impacts

- With financing a requirement for business engagement, banks’ hesitation to engage with Iran will curb European investments.

- Transatlantic sanctions policy coordination is likely to deteriorate further, with the private sector caught in the crossfire.

- High-value hydrocarbons and aircraft contracts may make investing in Iran worth the risk for large firms, but other sectors may not follow.

Analysis

The implementation of the JCPOA began in January 2016, when sanctions on Tehran were relaxed in exchange for rollbacks in Iran's nuclear capabilities.

The agreement facilitated comprehensive termination or suspension of UN and EU sanctions, while US sanctions removal has been more modest (see IRAN/US: US policy will threaten the nuclear deal - December 2, 2016).

A US trade embargo on Iran remains in place, with limited exceptions authorised by licences. Primarily affected by the JCPOA are US secondary sanctions imposed over Iran's nuclear activity, which the United States has "ceased to apply".

These sanctions need to be waived periodically (every 120-180 days), which has so far been done routinely.

A separate piece of US legislation, the Iran Nuclear Agreement Review Act (INARA), requires the president periodically (every 90 days) to certify to Congress that Iran is fulfilling its commitments under the deal and that continued waiving of sanctions is in the national interest of the United States.

In October, Trump announced that he would not offer such certification.

US Congress

The president's decision has shifted responsibility to Congress, which has 60 days to decide whether to snap back sanctions on Tehran. It has three options.

Lawmakers could decide with a simple majority vote to reinstate the nuclear-related sanctions that have been suspended pursuant to the JCPOA. This would place the United States in violation of the agreement.

They could also decide to do nothing, effectively leaving the deal intact.

Congress could also pursue a third option and consider legislation to amend INARA and propose a framework for reopening negotiations on the JCPOA, with the hope of adding more teeth to the deal. A proposal for such legislation has been issued by Senators Bob Corker and Tom Cotton.

Such legislation would require 60 votes in the Senate. With a slim Republican majority and substantial internal discord within the party on the matter, this is highly unlikely.

It is unlikely that Congress will reimpose sanctions or reopen the JCPOA

Many lawmakers who opposed the JCPOA and remain sceptical of it concede that pulling out of the accord would damage the United States. There is also significant disagreement among lawmakers over how to address perceived shortcomings.

It is unlikely that Congress will vote to reimpose nuclear-related sanctions on Iran or seek to reopen the JCPOA, yet pressure is building to address Iranian non-nuclear activities. Sanctions targeting its ballistic missile programme, human rights record and regional activities are likely.

EU policy

European leaders have signalled strong disagreement with the Trump administration over the JCPOA (see EU: Leaders’ approaches to Trump will vary - August 17, 2017).

EU foreign policy chief Federica Mogherini issued a stark statement stressing that the JCPOA is an international agreement endorsed by the UN and accordingly "does not belong to any single country and it is not up to any single country to terminate it".

The leaders of Germany, France and the United Kingdom also issued a joint statement in full support of the agreement and its continued implementation.

EU representatives have swarmed to Capitol Hill to express their support for the agreement's progress. The low likelihood of reimposition of US sanctions is cause for optimism for Europeans.

Nonetheless, mindful of the lingering risks of such a prospect and concerned that US sanctions outside the JCPOA will imperil European investments in Iran, Europeans are devising contingency plans.

The European Commission has proposed to allow the European Investment Bank to operate in Iran to signal a commitment to investment in the country.

Should the United States enact legislation that damages European interests, the EU could also bring disputes to the WTO, which it threatened to do in response to the Iran and Libya Sanctions Act enacted by Congress in 1996.

Another option would be to revive 'blocking legislation' from the same period, which prohibits European businesses from complying with US sanctions.

Reviving blocking legislation could pave the way for an EU-US trade conflict

Such moves would come with a high risk and could set the EU and the United States on a path towards a trade conflict. Blocking legislation also comes with practical challenges as it would have to be enforced at state level -- which allows for uneven implementation across the EU -- and the statutes in place would have to be amended and updated.

It would probably be a political rather than legal instrument, intended to send a signal to Washington.

Because of these risks, European leaders overwhelmingly prefer to continue transatlantic coordination and implementation of the JCPOA.

European business community

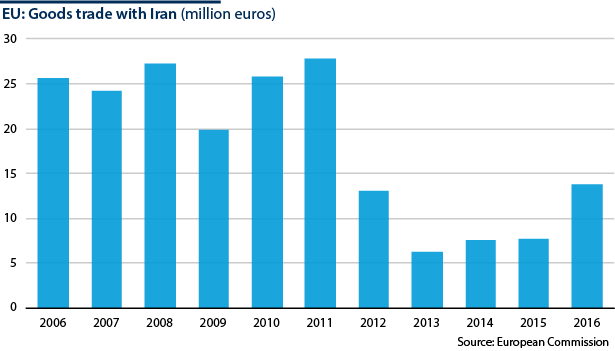

The EU was Iran's primary trading partner until 2010. Following several rounds of stringent sanctions, trade between the two decreased sharply.

This trend has been reversed following the removal of sanctions. Helga Schmid, secretary general of the European External Action Service, said last month that trade with Iran nearly doubled in the first half of 2017 from the same period in 2016.

There has been strong interest from the European business sector in entering the Iranian market. Since the implementation of the JCPOA there have been some notable commercial deals. These include French oil major Total's investment in the South Pars gas field and aircraft exports by European manufacturers Airbus and ATR.

Interest in the Iranian market is strong but investment will be modest

While interest in the Iranian market is strong, investment is likely to be modest due to the dismal investment environment in Iran and hesitation among major European banks to process transactions with Iranian entities.

European banks are heavily exposed to US capital markets and dependent on their ability to clear dollar transactions in the United States. As a result, financing for European investment in Iran relies significantly on US policy.

With uncertainty surrounding the future of the JCPOA, banks' hesitation is unlikely to diminish. As financial institutions are precursors to other business activities, European investment into Iran is likely to be modest going forward.