Trump's China tariff ceasefire buys time for talks

Presidents Trump and Xi have averted further escalation of tariffs and agreed to resume trade negotiations

Updated: Jul 3, 2019

On June 29, US President Donald Trump and Chinese President Xi Jinping met on the margins of the G20 meeting in Osaka, primarily to discuss the ongoing bilateral trade disputes. The results of the meeting can be considered progress in that they averted a further escalation of tariffs and agreed to resume trade negotiations, the latest round of which broke down seven weeks ago.

What next

On balance, China probably came away with the greater gain. None of the 'deliverables' address the root causes of the tariff war. Even solid progress toward resolving current trade tensions will not necessarily stabilise US-China relations.

Subsidiary Impacts

- South-east Asia, which benefits from firms redirecting investment, can probably count on US tariffs remaining in place during negotiations.

- US pressure on other states to choose 5G hardware from Western companies rather than from Huawei has not been addressed.

- Trump will face bipartisan anger from Congress if he eases restrictions on Huawei.

Analysis

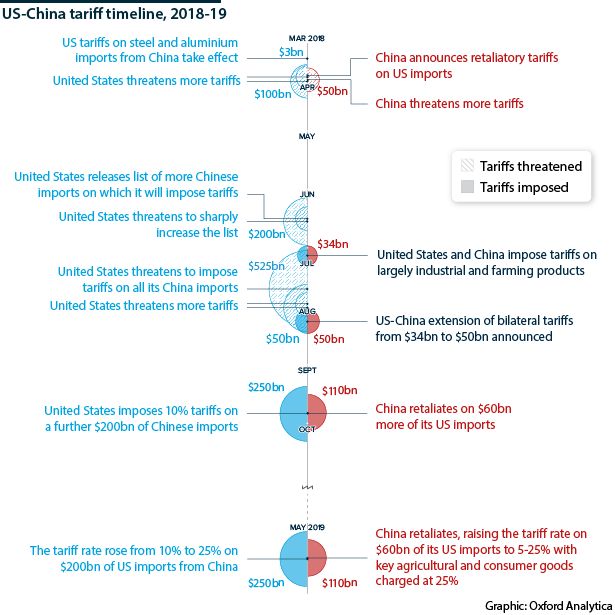

Trump agreed to delay imposing new tariffs of 25% on 300 billion dollars' worth of additional imports from China. Existing tariffs imposed in the past year will remain in place while trade officials formulate a new schedule for talks.

The Asia-Pacific region remains in limbo about the ultimate direction of US-China trade relations

Huawei

Trump said he would consider walking back some restrictions on Chinese technology company Huawei. He will likely revise the executive order issued in May that would prohibit US companies from trading with Huawei when the company's licence with the US Commerce Department expires on August 17.

When stock markets opened on Monday July 1, US technology stocks rose.

Any diminution of restrictions on Huawei will help salvage the future of a company that has come to symbolise China's ambition to lead the world in 5G technology.

It is not clear, however, whether Trump intends to reduce restrictions on Huawei permanently or merely delay the imposition of the executive order.

Prior to his departure for Osaka, senators from both parties warned him not to reverse course on Huawei for security reasons.

The administration is considering a proposal to allow US companies to provide Huawei with components while it prohibits the Chinese company from selling its products in the United States.

This might cushion the blow to US technology companies, but would not address the risk that sharing intelligence with allies who use Huawei technology could compromise the security of US data.

Agricultural imports

Xi promised that China would import more from the United States, especially food and other agricultural products, to lower its trade surplus. This will help Trump claim that he is fulfilling a 2016 campaign promise to lower the US trade deficit, despite the overall US deficit climbing to 621 billion dollars in 2018, from 552 billion in 2017.

US soybean farmers express doubt that they will ever completely reclaim the Chinese market, which now imports soybeans largely from South America and Eastern Europe.

It was far easier for Xi to agree to increase imports than to accede to US demands that China change its laws to accord with US demands.

Irreconcilable demands

Despite the impact of the tariff war on the global economy, both sides have reason to proceed cautiously, even slowly, as talks resume.

China is unlikely to agree to US demands at this time, and the two sides may not even be able to envision a realistic compromise.

The US demands include:

- increased market access;

- protection of US intellectual property;

- withdrawal of privileges enjoyed by state-owned enterprises; and

- greater regulatory transparency.

Meeting these demands would at the least require the negotiation of a major trade agreement, if indeed it is realistic at all. This is unlikely to be achieved with a US presidential election approaching in 2020.

Strong leaders

Both Trump and Xi benefit from a certain amount of friction.

Both leaders want to appear tough for their domestic audiences

Xi must shepherd China through a period during which, regardless of US policies, growth rates fall and there is economic dislocation as the economy moves up the value chain.

Now formally and fully in his re-election campaign, Trump will revert to scapegoating China for the administration's failure to lift his political base into economic prosperity.

This cuts two ways for Trump, however. By delaying further tariffs (and the economic pain they would cause the US public), Trump has undercut Democratic charges that he is headed in the wrong direction on China trade.

Tensions in Trump's team

Continued factions and tensions within Trump's trade team -- evidenced by the last-minute addition of trade adviser and China hawk Peter Navarro in the US delegation -- will make productive talks more difficult from the Washington side.

Navarro, who supports tariffs and opposes trade deals in general, was thought to be a check on Trade Representative Robert Lighthizer and Commerce Secretary Wilbur Ross, who also accompanied Trump.

However, the outcome of the Trump-Xi meeting was a defeat for Navarro and his fellow hardliners. They will attempt to recover influence as talks progress.

Broader bilateral relationship

In contrast to previous administrations, Trump's administration has not built a process of regular dialogue on major fronts in the bilateral relationship: security, trade, human rights and such issues as visa restrictions.

Beyond this structural problem, Trump is prone to sending mixed signals, either as a bargaining tactic or simply because his administration lacks organisation. While he was in Osaka conferring with Xi, Secretary of State Mike Pompeo was in Delhi encouraging India to increase its naval presence in the South China Sea.

Decoupling

As painful as the tariffs are for both sides, the disruption of trade as usual gives both China and the United States an opening to reduce dependency on the other, Beijing on the technology side and the United States in manufacturing (see CHINA/US: Tensions risk unravelling tech value chains - January 3, 2019).

Each side is only beginning to realise that the political environment in the other country is changing.

Xi is a more assertive leader than his immediate predecessors, aims to reassert Chinese civilisation in the world and to forge a new role for China as a responsible player on the global stage.

In the United States, meanwhile, views of China are becoming more negative across the board:

- The last three national security strategy papers issued by the Department of Defense have named China specifically as a major threat to the security of the United States and its allies.

- Human rights groups have made common cause with religious conservatives over the Chinese Communist Party's treatment of religious groups, particularly Muslims (see CHINA: Beijing will promote Party-friendly religion - April 8, 2019).

- Most significantly, US business is no longer willing to be the unofficial lobby for China with the US government.

This leaves Beijing with few, if any, allies within the US policy process.