Looser Chinese policy could aggravate US trade hawks

Bank liquidity and investment are the weakest on record, prompting looser policy, but currency weakness riles US critics

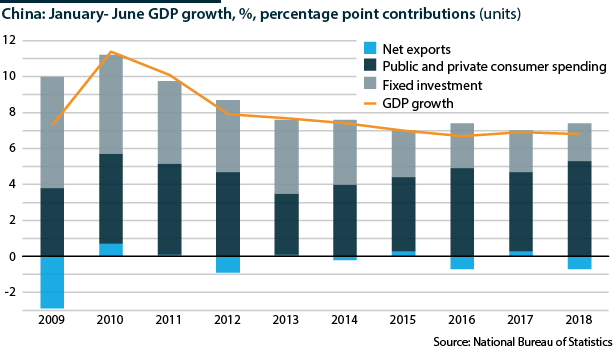

GDP grew 6.7% year-on-year in April-June, the National Bureau of Statistics reported on July 16, keeping the economy on track to meet the government targets of 6.5% growth this year and doubling 2010 nominal GDP and per capita income by 2020. Consumption contributed more than ever in January-June but fears of weaker exports after the imposition of US-China tariffs from July 6 are exacerbating longstanding fears that reining in corporate debt and industrial pollution too quickly could reduce growth sharply, putting jobs and social stability at risk.

What next

Growth will take priority over reform despite the government's vows to 'battle' against pollution and threats to financial stability. The overall economic impact of US tariffs will be small; the affected sectors account for less than 1% of GDP. However, the central bank is still likely to loosen monetary policy and the government looks set to increase investment.

Subsidiary Impacts

- China’s trading partners may transfer orders elsewhere to avoid direct exposure to higher costs, reducing demand for China’s exports.

- Risks will persist throughout Trump's term, and will rise sharply if Washington erodes the authority of the WTO.

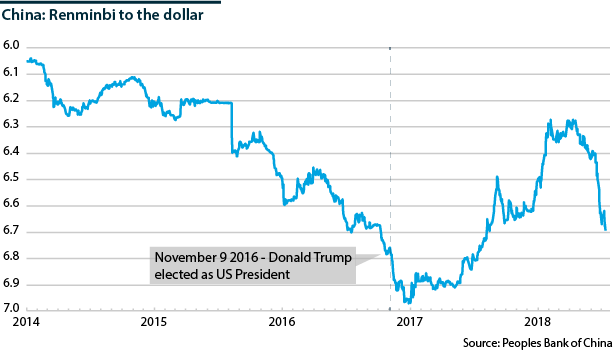

- Looser monetary and fiscal policy coinciding with tightening global monetary conditions will pressure the renminbi.

Analysis

GDP growth has firm momentum, recording between 6.7% and 6.9% for twelve consecutive quarters (see PROSPECTS H2 2018: China - June 29, 2018), and it is becoming more balanced, with consumption contributing more than 75% in January-June 2018, the most ever, and investment contributing the least ever.

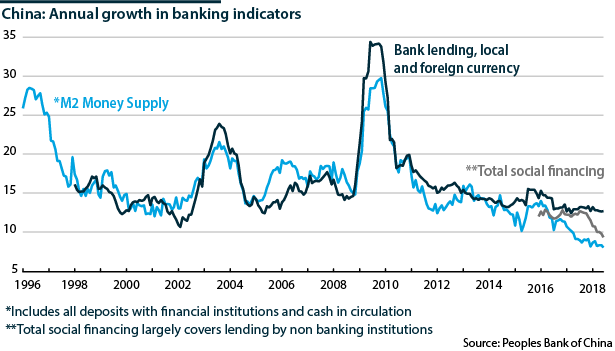

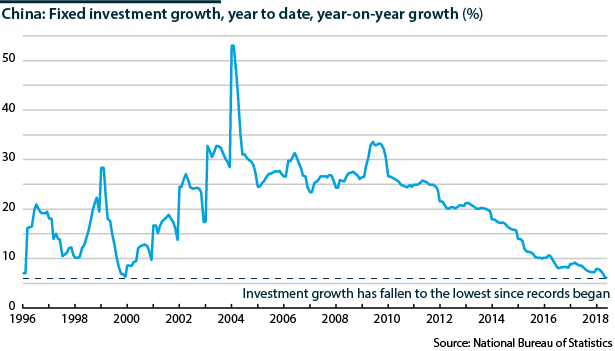

However, both M2 (the measure of money supply comprising bank deposits and cash in circulation) and total fixed-asset investment (of which state spending contributes more than private spending) are growing at the slowest pace on record.

The authorities appear more concerned about the latter and are leaning towards stimulus. Last month, the People's Bank of China raised the reserve requirement ratio by 50 basis points. Regulators are holding back on tightening the rules on investing in wealth management products, which offer higher interest than banks' traditional products, according to Caixin, a leading finance and economic news service.

Domestic activity

Progress is underway reducing the capacity of oversupplied sectors including property and many mining sectors. Property developers constructed over 10% less floor space during January-June than a year earlier.

Offsetting this, production is rising faster in sectors crucial to the 'Made in China 2025' industrial policy. High-tech industrial production grew 11.6% year-on-year during January-June.

