US recovery of GDP and jobs will vary widely by region

Every US state suffered a sharp GDP decline and job losses in April-June 2020; recovery will be uneven and uncertain

The Atlanta Federal Reserve forecasts that US GDP will grow by 35.3% in the third quarter, erasing most of the impact of the 31.4% contraction seen in April-June. COVID-19 has affected all 50 states unevenly, so the starting points for recovery vary. Twenty-one states have this month recorded their highest 7-day average of new cases, many of them among the first to reopen, which will slow the recovery. The labour market consequences are shaping voter intentions in the presidential election.

What next

Individual states' output and employment recoveries depend on their economic structure, as well as the management of COVID-19 and federal income support for households and governments. States most reliant on leisure and hospitality, healthcare and manufacturing face the greatest challenge. Uncertainties over further layoffs, evictions, foreclosures, bankruptcies and when a vaccine will be found will weigh on sentiment into 2021.

Subsidiary Impacts

- Protracted recession, especially in less-urbanised areas, will increase ‘deaths of despair’.

- A slow recovery may push discussion of new broad-based taxes up federal and state policy-making agendas.

- COVID-19 will accelerate the reforms to underfunded state and local government pensions that were initiated after the 2008-09 recession.

- Investors’ overvaluation of the biotech sector in the rush for a vaccine could trigger a sell-off in equities.

Analysis

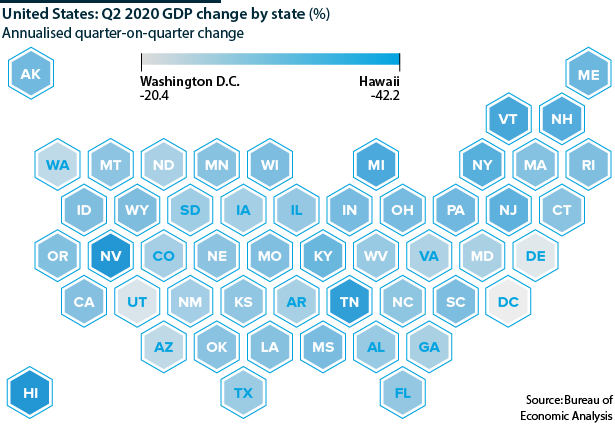

Declines in state GDP in April to June stretched from 42.2% quarter-on-quarter contractions in Nevada and Hawaii to 21.9% in the least affected state, Delaware. These followed smaller first-quarter contractions in all states, from 1.3% in Colorado to 11.9% in Louisiana.

22% to 42%

GDP contractions by state varied widely in April-June

Hawaii and Nevada are heavily dependent on tourism (the latter is Las Vegas's home state) and so were hit hard by travel lockdowns. The accommodation and food services sector was the leading contributor to the second-quarter GDP contraction in both states, as it was in 15 others and the District of Columbia. In Tennessee, the state with the third-largest second-quarter contraction overall, the healthcare and social assistance sector was the largest contributor to the decrease, as it was in 18 states.

In eight states, including four industrial Midwestern states -- Indiana, Michigan, Ohio and Wisconsin -- durable goods manufacturing was the largest contributor to the contraction. Positive contributions from the finance and insurance sector moderated the scale of the contraction in 48 states plus the District of Columbia. In Delaware's case, that offset 4.5 percentage points of contraction in other sectors.

Third-quarter GDP

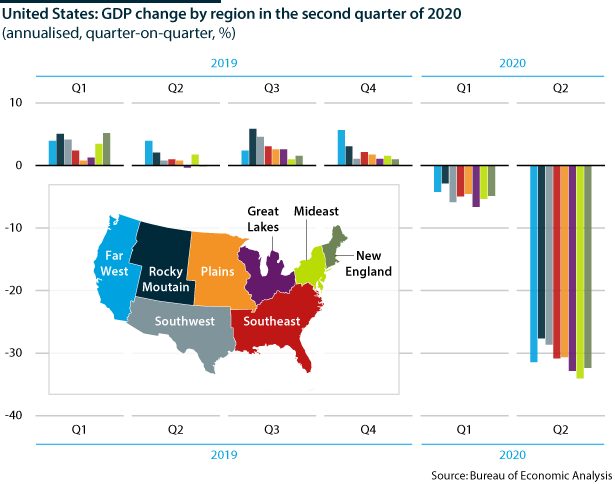

Forecasts for national GDP growth in the third quarter suggest a recovery of about one-quarter to one-third of lost output, although the gains in activity and employment seen early in the quarter have slowed with a resurgence of COVID-19 cases.

States and regions report a similar broad pattern but with regional variations. Manufacturing expanded briskly in the Great Lakes region, for example, but modestly in the Far West, where conditions in consumer and business services also remained precarious.

Consumer sentiment remains fragile and vulnerable to a winter wave of infection, further layoffs and constraints on government financial and social support. The regional Federal Reserve banks already report that the pace of recovery in tourism and retailing is slowing in many of their districts.

That suggests the states most-heavily dependent on accommodation and food services will take longer than most to recover. Along with uncertainties about the long-term impacts of increased digitalisation, from remote working to e-commerce and online services, this darkly clouds the outlook for commercial construction and real estate. Residential construction and real-estate markets look brighter, except in New York City where demand is low and inventories high.

