US monetary tightening will hit emerging markets

As the Fed gets ready to raise rates, higher borrowing costs and a stronger dollar will weigh on global debt management

Source: World Bank (World Development Indicators database), Oxford Analytica

Outlook

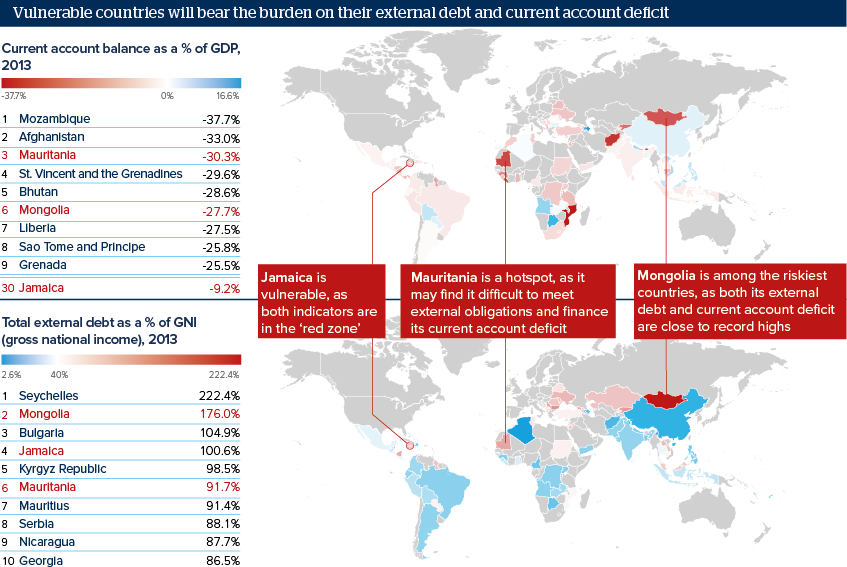

Since the Great Recession, dollar-denominated debt issued by emerging markets has more than doubled, from around 2 trillion dollars in 2009 to about 4.5 trillion dollars in 2014, according to the Bank for International Settlements. Coinciding with this borrowing binge, current account deficits in many emerging markets ballooned, requiring large capital inflows to balance the gap.

As the US Federal Reserve (Fed) is set to start soon its first monetary tightening cycle in almost ten years, global bond yields should rise, while the dollar is likely to stay strong, particularly now that US growth is through its first-quarter soft patch. This will threaten the ability of vulnerable countries to meet their debt obligations as countries and corporates will have to devote a larger share of their revenue in depreciated local currency to debt service.

Impacts

- A later Fed lift-off could delay, but not avoid, debt management troubles in countries at risk.

- Commodity-producing countries will be among the most affected, as low commodity prices deepen their balance of payments deficit.

- Affected countries may use their forex reserves to mitigate their debt management issues, if the reserves are large enough.

- Investors will favour emerging markets with greater fiscal and monetary flexibility and healthy external accounts.