SVB failure spells contagion but not systemic risk

Major global tech lender Silicon Valley Bank and crypto lender Signature Bank have collapsed in quick succession

New York State financial regulators yesterday closed crypto lender Signature Bank, two days after the second-largest US bank failure ever: California's Silicon Valley Bank (SVB), the central lender in the US tech ecosystem. The Federal Reserve (Fed) yesterday announced emergency measures to backstop banks facing short-term liquidity pressures, in order to forestall bank runs like those which overwhelmed SVB and Signature.

What next

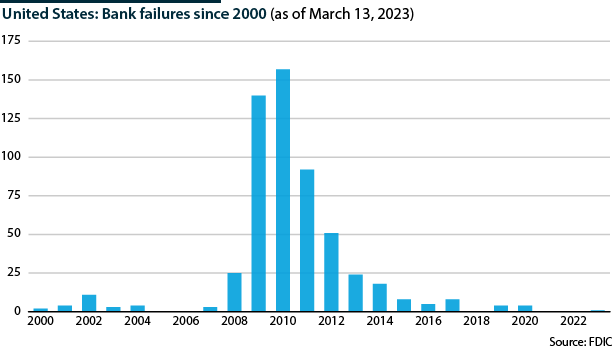

SVB’s collapse is unlikely to indicate systemic risk to the broader banking system, although contagion will spread. SVB's assets are mostly US Treasury bonds, which are at little risk of default, in contrast to mortgage-backed securities in the 2008-09 bank failures. This has lessened counterparty default risk. The disruption to tech firms' cashflows and capital-raising due to the SVB and Signature collapses will be widespread but uneven.

Subsidiary Impacts

- The Fed may pause its next rate hike to await more clarity on the extent of any contagion in the banking system.

- SVB’s demise will exacerbate the capital-access challenges facing its primary customers: tech venture capitalists and startups.

- Startups will lose key talent if they cannot pay wages, as employees will walk out or be laid off.

- Banks with large bond holdings will face investor scrutiny for mismatches between their funding costs and the rates earned on their assets.

- Tighter online regulations are making it harder for tech firms to generate revenue and keep compliance costs low.

Analysis

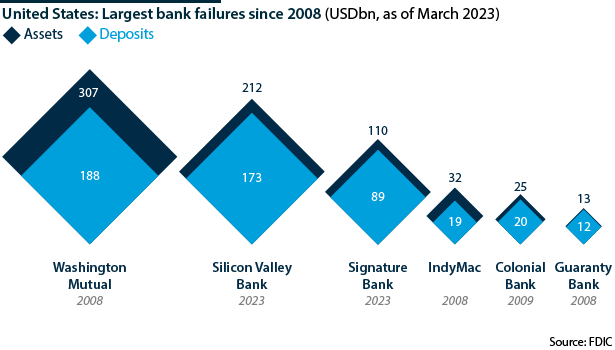

SVB is the largest US banking failure since the 2008 financial crisis, the second-largest ever and probably the most rapid collapse as it took only a few days.

It is the most prominent corporate casualty of the Fed's policy of raising interest rates to reduce inflation.

At this point, there is no suspicion of fraud, lax lending practices or unreasonable risk-taking by the bank's management, of the sort that characterised banking failures in the 2008-09 global financial crisis.

Regulators are scrambling to minimise business disruption, particularly to the thousands of tech firms that were SVB customers, and to deter customers fleeing from lenders that are under financial stress from the Fed's rate hikes, especially smaller banks focused on venture capital and startups.

SVB business

For 40 years, SVB provided traditional banking services to tech firms. It funded early-stage startups and venture capital deemed too risky for conventional lenders.

It was banker to almost half of the US venture-backed technology and healthcare companies that went public over the past two years.

As interest rates rose and venture capital became more difficult to find, some tech startups were already withdrawing deposited funds to provide working capital.

Capital plentiful but illiquid

SVB was well-capitalised: it had USD209bn in total assets and USD175bn in total deposits as of end-2023. However, it still needed to sell assets to cover the withdrawals.

Most of SVB's assets were Treasuries that will not default like mortgage-backed securities

SVB had tied up USD91bn of its assets in low-yielding long-term Treasury and other bonds, which had fallen in value as interest rates rose and were difficult to sell at short notice.

