Successful Aramco sale may squeeze Saudi finances

The long-awaited share offering is breaking global records -- but only locally

Shares in state oil firm Aramco were today listed for the first time on Riyadh’s Tadawul stock exchange and rose by the maximum possible 10%, hiking the company’s valuation to 1.88 trillion dollars. The initial public offering (IPO) of a 1.5% stake in Saudi Aramco on December 6 reached the top end of the recommended price range, giving the company a relatively high valuation of 1.7 trillion dollars and netting a record 25.6 billion dollars for the Public Investment Fund (PIF) -- a vindication for Crown Prince Mohammed bin Salman. The shares were sold mainly to Saudi and regional investors.

What next

Government sweeteners to boost the IPO will reduce oil revenue going to the general state budget, although PIF domestic investment could potentially replace some capital spending. Post-issue exuberance is set to push the share price up further, to support the crown prince’s preferred 2-trillion-dollar valuation -- but this will likely be temporary, especially if the oil price slips. Shelved plans for an international listing may be revived on the back of a higher valuation, but international investors would remain sceptical, while regulatory and legal problems with an international listing persist.

Subsidiary Impacts

- The PIF will deploy sale proceeds as part of a drive for economic diversification, both domestically and in acquiring global assets.

- Aramco’s commitment to generous dividends could pose problems if oil prices weaken.

- PIF spending of the domestic sale proceeds will lead to a foreign exchange outflow, either directly or through new imports.

Analysis

Mohammed bin Salman's January 2016 announcement of plans to float 5% of Saudi Aramco's stock -- with a 2-trillion-dollar valuation generating 100 billion dollars to supercharge the PIF in its pursuit of futuristic assets such as the Softbank Vision Fund and Virgin Galactica -- was a defining moment in his emergence as a pivotal figure in Saudi and international politics and business.

Subsequently, the crown prince pressed ahead with domestic economic and social reforms, but his international reputation was tarnished by human rights scandals (see SAUDI ARABIA: Crown prince may move against detractors - October 30, 2018). Simultaneously, his economic credibility was affected by the delays to and scaling-back of the Aramco deal, as well as the poor performance of some of his high-profile global investments.

Plans for a foreign listing were quietly shelved because of a combination of regulatory and legal snags, the lukewarm response of global investors and resistance within Aramco itself. The IPO only regained momentum in mid-2019, with the replacement of top oil officials (see SAUDI ARABIA: Aramco signals new momentum behind IPO - September 2, 2019).

Strong response

Pressure from the authorities, including on banks to lend to small investors, meant the response to the offering was strong, but not spectacularly so, with bids equivalent to almost five times the 3 billion shares on offer (one billion for retail investors and the rest for institutions). The bulk of the oversubscription came from institutions, as regional sovereign wealth funds such as the Abu Dhabi Investment Authority and the Kuwait Investment Authority offered support. The retail tranche was only 50% over-subscribed.

The deal finally gave the company a valuation of 1.7 trillion dollars (overtaking Apple as the world's most valuable quoted company). On December 9, Aramco announced plans to exercise an option to increase the total number of shares to 3.45 billion (1.725%), bringing sale proceeds up to 29.4 billion dollars. This comfortably breaks the IPO world record of 25 billion set by China's Alibaba in 2014.

x4

Increase in the local stock market capitalisation

Today's share listing hikes the Tadawul's market capitalisation to 2.2 trillion dollars, from just under 500 billion. Yet the actual addition of tradeable shares is a much more modest 5%, and not all those are genuinely free-floating, given the preponderance of institutional investors.

The Tadawul is included in several international benchmark indices and the listing of Aramco is likely to draw in some investment from emerging market funds as a function of the increased capitalisation. The bulk will be from passive investment funds, with active fund managers concerned over fossil fuel risks, the oil price outlook and a perceived inflated valuation resulting from manipulation of the IPO process.

Attractive deal

Saudi buyers are nevertheless likely to be satisfied with their investment, given the inducements offered.

Dividend guarantees

Aramco has promised to pay a cash dividend of at least 75 billion dollars in 2020. It also said that if the board decides on a lower overall dividend in 2020-24, all non-governmental shareholders will still be paid as if it were a 75-billion-dollar dividend, through the government foregoing part of its entitlement.

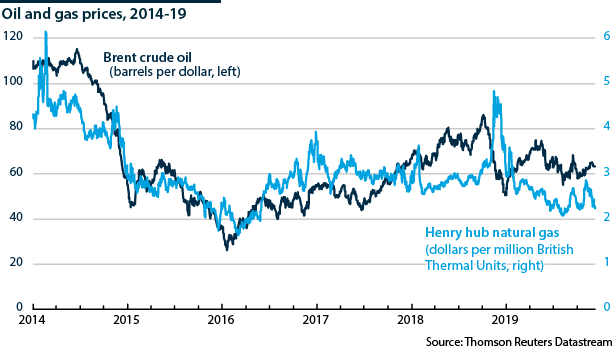

This will come at a cost to the government: in 2018, Aramco paid out a dividend of 58 billion dollars, and although the dividend in the first half of 2019 was 46.4 billion dollars, this included a 20-billion-dollar special dividend arising from the strong performance in 2018, when the oil price averaged about 70 dollars/barrel. The guarantees also mean that Aramco's stated commitment to invest 35-40 billion dollars per year may need to be financed by borrowing.

Royalty payments

In addition, the authorities lowered the royalty paid to the government on crude oil and condensate production to 15% from 20% at oil prices below 70 dollars/barrel. They did increase the marginal royalty to 45% from 40% for sales at 70-100 dollars/barrel, and to 80% from 50% if Brent rises over 100 dollars/barrel -- but these prices are well above current forecasts.

Tax concessions

The government has already cut the income tax rate for Aramco to 50% from 85%. It also promises to compensate Aramco if its rate of return on domestic natural gas sales, for which prices are regulated, falls below the agreed level. The tax rate charged on Aramco's domestic sales of petroleum products and petrochemicals will be gradually lowered to the general corporate rate of 20%, from a range of 50%-85% now.

Budget implications

These sweeteners will likely reduce Aramco's contribution to the state budget (about two-thirds of total government revenue in 2019), perhaps by as much as 10%.

Efforts to boost oil prices may falter

In its medium-term planning the government has factored in a decline in revenue from Aramco. The Saudi pledge to cut production by 400,000 barrels/day as a part of the December 6 OPEC agreement will provide a fillip for oil prices, but this will likely not offset Aramco's losses on lower output (see SAUDI ARABIA: New energy minister faces the OPEC test - December 6, 2019). Moreover, the price boost may be short-lived, given the weakness of global oil demand and the fact that Saudi output has recently been significantly below its previous target.

In the 2020 budget, approved by the cabinet on December 9, total government revenue is set to dip to 833 billion riyals (222 billion dollars) from an estimated 917 billion in 2019, with only very modest increases in 2021 and 2022. Lower returns from Aramco will widen the deficit but might be partly compensated by domestic investment in infrastructure and private sector business from the PIF, which seems less fixated than it was on global trophy assets.

Many of the PIF's funds will come from the Aramco sale and from Aramco's 69.1-billion-dollar acquisition of 70% of Saudi Basic Industries Corporation (SABIC), payable over the next four years (see SAUDI ARABIA: Merger raises questions over strategy - March 21, 2019). In some respects, this is therefore just an alternative means of recycling oil money -- but with more focus on capital spending. The government says it will keep capital expenditure in the 2020 budget at the same level as in 2019, asking the "private sector" to shoulder more of the burden.