Oil drop will have global ripples

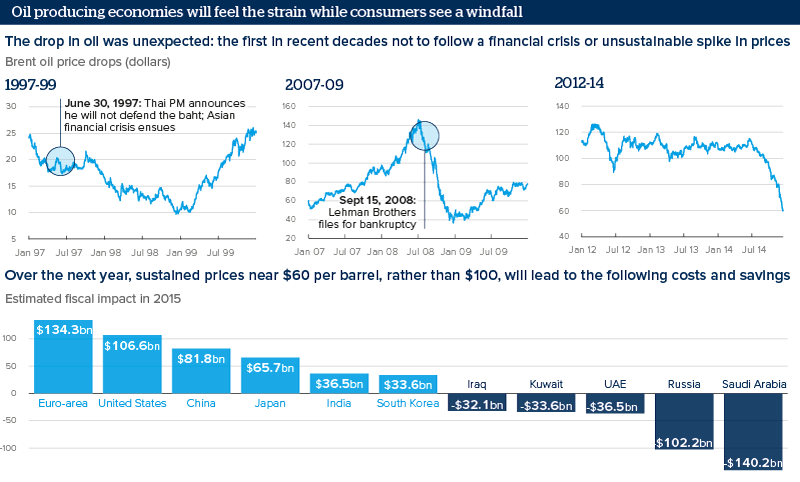

The decline in oil prices will act as a major transfer of wealth from oil exporting to oil importing countries.

Source: Bloomberg EIA Oxford Analytica

Outlook

The United States will be a net beneficiary, though the rise in domestic production means that it will cause pain for Texas and North Dakota, while offering profits for refineries in Louisiana and drivers in California. In the euro-area, the price drop will act as a stimulus in lagging economies.

The price drop will cause a deep recession in Russia. Venezuela will be affected with similar severity: each 10 dollars per barrel fall in price equates to a 5.7 billion dollar loss to the Finance Ministry and oil comprises 50% of revenues and 95% of foreign exchange.

Impacts

- Regionally, this will be of greatest benefit to East Asia and of greatest detriment to the Gulf.

- With a fiscal breakeven price of around 135 dollars, Iran's sanction-battered economy faces a further squeeze from low oil prices.

- Lower headline inflation could push the ECB to embark on sovereign funds quantitative easing early in 2015.

- Countries with high fuel subsidies may use falling prices as an opportunity to withdraw support for consumers.

- The oil sector will face heavy pressures to reduce exploration and Brazil's pre-salt fields may be reaching their breakeven point.