Prospects for the Gulf states in 2022

Hydrocarbons-buoyed Gulf Arab economies will boost business confidence

The six member states of the Gulf Cooperation Council (GCC), especially Saudi Arabia, are enjoying the windfall from a tight global energy market that has pushed up oil and natural gas prices. They have also coped effectively with the healthcare challenges of the COVID-19 pandemic, laying the groundwork for positive economic prospects in 2022.

What next

The region is looking to capitalise on global events such as the ongoing Dubai Expo and the 2022 football World Cup in Qatar. The main political issue of concern remains uncertainty regarding negotiations on Iran’s nuclear programme, and associated security risks. Rivalry between Saudi Arabia and the United Arab Emirates (UAE) over regional economic leadership will intensify, but a serious breach in relations is unlikely.

Strategic summary

- Buoyant revenue will enable governments to step up investment in infrastructure and housing, as well as renewables and carbon capture.

- Despite the comfortable fiscal position, governments will remain committed to long-term reforms geared to post-oil sustainability.

- Gulf stock markets are likely to see more equity offerings following the success of a series of major initial public offerings in 2021.

- Better ties with Tehran will not eliminate the risk of the Gulf being caught up in any US-Israel military escalation over Iran’s nuclear programme.

Analysis

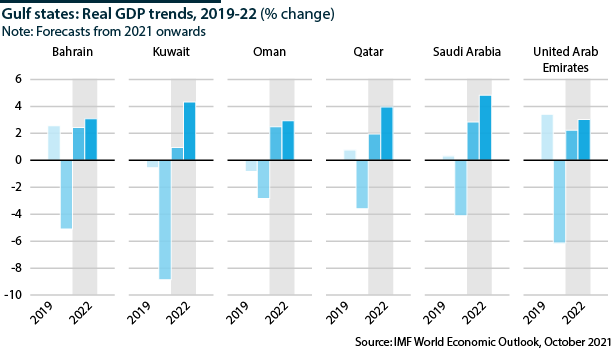

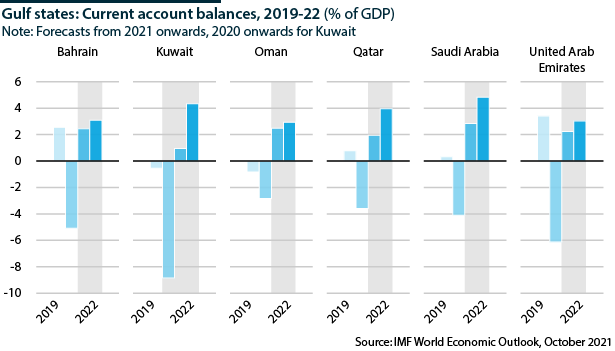

The IMF now projects that economic growth rates in the Gulf states will range from about 3% to almost 5% in 2022. It estimates a range of 0.9-2.4% growth in 2021. An ongoing surge in oil and gas prices is likely to mean these estimates are excessively conservative.

Saudi economy

Saudi Arabia is set to be the fastest-growing economy in the Gulf in 2022 because of the July 2021 OPEC+ agreement allowing monthly increases in oil output -- likely to equate to about 1.2 million barrels per day of extra Saudi production by late 2022. The effect of this extra income has already appeared in Riyadh's fiscal accounts for the third quarter of 2021, which show a surplus of USD1.8bn.

The IMF has assumed an oil price of about USD65 per barrel for 2021-22 in its most recent forecasts but it now seems likely that the 2021 price will average more than USD70 per barrel.

Additional OPEC+ supply could bring a moderation in prices next year, but with demand still strong and little sign of any major increase in US production, the average price is unlikely to fall much below USD70 per barrel, and it may well be higher (see INTERNATIONAL: Oil market will move to balance in 2022 - September 2, 2021).

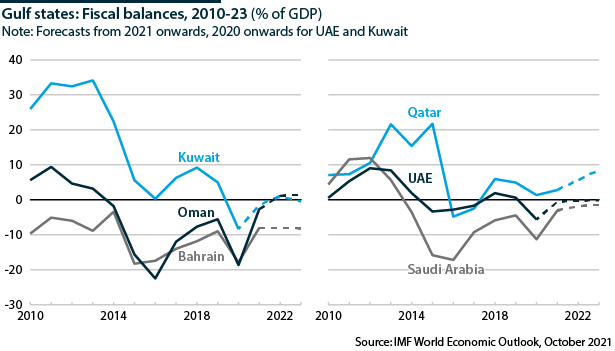

Saudi Arabia is thus on course for a budget surplus this year, and the IMF forecasts a budget deficit of only 1.8% of GDP in 2022.

Buoyant government finances in Saudi Arabia will lead to more opportunities for the private sector in state-backed investment projects. Riyadh will also step up initial public offerings next year, including for the stock market (Tadawul) itself -- a deal expected to raise USD4bn (see SAUDI ARABIA: Investors will welcome share offerings - October 1, 2021).

One of the major growth areas will be renewable energy. After a tardy start, Saudi Arabia has embarked on an accelerated programme of solar and wind power generation, with 4,500 megawatts of new capacity either under development or in the tender process, as well as a 4,000-megawatt green hydrogen project in the new city of Neom, on the Gulf of Aqaba.