States with large agricultural or energy sectors -- the Plains states and Alaska, Oklahoma, New Mexico and Texas, respectively -- face low commodity prices, driven by supply in the case of crops and by demand in the case of oil. Neither sector is expected to see much near-term improvement.

A sustained manufacturing expansion would increase activity at ports and among transportation and distribution firms. This will benefit states such as California, New Jersey and Pennsylvania and others with important logistics hubs including Tennessee, Illinois, Texas and Michigan.

Jobs

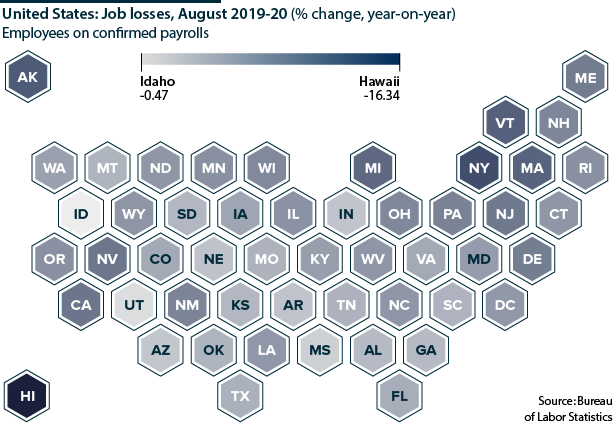

A similar picture of regional and state disparities is seen in labour markets (see INT: Joblessness will rise as job-save policies unwind - July 30, 2020). State unemployment rates in August, the latest available, range from 13.2% in Nevada to 4% in Nebraska. Unemployment rates do not fully reflect the massive economic disruption caused by COVID-19 because they exclude under-utilised workers.

Year-on-year changes in non-farm payrolls provide a more focused snapshot of state labour markets. For August, the range extends from a 1.6% decline in Utah, where only 10% of jobs are in the leisure and hospitality sector, to a 16.3% decline in Hawaii, where the sector accounts for twice as large a share of jobs. Alaska, Michigan, Massachusetts, Vermont and New York all show double-digit job losses.

Battleground states

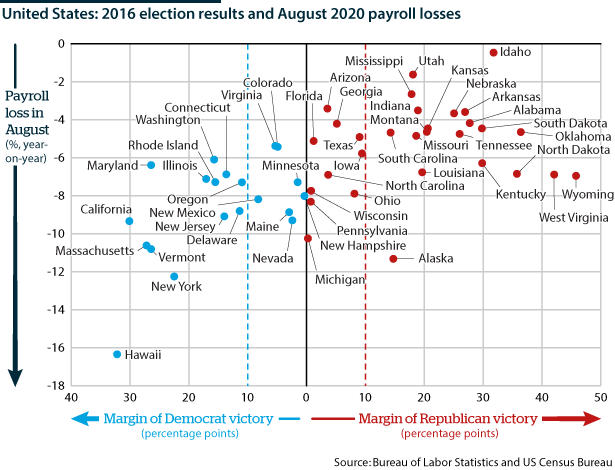

A biannual poll published this month by Gallup on voters' top issues ranked the economy first, with Republicans placing it higher priority than the Democrats. Polls show the president's popularity tracking the progress of the recession.

Job market conditions are uppermost in the minds of voters. Of the nine currently most competitive states in the presidential election, the median year-on-year loss of jobs in August was 6.7%. In the 'tipping point' states of Pennsylvania and Florida, the numbers are 9.0% and 6.7%, respectively. Five of those states (Arizona, Florida, Georgia, Iowa, and Texas) were in the top two quintiles for smallest second-quarter GDP contractions so the correlation between voting intentions and current labour market conditions seems stronger than with GDP.

State and local finances

The fiscal position of state and local governments is a potential long-term drag on the recovery, as it was during the recession following the 2008 global financial crisis. This time, state and local finances have held up better than expected thanks to flush rainy day funds. In addition, and mitigating the lost tax revenues, the job losses have been concentrated among low-earners, and thus low tax-payers. Different states have been affected in different degrees depending on their dependence on, for example, sales versus income tax for revenue.

A prolonged recession will test the fiscal resilience of states and local governments. Minnesota has become the most recent state to suffer a credit-rating downgrade, following New York, New Jersey, Illinois and Hawaii. The risk is that without federal aid to states, there will spending cuts (especially layoffs) next year. In the 2008 recession, some 40 states made mid-year budget cuts the following year and thereafter.

Outlook

COVID management, and government support for individuals and businesses, is key

States' capacity to 'reclimb the cliff' are tied to the progress of the pandemic, and the ability of governments to manage a winter wave of infections to minimise economic disruption. The severity of seasonal flu, and the widespread availability of a safe and effective COVID-19 vaccine, will be critical in this regard. The latter may take a further nine months.

In the meantime, income support from government for individuals and businesses will be vital to offset what looks likely to be a slow recovery that will be highly variable by sector and region (see UNITED STATES: COVID aid still likely post-election - October 19, 2020).

Like the national economy, few if any states will get back to the levels of output and employment they had before the pandemic until the end of next year.