Italy’s BRI pact will be measured by domestic politics

Italy is the first G7 country officially to endorse China's BRI, but its cooperation faces various obstacles

On March 23, Italy became the first G7 country officially to endorse China’s global infrastructure and connectivity project, the Belt and Road Initiative (BRI). However, Italy’s populist government is itself divided on engagement with the BRI; the anti-establishment Five Star Movement (M5S) views it as a timely opportunity to boost Italy’s struggling economy and deliver populist fiscal policies, while the far-right League is concerned lest it lead to Chinese ‘colonisation’ of some of Italy’s ports. Ultimately, the extent of the engagement will be determined by: voter concerns; the longevity of the current government; and which party holds the balance of power over coming years.

What next

At the EU-China summit on April 9, EU leaders will ask China to open its market to European industries. Creating more opportunities for Italian companies to succeed in China will be critical if the League is to support greater Chinese investment and development in Italy.

Subsidiary Impacts

- Italy will pursue closer relations with Washington than Beijing.

- Rome’s BRI endorsement could be used as bargaining power to sell Italian government bonds to China.

- Development of Italian ports will bolster connectivity with Africa.

Analysis

Cooperation between Italy and China dates to antiquity, when the Roman empire and Han dynasty coexisted as global centres of power.

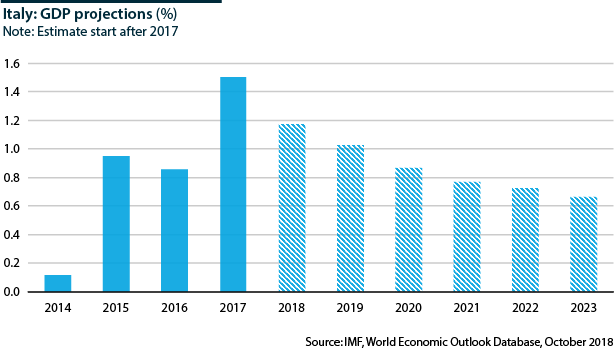

Today, the dynamics of Italy-China relations are vastly different. In late 2018, Italy plunged into economic recession for the third time since 2008. Italy's sovereign debt stands around 132% of GDP, making it the second most-indebted country in the euro-area (see ITALY: Debt sustainability faces several challenges - February 1, 2019).

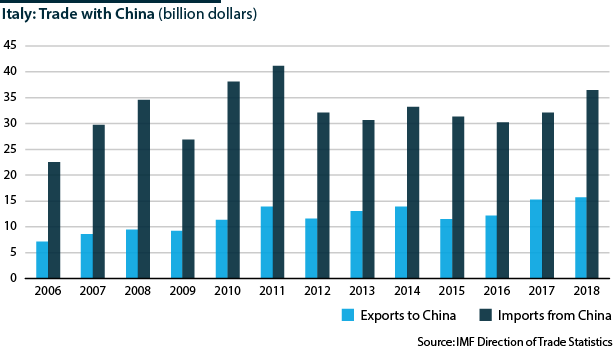

Italy's economic woes have coincided with China's growing global influence through foreign direct investment and loans, helping economies like Italy's grow despite adverse domestic and regional factors. According to the Italy-China Foundation, China has invested around 13.7 billion euros (15.3 million dollars) in over 600 Italian businesses since 2000, while Italy is the EU's third-largest recipient of Chinese investment (see EUROPE: Southern Europe seeks closer China relations - March 13, 2019).

Italy's nuanced China view

However, economic support from China has not fostered an unwavering pro-Beijing outlook in Rome. Despite welcoming Chinese investment, in 2017 the Italian government spearheaded EU efforts to strengthen foreign investment screening mechanisms, with the aim of protecting European industries from countries such as China (see EU: Competition policy faces opposition - January 29, 2019).

For different reasons, Italy's elites have been sceptical about China

During the campaign for Italy's general election in 2018, M5S and the League used anti-Chinese rhetoric in order to convey an image of 'Italy First' to voters. Although M5S wants to reduce Italian dependence on NATO and the United States by enhancing ties with emerging market countries such as China, the party has been critical of China, following allegations of unfair trade practices.

