Latin America / China development faces reversal

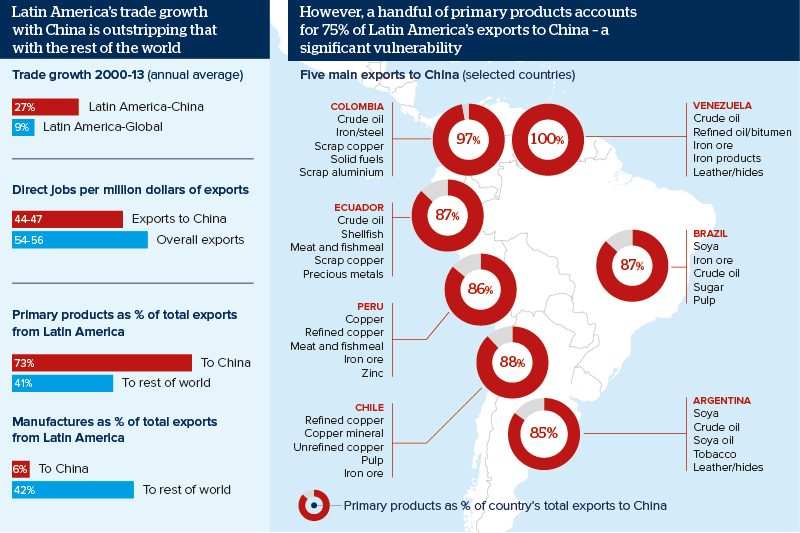

Chinese raw material demand may be pushing Latin America down the road of commodity dependency

Source: ECLAC

Outlook

Premier Li Keqiang's recent visit to Brazil, Colombia, Peru and Chile refocused attention on China's impact on regional economic development.

According to the UN Economic Commission for Latin America and the Caribbean, natural resources represent the bulk of China's imports from and direct investment in Latin America.

This runs counter to recommendations that Latin America boost productivity and value-added to stabilise growth and reduce commodity dependency.

Impacts

- A sharper-than-expected slowdown in China in 2015 or 2016 remains a downside risk for the region's commodity exporters.

- Argentina and Venezuela's external positions make them particularly vulnerable to any further fall in commodity prices.

- Argentina, Ecuador and Venezuela receive some 75% of Chinese lending to Latin America, often repaid in crude oil exports.

- Widening current account deficits in Brazil, Peru and Columbia will increase the opportunities there for bilateral financing from China.

See also

- China trade may bring new investment in Brazil - Oct 27, 2017

- Trump prompts Latin America-Asia integration rethink - May 17, 2017

- China's Latin America funding brings calculated risk - May 4, 2015

- More graphic analysis