High US government debt does not itself raise risks

US public debt is at a record high, but any fears that this could signal a crisis further out are unwarranted

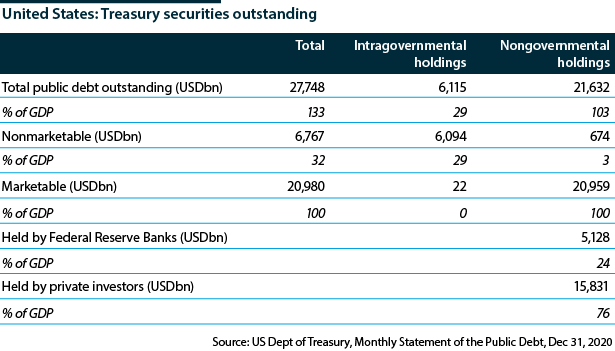

The stock of outstanding US federal government debt stands at 133% of GDP, higher than after the Second World War. Some economists are suggesting that, over the longer term, this could cause financial markets to stop buying US debt and charge prohibitively high rates, and cause the dollar to crash. Other economists argue that more deficit spending could fuel output and so keep relative debt levels in check.

What next

Debt is manageable because the portion that is marketable and held by non-US government entities is equal to less than 80% of GDP. The Congressional Budget Office projects that the budget deficit will decline in the next two years, as the effects of the pandemic wane, but will double over the next 30 years. However, debt-funded investments could raise productivity and future output, reducing future deficits and debt.

Subsidiary Impacts

- In the recovery and beyond, financing the debt could raise private borrowing costs, reduce business investment and slow economic growth.

- High and rising debt might constrain policymakers in their ability to respond to unforeseen events.

- A higher debt path that boosts interest rates would give the Federal Reserve more flexibility in implementing monetary policy.

Analysis

Although the stock of government debt stands at 133% of GDP, this does not portend a crisis. More than four-tenths of this debt is held within the government and is mostly non-marketable. A consolidated government balance sheet cancels out the debt held by approximately 150 government agencies; for example, the social security system holds almost USD3tn of government securities and the retirement funds of the civil service and Defense Department hold 1 trillion dollars each. Such intergovernmental holdings equal almost 30% of the total.

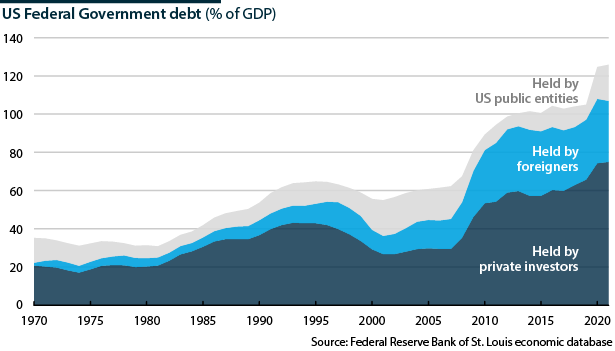

The Federal Reserve Banks are owned by private banks, putting the Fed in the private sector. However, Federal Reserve Banks remit their profits to the Treasury; their holdings constitute liabilities that the federal government owes to itself. Consequently, their 24% share of outstanding debt should effectively be considered as public sector rather than private. Thus the portion of marketable debt held by private investors is less than six-tenths of the total, at 76% of GDP.

Who holds the marketable debt?

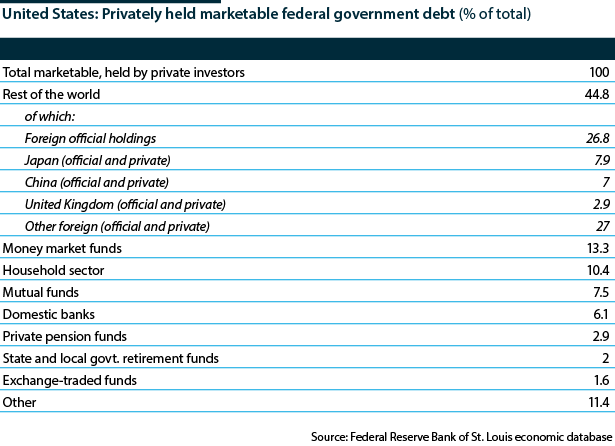

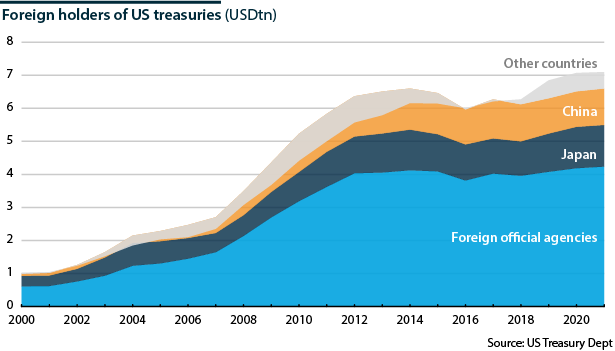

Just over 40% of the marketable debt outside government is held by foreigners. Foreign official agencies hold more than half of that, mainly central banks (principally China and Japan) that have acquired US treasuries to stabilise their foreign currency markets. Foreign official holdings have been stable since 2012.

A longer-term burden?

