Global deflation risk will fade due to monetary action

Despite some hotspots, deflation risks prevail over high inflation trends

Outlook

Most countries (mainly advanced economies, but also some emerging ones) are fighting deflation and low inflation, caused by economic weakness, cheap energy, industrial overcapacity or past currency strength. Consequently, many central banks are easing monetary policy, both through rate cuts and unconventional moves, mainly quantitative easing (QE) programmes. Some countries' central banks (namely the United States and the United Kingdom) see deflation as a transitory phenomenon and could raise rates this year or in early 2016.

From a longer-term perspective, recent research by the Bank for International Settlements finds that deflation has been rare since the Second World War, while asset price deflation has worse consequences for growth than consumer price deflation.

Impacts

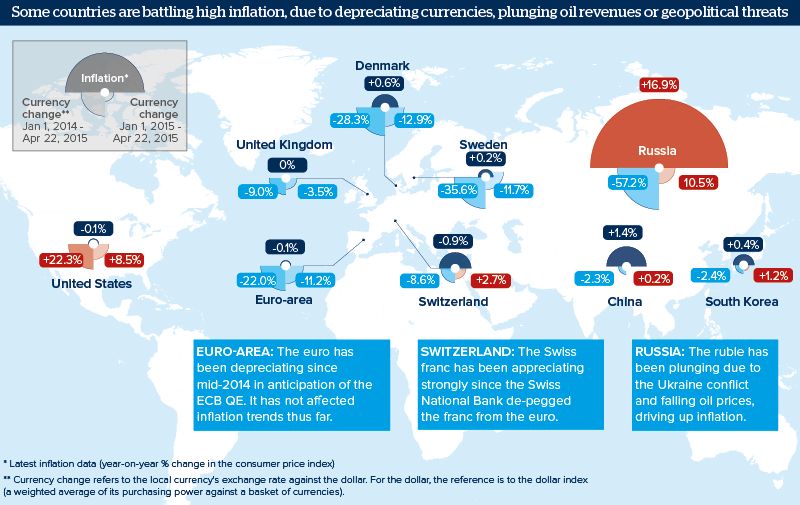

- Many central banks have embarked on balance sheet wars and competitive devaluations.

- Global monetary policy will stay accommodative despite the Federal Reserve's likely rates lift-off in 2015.

- Asset price deflation has negative wealth effects, as it causes deleveraging and more savings, weighing on aggregate demand.

- Property price deflation holds the worst consequences in terms of growth slowdown, as housing is non-mobile capital.

See also

- Currency wars will break out globally - Feb 9, 2015

- More graphic analysis