Annual growth in retail sales picked up to 9.0% in June from 8.5% in May, increasing first-half sales by 9.4% year-on-year. Online sales are growing more than three times as fast, rising 30.1% year-on-year during January-June. Inflation was just 1.9% in June; real incomes rose by 6.6% year-on-year during the first half.

Consumer strength will cushion China's growth prospects amid the rising risks

Tariff troubles

Since July 6, US importers are paying a 25% tax on their purchases of 818 products from China, worth 34 billion dollars and centred on industrial sectors crucial to 'Made in China 2025'. In retaliation, China is charging 25% on 545 product groups it imports from the United States (see CHINA/US: Neither side will budge on tariffs - July 11, 2018).

The Office of the US Trade Representative is accepting 'public comment' on subjecting 284 more products worth 16 billion dollars to 25% tariffs, and has begun the process for imposing 10% tariffs on 200 billion dollars' worth of imports from China.

Short-term impact

Tariffs will reduce trade in the affected sectors. Indirectly, they will also raise costs across the supply chain as importers try to pass on their higher costs. Manufacturing producer price inflation averaged 4.3% in January-June 2018 but could top 5% in July-December. Consumer price inflation is likely to rise towards 3% in the rest of 2018.

Higher input and output prices could mean that firms take longer to pay off their debts if they divert spending to paying for more expensive materials, or they take on more debt to pay for materials.

Investment will suffer. Firms will avoid decisions while it is uncertain which, if any, of the US policies are permanent (see CHINA: US firms will feel pressure, trade war or not - May 14, 2018). Record low investment growth has been temporarily dragged yet lower this year by a central government review of local government infrastructure spending. In the second half of 2018, local governments are likely to increase investment to combat the risk that aggressive US trade and investment policy will sharply dampen growth.

Longer term

Regardless of the delay in investment decisions, global growth and trade flows have momentum, and the goods exports involved account for much less than 1% of Chinese GDP, limiting the impact (see INTERNATIONAL: US/China self-sufficiency is dangerous - April 4, 2018).

Even if a 10% tariff is imposed on another 200 billion dollars of China's US sales, this is less than 9% of China's 2017 goods exports.

The US tariff rate on consumer imports averaged 4.4% in 2016, but the global average tariff on consumer goods was 11.8%, making the 10.0% US tariff little different to what China already faces elsewhere.

A 10% tariff is not high comparatively, but hiking tariffs encourages a race to the top

Possible concessions

The removal of the ban on Chinese Telecoms giant ZTE importing US components shows Beijing that Washington is willing to make some concessions and is worth negotiating with.

China, the weaker party, could make concessions such as agreeing to buy US liquefied natural gas, helping to satisfy its energy needs and helping the United States export more energy.

The WTO agreement on trade-related intellectual property rights could also be enhanced.

Currency concern

Having gained more than 8% against the dollar between Trump's election and mid-April, the renminbi has since lost more than 6%.

Trump can accuse China of currency manipulation to prolong talks and encourage concessions, but he cannot label China a currency manipulator unless China meets all the conditions specified under US law. At this point:

- China does run a trade surplus with the United States above 20 billion dollars (293.7 billion dollars in the year to June).

- However, it does not run a current account surplus of 3% of GDP (less than 1% in January-March).

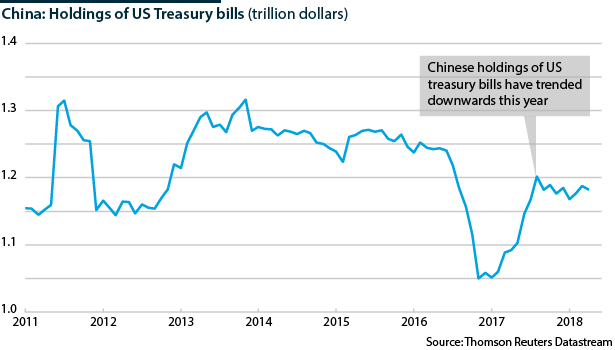

- Its foreign currency purchases have trended downwards as capital outflow restrictions have tightened.

Reform risks

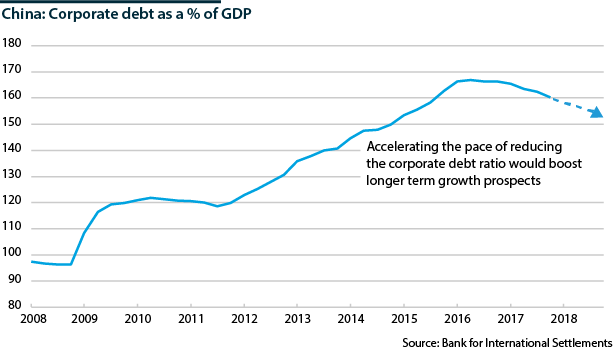

US policy has already shifted Chinese policy from last year's commitment to reducing debt back to prioritising immediate growth at the expense of sustainability.

Corporate debt fell to 160.3% of GDP at end-2017 after peaking at 166.9% in the second quarter of 2016, but government and household debt still grew and total credit continues to expand faster than GDP.

The risk is that, the longer the gap between credit and GDP growth remains large, the higher the resolution costs -- and the eventual hit to growth -- will be.