Modi-Xi summit will foster goodwill but little more

India’s prime minister and China’s president are set to meet for informal talks next week

Chinese President Xi Jinping is expected to be in India on October 11-13 for a second ‘informal’ summit with Indian Prime Minister Narendra Modi. The first such summit in Wuhan, China, in April 2018 prompted the two countries to tone down their differences following a border standoff the previous year. Since August this year, that rapprochement has come under pressure due to India’s constitutional changes in Jammu and Kashmir state, part of which is claimed by Beijing.

What next

India and China will reaffirm their move towards more accommodative relations. The two countries will in the medium term seek to manage their border disputes better (without resolving them), making another military standoff unlikely. However, there will be further disagreements over trade and investment.

Subsidiary Impacts

- Rivalry in the Indian Ocean could become a greater source of bilateral tension, depending on government transitions in the region.

- Since Indian majors are reportedly wary of using Huawei and ZTE core equipment in 5G trials, market barriers may expand in the tech sector.

- Chinese foreign direct investment in India will be constrained compared to China’s global outbound investment.

Analysis

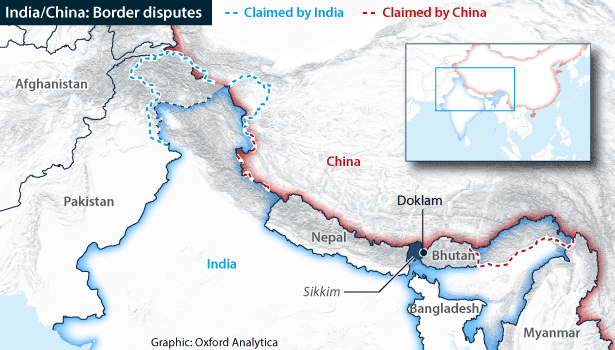

Last year in Wuhan, Xi and Modi spoke for nearly nine hours. The summit came months after a 73-day standoff between Indian and Chinese military forces at Doklam, located at the countries' tripoint with Bhutan. India and China have no formally agreed border, and there are occasionally (less prolonged) face-offs at various points along their roughly 3,500-kilometre frontier.

Neither China nor India regarded the Xi-Modi talks as an attempt to settle bilateral disputes. The aim of the summit was to provide an informal setting for the leaders to ease tensions and understand better each other's views and priorities (see CHINA/INDIA: Differences will be toned down for now - May 30, 2018).

This year's summit is set to take place, subject to official confirmation, in Mamallapuram in India's Tamil Nadu state. Delhi likely regards the southern temple town as an ideal backdrop for the meeting, since it is associated with historical trading and cultural links between India and China. Its location near India's naval centres on the Bay of Bengal coast also projects the country's strategic maritime power.

As in 2018, the two sides will approach the meeting without expectations of resolving disagreements.

The summit will probably help Delhi and Beijing signal to their respective militaries a wish for friendlier ties, and reaffirm mutual commitment to a less tense border.

Yet the India-China relationship will remain competitive, and to some extent undercut by Beijing's strengthening ties with Delhi's enemy, Islamabad.

Kashmir crisis

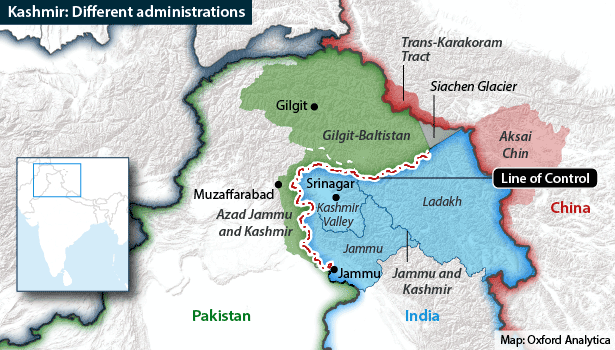

Pakistan has sought increased diplomatic support from China following India's move to revoke Jammu and Kashmir's special constitutional status and divide the state into two union territories (see PAKISTAN: Islamabad will bide its time over Kashmir - September 3, 2019). India, Pakistan and China administer different parts of the Kashmir region. India claims it in its entirety. Pakistan claims all of it except areas ceded to Beijing. China's Kashmir claim covers parts of Ladakh, set to be one of India's new union territories.