A common warning that can be dismissed is that today's government debt is a burden passed on to future generations. The originators of such warnings forget the first lesson of accounting: liabilities are matched by assets. For every liability that is passed on, there is an equal-valued asset. Future generations inherit government bonds: an asset. They also inherit the obligation of paying taxes so that the bonds can be redeemed when they come due (a liability). There is no net burden on the future.

Unless it discourages investment, government debt is not a future burden, as it is matched by assets

The only way to transfer assets to future generations is through investment. A failure to invest because of debt fears would truly disinherit the future. The warnings may have some validity when future owners of US debt live in other countries; US residents may have to pay taxes to redeem those US bonds, unless the bonds are rolled over indefinitely, which is the most likely scenario.

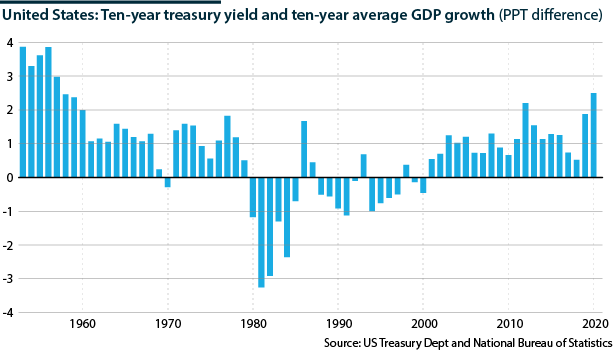

Growth and the interest rate on debt

Research confirms that the present environment is particularly benign for government debt. Provided an economy's GDP grows faster than the interest rate it is paying on its debt, as it is today, the government can issue debt to finance spending and then roll over the debt without the need for new taxes. For seven decades, US economic growth has been above the 10-year Treasury bond rate 75% of the time. Current low rates may be a consequence of 'secular stagnation', increased global demand for safe assets that generates a market for US government debt, or aging in advanced economies. Importantly, interest rates lower than growth rates have been the rule rather than the exception globally.

Critics raise several points against this:

- interest rates and economic growth fluctuate, and we cannot predict the future;

- a high level of debt can crowd out high-return private investment; and

- a zero or very low primary deficit (net of interest payments) is required to make the arithmetic work.

However, debt should not be feared if it is needed to dig an economy out of a crisis. When the crisis passes, higher taxes and reduced spending can bring the primary deficit back toward balance.

Comparison with Japan

Investors with qualms about US treasuries should quake when considering Japan, where government gross debt to GDP is twice the US ratio and a decade ahead in timing (see JAPAN: Fiscal deficits will continue indefinitely - January 22, 2020). Nevertheless, investment managers refer to Japanese government bonds (JGBs) as 'widow-makers'. For 30 years, investment professionals have expected JGBs and the yen to collapse -- and they have not, hence the 'widow-maker' moniker.

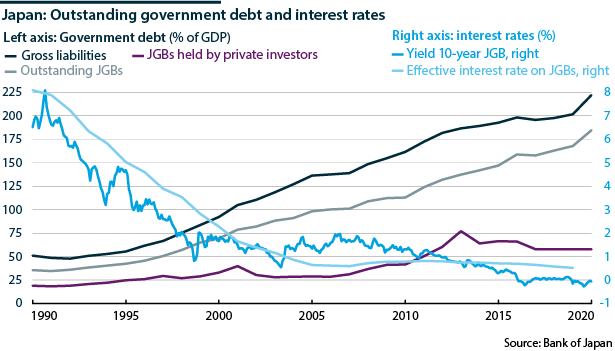

Those predicting calamity in US and Japanese bond markets share a common error: they are not making appropriate adjustments to the raw figures. The usually quoted ratio of total Japanese government debt, 225% of GDP, is for gross debt, which omits substantial holdings of financial assets in the Finance Ministry's accounts as it funds expenditures with short-term bills. Net central government debt equals the amount of outstanding JGBs, 185% of GDP. Furthermore, more than half of JGBs are held within the government sector, mainly the retirement accounts and the central bank. Private holdings constitute only 60% of GDP.

Private holdings of Japan's government debt equal 60% of GDP, far less than the 225% total

The JGB market has not collapsed, because the sum being marketed is manageable. Another reason is that the effective interest rate on the debt (ratio of interest payments to outstanding liabilities) has fallen because deflation, monetary policy and stagnation have kept interest rates low. Even as debt grew, the effective interest rate declined from 8% in the 1980s to under 1%. Moreover, GDP growth has been higher than the ten-year bond yield for the past five years. JGBs are a haven among global investors who pile into the bonds when anxieties rise elsewhere.

Fear of Fed policy

Concerns about the government's debt seem to be founded on fears that the Fed will wait too long to respond to rising pressures, or that the Fed might have to return the policy rate to the range that used to be considered normal more rapidly than expected (see UNITED STATES: Inflation fears are exaggerated - March 24, 2021). Such concerns are arguments for the Fed to be alert, not to avoid relief spending. Moreover, the possibility that we are experiencing secular stagnation, or a global savings glut, suggests that conditions in which a higher policy rate is warranted as a return to normality should be welcomed (see INTERNATIONAL: Inflation to worry, not derail, markets - May 27, 2021).