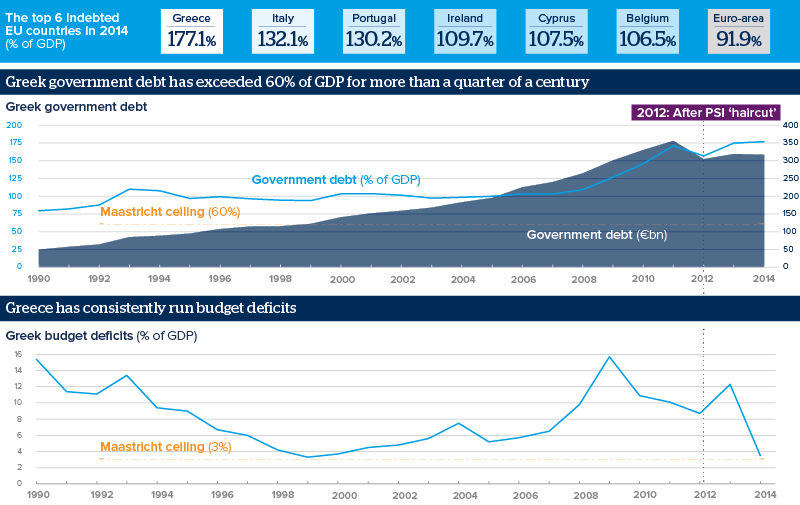

Without radical reform Greece will run up more debt

Decades of fiscal deficits, not just recent indiscipline, piled up Greece's debt mountain

Source: Eurostat

Outlook

Emergency talks were held in Berlin last night as senior European leaders sought to forestall the possibility of a Greek debt default. Although reneging on its debts would let Greece start again with a clean slate, it would immediately require the government to close its financing gap and restrict spending to income. That would impose the financial discipline that Greece has lacked for decades. For that reason, Athens will try all other options first.

When Syriza took office in January, there were hopes that, as an avowedly anti-establishment party, it would embark on much-needed and radical economic reform. These now seem naive. Syriza's policy is rather to defend vested interests in the public sector, neglect the private sector and replace its predecessors' patronage with its own.

Impacts

- The pension system needs a massive rationalisation which is far beyond the resources of Syriza to undertake.

- Bad publicity about 'Grexit' risk and fears of attendant disruption may reverse recent years' recovery in the important tourism sector.

- Prime Minister Alexis Tsipras says he would tax the rich, crack down on tax evaders (which rarely yields much) but cut no spending.