Prospects for China's economy in 2019

Subtle fiscal and monetary policy loosening will shore up economic activity amid rising external risks

China goes into 2019 dealing with US trade policy that is proving far more aggressive than Beijing had expected a year ago, when it was pursuing goals of deleveraging debt, reducing pollution and cutting overcapacity in specific industries, all the while keeping the economy on track for 6.5% GDP growth. Instead, Beijing has had selectively to loosen fiscal and monetary policy and put support for trade and investment ahead of the original goals. It will have to continue to do so while trade frictions persist.

What next

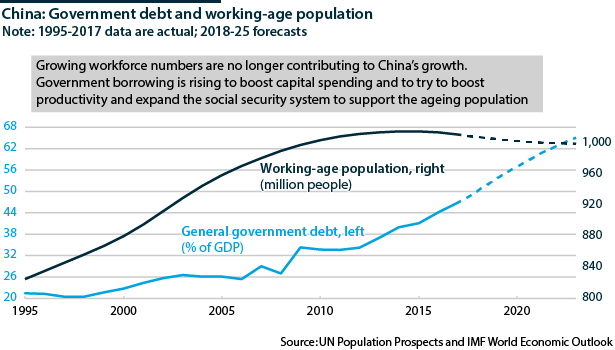

The authorities will be prepared to make modest concessions to maintain relations with trade partners, foremost the United States, but will not abandon the ‘Made in China 2025’ industrial goals and will devote more resources to 'self-sufficiency'. Measures to tackle debt, pollution and overcapacity will remain major goals, but will ultimately take second place to stimulus if GDP growth looks in danger of falling significantly short of the 6.5% needed to meet the 2020 goal of doubling per capita income from 2010. Beyond 2020, the managed slowdown will deepen.

Strategic summary

- The ultimate impact of tariffs will depend on substitution decisions and the sectoral and regional composition of future tariffs, all yet to be determined.

- China stimulating GDP amid other economies tightening will increase China's contribution to global growth.

- Policy divergence with other major economies will weaken the renminbi, helping Chinese exporters on price but harming sentiment among foreign portfolio investors.

- If slower 'shadow' lending is not well managed, property investment (over 10% of GDP) could slow suddenly and sharply.

Analysis

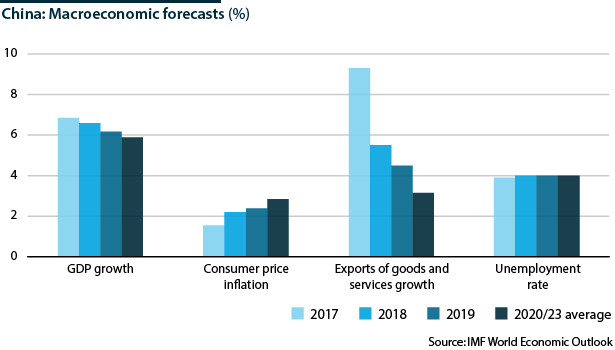

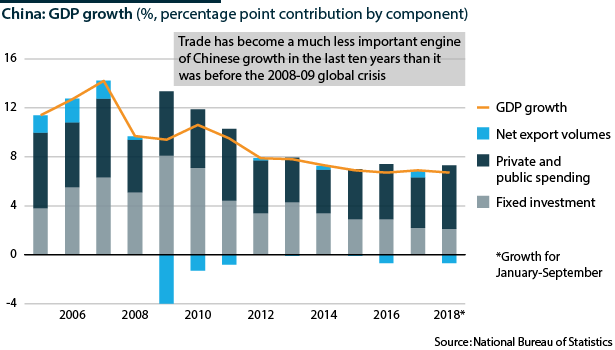

The economy is on track to carry robust momentum into 2019. GDP grew by 6.7% year-on-year in the first nine months of 2018. It is forecast to expand by its target 6.5% for the whole of 2018.

The stimulus that the authorities have mobilised since mid-year shows the extent to which fears are growing of a sharper slowdown. Third-quarter growth was the weakest since 2009.

Monetary policy

The People's Bank of China has selectively loosened monetary policy this year, raising the ratio of reserves that banks must hold and clamping down on peer-to-peer lending to meet the debt deleveraging goals (see CHINA: Policy will return to putting growth first - September 5, 2018), but introducing other measures to encourage more lending to small and medium-sized enterprises.