Depositors spooked

On March 8, having sold USD21bn of its assets at a USD1.8bn loss to give depositors their cash, SVB announced that it planned to raise USD2.25bn to shore up its balance sheet.

Depositors took fright, and some venture capital firms told their portfolio companies to move their cash out of the bank immediately. Customers withdrew USD42bn the following day (March 9), leaving SVB with a negative cash balance of almost USD1bn.

The bank had tried to raise more capital to add to USD500mn from venture firm General Atlantic, or alternatively to sell itself, but failed to do either.

The California Department of Financial Protection and Innovation closed SVB on March 10 and named the Federal Deposit Insurance Corporation (FDIC) as receiver.

Working capital

The FDIC, in turn, has created the Deposit Insurance National Bank of Santa Clara to hold the insured deposits from SVB.

The FDIC's primary goal is to ensure that routine commercial banking services are not disrupted and to stabilise the financial services segment that caters to the technology sector.

SVB's 17 branches are due to reopen today under the control of regulators, and insured deposits should be immediately available to their owners, up to the FDIC insurance coverage limit of USD250,000 for each qualifying account.

Insured deposits up to USD250,000 will be available today

Some uninsured deposits will still be available, and the FDIC says all depositors will eventually get all their money back.

Buyer for SVB

When a bank fails, uninsured depositors become unsecured creditors and typically face long waits and the return of only a percentage of their funds.

In this instance, the timing of when uninsured deposits are returned will depend on the pace at which the FDIC can sell SVB's assets to make good on the deposits. Uncertainty looms over who will buy SVB's USD73bn loan book, some one-fifth of which is venture capital debt.

Over the weekend, the FDIC sought bids for the bank's assets. There was some expectation that the FDIC might announce a buyer for SVB yesterday, but that did not materialise. FDIC would prefer a single buyer, for instance a large bank, as happened after the 2008 failure of Washington Mutual, bought by JP Morgan.

Cashflow squeeze

The immediate concern for tech firms that were SVB's customers is whether they can access the cash needed to make this month's mid-month payroll; US firms typically pay wages on a bimonthly cycle.

For all but early-stage startups, even the immediate return of the insured USD250,000 will barely cover one payroll cycle. Firms unable to withdraw their money in time are getting emergency funding from investors or seeking it from third-party lenders.

Upwards of 90% of SVB's customers are estimated to have uninsured deposits, so the scale of the cashflow problem, though unclear at this point, is potentially significant.

A significant number of tech workers may be laid off or leave due to unpaid wages, compounding the problems already afflicting tech sector employment (see UNITED STATES: Some tech labour markets will be tight - February 6, 2023).

Major firms with exposure

Well-known tech companies that say they held deposits at SVB include:

- Roku, a maker of set-top boxes for streaming, which says it had USD487mn or about a quarter of its cash and cash equivalents, at the bank.

- Gaming platform Roblox, which says SVB held about USD150mn of its USD3bn in cash and securities.

- Rocket Lab USA, a space launch startup, said it had about USD38mn of cash and cash equivalents at SVB.

- Cryptocurrency group Circle, which operates one of the world's largest stablecoins, has revealed a USD3.3bn exposure to SVB.

Capital crunch

SVB's collapse exacerbates the challenges facing tech venture capitalists and startups to access capital, from funding for founders to exits for investors.

With the rise in interest rates, venture capital deal activity fell by more than 30% last year to USD 238bn, according to Morningstar's PitchBook. The continuing dearth of initial public offerings and falling tech equity valuations suggest that funding challenges continued into this year even before the bank failures.

Beyond US tech

SVB was also the banker for tech firms in China, Denmark, Germany, India, Israel and Sweden. Its UK subsidiary was placed in receivership yesterday.

In many of those countries, the tech startup ecosystem is less robust than in the United States, so governments will have to act as the backstop to prevent companies going under.

SVB contagion affects multiple countries' tech sectors

UK contagion

The UK government has stated that although SVB's collapse presents no systemic risk to the domestic financial system, contagion effects touch on some of the country's the most promising technology and life sciences firms.

UK financial authorities had already made GBP85,000 (USD102,600) of insured deposits immediately available to customers of SVB UK, but exposed tech firms will require significantly more than that to cover payroll and operational costs.