After China led closed-door consultations on Kashmir in the UN Security Council and criticised India, Delhi postponed boundary talks with Chinese Foreign Minister Wang Yi in India.

Indian Foreign Minister Subrahmanyam Jaishankar had earlier visited Beijing and conveyed Delhi's view that its Kashmir move was an internal matter unrelated to India-China boundary disputes. India has frequently reminded China that it regards Kashmir in much the same way as China regards Tibet and Taiwan.

An escalation in India-Pakistan tensions over Kashmir would strain India-China ties.

Xi may pragmatically avoid mentioning Kashmir to Modi

A Chinese spokesperson recently said Kashmir may not be a major topic at the upcoming summit.

China no longer expects India to join its Belt and Road Initiative, an infrastructure development strategy that includes a China-Pakistan Economic Corridor passing from China's Xinjiang region to Pakistan's Arabian Sea coast, via Pakistan-administered Kashmir (see CHINA: Belt and Road aims differ in different regions - January 10, 2019).

Border contestation

Beijing may have wanted the boundary talks that Delhi rebuffed to focus on relatively less complicated sections of the India-China frontier, such as the part marking the north of India's Sikkim state.

Delhi likely prefers resolving the entire border in an overall settlement package.

India does not consider Sikkim as disputed territory. China recognised Sikkim as an Indian state in 2003 but occasionally hints at a U-turn. During the Doklam standoff, the state-run Global Times suggested that Beijing should "reconsider" its position on the matter.

Modi and Xi are unlikely to talk about the border issue simply because it is nowhere near resolution.

Nevertheless, another Doklam-type crisis is unlikely because Delhi and Beijing need a stable frontier while they are distracted by other priorities such as their respective economic slowdowns. The last reported China-India face-off, last month in Ladakh, was quickly resolved through delegation-level talks.

India and China are also unlikely to have maritime face-offs over their respective strategic ambitions in the wider Indian Ocean region, where the two countries are investing in ports and other infrastructure (see INDIA/CHINA: Rivalry in the Andaman Sea will increase - January 29, 2019).

Rethinking RCEP

Delhi and Beijing will in the short term find it harder to play down their differences over trade.

India is a participant in the Regional Comprehensive Economic Partnership (RCEP), a free trade agreement (FTA) being negotiated by the ten ASEAN members and six countries with which the South-east Asian bloc has existing FTAs (see ASEAN: Limited trade progress will be hailed at summit - June 13, 2019).

Many of India's government departments have argued that RCEP will lead to dumping of Chinese goods on the country, expanding India's 58-billion-dollar trade deficit with China.

Recent talks have highlighted that India is also concerned about its trade deficit with ASEAN, further raising the possibility that it may reject RCEP, but it will be keen to avoid an affront to the regional bloc, with which Modi seeks closer ties as part of his 'Act East' policy (see INDIA: Regional leadership will be asserted strongly - July 8, 2019).

India will only sign RCEP if it can allay its China concerns

Delhi may therefore sign RCEP if it can negotiate better terms for services exports and secure certain anti-dumping safeguards against Chinese exports to the country.

India believes China has unfair barriers against its IT, pharmaceutical and agricultural goods. China is making some attempts to close the trade deficit about which India complains by lifting restrictions on certain imports, such as non-basmati rice, and easing rules for importing cancer drugs.

Investment slowdown

Chinese investment in India is increasing more slowly than bilateral trade.

China's foreign direct investment (FDI) in India has plateaued at just over 0.5% of India's total inflows. The Alibaba Group this year reportedly stalled on new investments in India, although smartphone majors such as Vivo plan to expand there. A handful of Chinese property companies are making their first deals in Indian real estate.

According to Chinese official data, cumulative Chinese investment in India by December 2017 was some 4.7 billion dollars (these data do not include Chinese investment in India through other countries) and cumulative Indian investment in China by September 2017 was some 852 million dollars.

Cumulative project financing by Chinese companies is more notable. Chinese venture capital funding in Indian start-ups was reportedly up to 5.6 billion dollars in 2018 from 3.0 billion dollars in 2017. China's ambassador to India, Sun Weidong, believes that 40% of Indian companies in China wish to expand their investments this year.