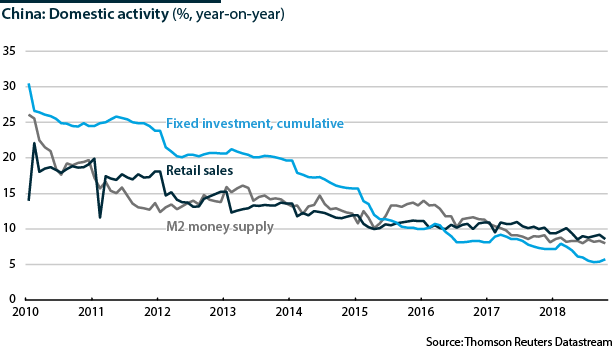

Growth in M2 money supply, which includes deposits and cash in circulation, eased further to a record low of 8.0% year-on-year in October. More measures are likely to be introduced to boost traditional lending and offset the crackdown on shadow lending. Measures will continue to prioritise helping households and small and medium-sized firms over larger state-owned enterprises, property developers and second-home owners.

Peer-to-peer lending for vehicles fell by almost 20% year-on-year in the first half of 2018 and car sales are likely to contract in 2018 for the first time in decades. However, the National Development and Reform Commission is finalising plans to halve the sales tax on purchases of cars with engines of 1.6 litres or less to 5%. This should shore up 2019 sales.

Fiscal policy

Infrastructure investment grew by 3.3% year-on-year in the first ten months of 2018 compared to 19.0% in 2017, reflecting the subtle shift in the design and implementation of fiscal policy from immediate investment to encouraging more efficient land use and enhancing social security protection.

Estimates by Bloomberg suggest that more than 40% of the special infrastructure bond issuance since August has been to prepare land for development or to compensate farmers. Local governments issued more than 1.24 trillion renminbi of these bonds by the end of September (92% of the quota for 2018). Infrastructure investment will pick up in 2019 but not to historic growth rates above 20%.

Infrastructure investment is getting smarter and consumer stimulus is prioritising social security over short-term giveaways

The threshold at which individuals pay income tax rose in October to 60,000 renminbi per year from 42,000 renminbi. Plans are also under public consultation to introduce tax relief from January 1, 2019 for childcare costs (excluding pre-school expenses), post-school education, urban workers' rental costs, mortgage interest payments and elderly care.

Retail sales continued to slow in October but are likely to edge up next year, supported by the tax cuts and by easing inflationary pressures, provided fuel prices continue trending down.

Trade policy

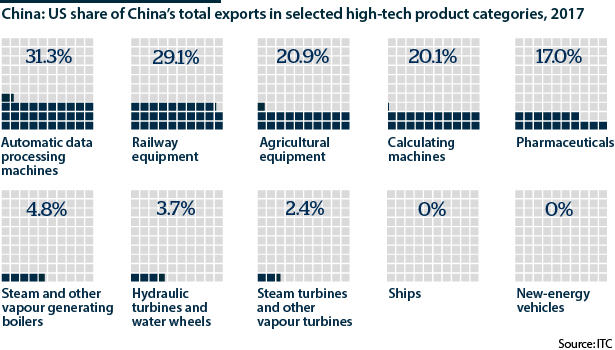

China's high-tech industries will continue to grow at a rapid pace as the United States does not take a large share of China's exports of these sectors (see CHINA: US moves against Chinese tech may backfire - October 18, 2018).

However, three risks stand out:

- The Trump administration plans in January to raise the tariff rate on 200 billion dollars of imports from China to 25% from 10%.

- President Donald Trump has threatened to impose tariffs on the other goods the United States imports from China that have not been included yet (worth more than 250 billion dollars).

- His government could follow through on its threat to impose 20-25% tariffs on all US imports of cars and parts.

IMF modelling last month suggested that these measures combined could reduce Chinese growth by 0.5 percentage points or more depending on firms' substitution decisions.

ECB modelling finds that the United States would suffer more than China if it imposes a 10% tariff on all US-China trade.

Large differences in various models' forecasts depend on assumptions about substitution and future tariffs. These are highly uncertain, making reliable modelling the impact of US policy on China's GDP impossible.

Trump will meet President Xi Jinping at the G20 meeting in Argentina starting later this month. Partial compromises are possible to keep both sides at the negotiating table -- perhaps on energy or intellectual property.

US-China antagonism will persist as the long-term strains will not be resolved

Divergence

China's monetary and fiscal policy loosening contrasts with much of the world, particularly the United States where interest rates are rising and fiscal policy will grow more cautious. The ECB will stop loosening monetary policy in 2019 while India, Indonesia and Malaysia are increasing rates to protect their financial markets.

The policy divergence will widen, keeping the renminbi under downward pressure.

Sentiment towards China is also vulnerable to US withdrawal from multilateralism. The United States is hindering WTO functions by blocking new judges. Washington's attention could turn to delaying IMF funding renewal, raising risks for fragile emerging markets and indirectly dampening demand for all emerging market assets including those in China (see PROSPECTS 2019: Emerging economies - November 6, 2018).