VAT recalibration is on Gulf states' agendas

Given its improved fiscal position, Saudi Arabia may consider cutting the value-added tax (VAT) rate, hiked to 15% from 5% in mid-2020. Such a step could be presented as compensation for pressing ahead with medium-term plans to introduce personal income tax.

Neighbouring economies

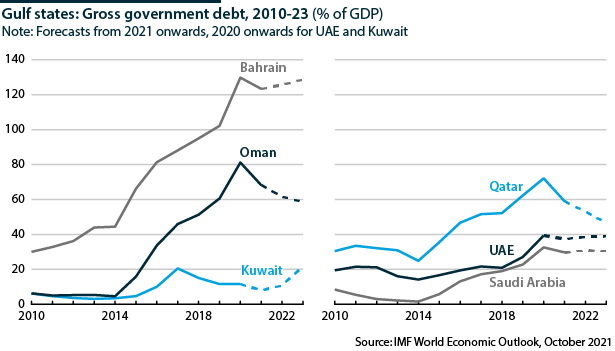

Elsewhere in the Gulf, Oman will apply a 5% VAT rate from January 2022, with income tax also on the agenda. Bahrain is set to double VAT to 10%, in return for a fresh infusion of financial aid from its neighbours.

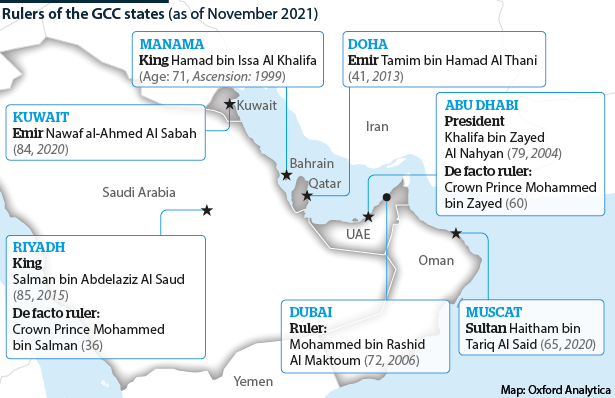

By contrast, in Kuwait, the introduction of VAT -- or indeed any steps to manage significant fiscal pressures, including more international borrowing -- still depends on parliamentary approval. Executive-legislature relations have been strained since the September 2020 accession of Emir Nawaf al-Ahmad Al Sabah, but recent signs of a thaw could help ease the public finances next year.

Boom conditions are also likely to prevail in Qatar and the UAE. Doha will see export revenue soar owing to the surge in gas prices in Asia and Europe, as will the Gulf's lesser exporters of liquefied natural gas (LNG), Muscat and Abu Dhabi.

The tightness of the global gas market appears to have vindicated Qatar's decision to press ahead with plans to increase its own LNG capacity by about 40% to 110 million tonnes per year by 2027 (see QATAR: Doha will lean on LNG strength post-boycott - March 26, 2021). During 2022, Qatar will select its major strategic equity partners for the four LNG 'trains' (liquefaction units) to be built during this phase of the expansion. It is also expected to issue a final investment decision for a second phase, which would bring capacity up to 126 million tonnes per year.

Both Qatar and Saudi Arabia have argued forcefully that continued investment in oil and gas development in the Gulf, where production processes entail relatively low greenhouse gas emissions, is an essential element in a smooth transition to a zero-carbon future. Nonetheless, Qatar's role in the global fossil fuel economy will come under further scrutiny as it hosts the football World Cup at the end of 2022.

World Cup will increase scrutiny of Qatar on emissions and labour conditions

The World Cup will also likely spark further negative media coverage of the conditions for the migrant labour used to construct facilities, and rights groups will intensify pressure for a boycott. Even so, Qatar will have an opportunity to reinforce its contention that it plays a progressive global role, for instance showcasing heavy investments in zero-carbon technology. The tournament will benefit both Doha and its neighbours through increased tourism.

The UAE's post-COVID-19 recovery has also been enhanced by the hosting of an international event: Dubai Expo 2020 opened in October 2021, one year late. The final days of the expo in March 2022 are likely to see heavy marketing of new investment projects in the UAE.

Political environment

Political relations between the Gulf Arab states have generally improved, following the reconciliation with Qatar in January 2021 (see QATAR: Doha will gain confidence as a regional player - March 10, 2021). The relatively recently installed leaders of Kuwait and Oman are reaching out to Riyadh as they too look to consolidate their domestic positions.

However, the rivalry between Saudi Arabia and the UAE has generated a fresh source of regional tension (see SAUDI ARABIA/UAE: Economic competition will mount - July 22, 2021). Riyadh will exert more pressure on international businesses to move their regional headquarters to the kingdom and will impose more tariffs on UAE-based businesses.

Saudi Arabia views this as a corrective to the kingdom's previous acceptance of Emirati primacy in certain economic sectors. As the policy progresses, it could alter the former close political relationship between the crown princes of Saudi Arabia and Abu Dhabi, Mohammed bin Salman and Mohammed bin Zayed -- especially after one or both succeeds to the throne.

The Iran nuclear issue will continue to loom over the region in 2022. Gulf Arab leaders are seeking to improve relations with Tehran, but this would not guarantee their immunity in the event of a military escalation (see GULF STATES/IRAN: Breakthroughs will be piecemeal - October 18, 2021). Such outreach is also unlikely to provide a breakthrough in Riyadh's efforts to extricate itself from Yemen.