Policy in China still puts growth before deleveraging

China has declared its strong commitment to reducing debt risks, but is still prioritising GDP growth

China will have to sacrifice a portion of its growth if it wants to reduce its dangerous debt burden. Reducing credit growth will almost inevitably lead to an even higher reduction in GDP growth. This is a price the Chinese government is not yet prepared to pay, but it could be forced to act in the medium term if it wants to avoid a financial crisis.

What next

Due to China’s ambitious economic development goals, full-scale deleveraging action will not happen until after 2020. Monetary and fiscal policy together is unlikely to be tightened to the point where real economic growth could drop below 6.0-6.5%. Economic growth is therefore likely to remain close to or above 6.5% annually at least until 2020. Adherence to these growth goals will prevent the regulatory campaign from becoming effective. As aggregate credit levels increase, so does the risk of financial crisis.

Subsidiary Impacts

- Investors, traders, central banks and governments should prepare for continued GDP growth, but a rising risk of a sharp slowdown.

- Rating agencies should remain sceptical regarding the government’s campaign against leverage and risk.

- Foreign banks wanting to increase their business in China must interpret government statements cautiously.

- Producer prices have risen since late 2016 after a spell of deflation, boosting profits; this will continue, helping them pay their debts.

Analysis

In recent years China has become dependent on credit to generate economic growth.

Before the global financial crisis, total credit extended to non-financials was 150% of GDP. Ten years later, this has grown to over 250%.

This would not be a problem if credit was extended to projects generating large profits or laying the foundations for future growth.

However, the amount of incremental GDP being generated by one incremental unit of credit has fallen, suggesting that this is not the case.

This means that the risk of a series of defaults severely hurting the financial system has grown. The government recognises the problem and has pledged to deleverage the financial system and contain risks.

That is easier said than done: over the past 30 years credit has mostly grown at a faster pace than nominal GDP, and since the two are highly correlated, both would have to fall considerably for them to converge.

Lower growth levels would not allow the Communist Party to reach its centenary goal of doubling the size of the economy from 2010 levels by 2020.

Policy priority

The leadership's concerns about the size of, and risks in, the financial system are publicly known. President Xi Jinping and other high-ranking officials have called the containment of financial risk a priority for 2018.

Referring to real estate markets, in which prices remain dangerously high relative to incomes in many cities due to an influx of credit, the recently retired head of the People's Bank of China, Zhou Xiaochuan, expressed the sternest warning. Zhou said that if action was not taken, China could have its own 'Minsky moment' -- a collapse in asset values that follows a period of prolonged optimism (see CHINA: Local government debt risk survives reforms - February 26, 2018). Such a collapse could cause a wider crisis in which investors scramble to convert their assets into something stable.

In their speeches, many officials refer to 'animal risks'. The two most commonly mentioned are 'grey rhino' and 'black swan', which refer to foreseeable and unforeseeable events that can rattle financial markets.

The leadership seems to agree that action is needed to reduce the mountain of debt so that oversight can be improved, and to ensure that credit is not issued to finance speculative investments.

However, there is considerable pain associated with reducing overall leverage.

Paying the price

Reducing the level of indebtedness means repaying existing loans while borrowing less, allocating a smaller share of the budget to new projects and consumption and a larger share to servicing existing debt. This will reduce debt but diminish growth.

There is a much-hated name for this practice: austerity.

In China, as anywhere else, first stabilising and then reducing the ratio of credit to GDP will lower the economic growth rate considerably.

Credit growth drives GDP growth

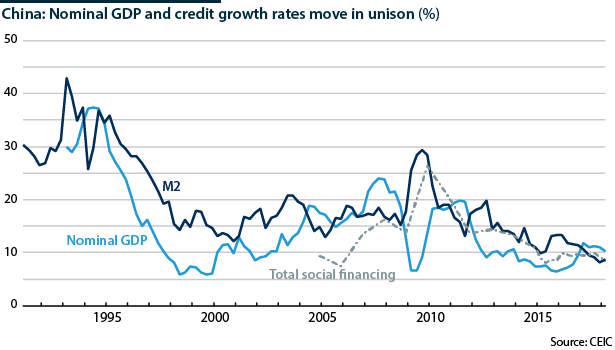

Historical data for GDP, money supply and 'total social financing' (the Chinese government's own measure of total credit in the economy) show credit and GDP moving in unison. They also show that the two measures of credit have grown faster than GDP.

The major exception was during the financial crisis in 2009 when GDP growth fell considerably and credit issuance increased following a government stimulus programme.

Recently all three fell in unison, with M2 growth falling below nominal GDP growth. However, M2 does not capture some off-balance-sheet shadow financing products which are captured in total social financing.

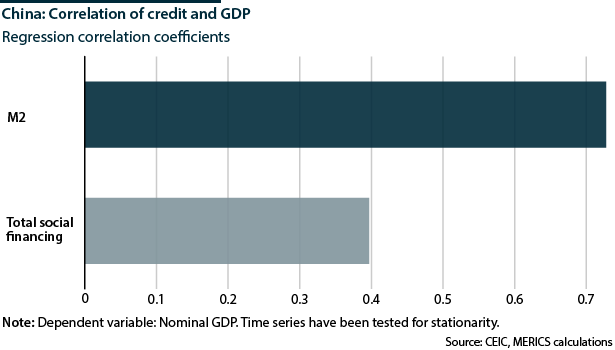

Two simple single-factor regressions can quantify the historical relationship between GDP and credit growth.

They show a positive and highly statistically significant correlation, supporting the idea that credit growth drives GDP growth. The correlation coefficient for M2 money supply is 0.73, meaning money supply explains 73% of GDP growth. Total social financing explains 40% of GDP growth (possibly lower as the time series is shorter). For both measures of credit to grow at the same pace as nominal GDP, economic growth would have to fall far below its current levels.

Half measures

The government's deleveraging campaign has reached considerable proportions, but it remains restrained by the government's continued commitment to growth (the official growth target remains at 6.5%).

The campaign has involved regulating financial markets to improve oversight and discourage risky lending. It has not led to a reduction of the ratio of credit to GDP, only to a slowdown in the growth of credit and a shift between various financing sources.

Major policy levers have not been pulled: interest rates have not been raised by much, liquidity has remained ample and implementation of new rules for wealth management product issuance has been pushed back past 2020.

Growth still comes first

Policymakers in China are aware of the relationship between growth and credit issuance. They would like to reduce the overall level of indebtedness so that oversight can be improved, but the 2020 targets supersede their other concerns (see CHINA: Sustainable growth initiatives will dampen GDP - January 19, 2018).

Attaining these goals requires real annual GDP growth of 6.4 percent. This means that nominal GDP must grow at even higher rates, since inflation will not be zero. If the leadership were to introduce policies to reduce the credit-to-GDP ratio, these goals would be unlikely to be met.

Even meeting the goals might not allow China to deleverage. The People's Republic of China has been built on a philosophy of unending progress and the setting of ever greater goals. Taking a decade or more to slow down and reform, and also deleverage in the process, might not be possible for a leadership that is unwilling to slow, divert or halt its country's perceived journey towards a brighter future.