Ideologically, League leader Matteo Salvini sees building close ties with US President Donald Trump and strengthening cooperation with NATO as seminal to Rome's foreign policy interests, more than developing closer ties with Beijing.

BRI symbolism

Italy's endorsement of the BRI on March 29 involved signing a non-binding Memorandum of Understanding (MoU) with 29 separate deals, totalling around 2.5 billion euros; that could rise to 20 billion euros. The main sectors affected by the deals include energy, finance, transport and agriculture, involving state-owned as well as private companies.

Several predominant agreements figure in Italy's endorsement of the BRI:

- China's state-owned China Communications Construction Group will cooperate with the Genoa and Trieste port authorities on infrastructure projects to enhance rail and sea connections to Central-Eastern Europe and Africa respectively (see EUROPE/CHINA: EU is now sceptical about ports - February 6, 2019);

- Italy's state-owned investment bank Cassa Depositi e Prestiti and Italian gas company Snam will cooperate with the Chinese Silk Road Fund on investment in China and in countries that have joined the BRI; and

- China's private e-commerce group, Suning, will cooperate with the Italian Trade Agency to create greater market opportunities for 'Made in Italy' products in China.

Italy's endorsement of the BRI is symbolic in two senses: it reaffirms Chinese investment in Italy, something that has continued for two decades; and BRI endorsements are portrayed in China as an international stamp of approval for President Xi Jinping.

It is also a product of the current Italian government's interest in enhancing ties with Beijing. In 2018, Italy's pro-Beijing Michele Geraci, the undersecretary of state in the Ministry of Economic Development, visited China four times. He also spearheaded the newly established 'China Task Force', which encourages Italian economic actors to cooperate with Beijing.

However, full details of the MoU are yet to emerge, and BRI MoUs are usually intentionally vague. They are also non-binding: there are no legal consequences if Italy decides to withdraw from any of the agreements. Ultimately, Italy's engagement with the BRI will be measured by what the coalition parties can sell to their voters.

Italy First

The notion of Italy First is core to the appeal of the League and M5S, but it is understood divergently in the case of China. For M5S, Italy First means defying EU convention and adopting national rather than pro-Brussels positions concerning relations with Beijing.

Chinese investment could be crucial for the affordability of the party's social-friendly citizens' income scheme, a key election promise that entered into force in March. The roots of M5S's popularity are in southern Italy, where Italians struggle most.

Under the citizens' income scheme, Italians whose annual household income is below 9,360 euros are eligible for a prepaid debit card of 770 euros per month to pay for essentials. With spending cuts very likely in next year's budget, strong and stable Chinese investment could be crucial in financing the popular scheme.

However, the League, which is anti-immigrant and has its roots in the industrial North, is concerned lest Italy be at risk of 'colonisation' from China. For Salvini to develop more support for the BRI, it is essential that China opens up its market to foreign industries and creates conditions that allow Italian firms to flourish overseas.

Future government

China will continue to be a strong source of investment in Italy, but the extent to which the BRI agreements will be realised is uncertain (see ITALY: Government relations - January 15, 2019).

The League is the Italian party that Beijing will watch attentively. Coalition relations are often fraught, marked by clashes over policy ideas; new polling trends suggest that the longevity of the government is in serious doubt.

Since last year's general election, Salvini's anti-immigrant agenda has seen his party's popularity rise from 17% to over 30%, while M5S's support has dropped from 33% to the low 20s. Three recent substantial electoral defeats for M5S in southern Italy are increasing pressure on the party to pull out of the government and sharpen its profile in opposition. That could happen if the party suffers further losses in the European Parliament elections in May.

Italy's engagement in the BRI could be watered down substantially if the M5S are no longer in government

In the case of an early general election, the League would, at best, win with a majority, or else head a right-wing coalition with its allies, Forza Italia and Brothers of Italy. It would be a populist government, but Salvini's variant of populism will be even more dominant than it is now. Also, in a 2018 Pew Research poll on European attitudes towards China, only 29% of Italians said they had a favourable view.