A major relief has come from the last-minute government approval for HSBC to purchase SVB UK. This will allow the government to protect the domestic tech sector without using taxpayer money to bail out the bank.

India

India's technology sector has already suffered a major downturn due to rising borrowing costs and falling post-pandemic consumer demand (see INDIA: Tech slump hits domestic IT industry - January 16, 2023).

Several Indian tech startups have significant exposure to SVB; they include mobile gaming company Nazara, which kept USD7.75mn of its cash balance at SVB.

The government is meeting tech startups to evaluate the scale of exposure and formulate a response. Even if it agrees to provide some rescue funding to the embattled tech sector, many firms are unlikely to survive, and future startups and scaleups will face increasing difficulty in raising capital to fund growth.

Limited risk of systemic crisis

On March 10, equity investors marked down all banking stocks, particularly those of regional or single-industry banks, on fears that other banks with large bond portfolios could face liquidity pressures if they have to sell bonds before maturity to raise funds.

Markets are not over-worried about systemic risk, even if banks and investors start paying more attention to whether individual banks have a mismatch between their funding costs and the rates they earn on their assets.

The specific nature of SVB's funding base (focused on tech startups) and Signature's crypto customer concentration would suggest that any contagion will spread to tech firms rather than the broader banking sector.

The SVB and Signature failures resulted from textbook panic-driven bank runs that created a self-fulfilling liquidity crisis.

To forestall any repeats and minimise systemic risk to the financial system, the Fed has introduced emergency measures to backstop banks facing short-term liquidity squeezes. These include:

- a new Bank Term Funding Program that offers one-year loans to banks under easier terms than the Fed typically provides; and

- relaxed terms for borrowing through the Fed's discount window, its main facility for lending directly to banks.

Cryptocurrency crisis

On March 8, Silvergate Capital, one of the two leading bankers to the crypto industry, announced that it was going into voluntary liquidation. Like SVB and Signature, it found itself with footloose depositors and a business environment much changed by the rise in interest rates.

However, the problems of the crypto sector predate this crisis and have affected both developed and emerging markets such as India (see INDIA: Legitimacy problem of crypto market deepens - January 31, 2023). Tech investors were already on edge because of the deep financial winter afflicting the crypto sector, including the collapse of Sam Bankman-Fried's FTX group -- a Signature customer (see INT: FTX will not spell end of crypto industry - November 23, 2022).

The industry will be fundamentally transformed by the outcome of Bankman-Fried's trial in the United States (see UNITED STATES: Case law likely to shape crypto rules - December 20, 2022), and by forthcoming EU regulations on the crypto industry (see EU: FTX crypto collapse boosts case for MiCA rules - February 28, 2023).

US political contestation over consolidation

In the era of high interest rates, there are arguments for bank consolidation on grounds of financial stability and business logic. However, further banking sector concentration would be politically contentious.

US Congress will not want to bail out banks with taxpayer money again

Congressional Democrats would oppose a further flow of wealth and power to Wall Street at the expense of small businesses and US taxpayers and workers. Populist Republicans would oppose any strengthening of two constituencies that are increasingly out of favour with them for 'corporate wokeness' -- big banks and big tech.

JP Morgan is a potential buyer of SVB's assets as it has deep pockets and wants to increase its market share in venture capital and venture debt. However, CEO Jamie Dimon is a particular target of Republican populists as a 'poster boy' for 'wokeness'.

Outlook

SVB's US branches will reopen today, and state regulators say all depositors in SVB and Signature will start to have access to all their money.

By saying that all depositors will be taken care of, the government is prioritising protection of the tech industry, not bailing out banks as in 2008. To do so, as it says, at no cost to the taxpayer, it will have to sell the failed banks' assets quickly to private buyers. Equity and bondholders of SVB and Signature will be wiped out.

US President Joe Biden will address the issue publicly today: his key focus will be on reassuring markets of the low probability of systemic risk and on highlighting government preparedness for helping the technology sector manage contagion risks.

The SVB affair may lead Congress to revisit 2018 Trump-era loosening of regional bank capital and liquidity rules. Specific changes would likely be to the liquidity coverage ratio and net stable funding ratio.