EU housing will recover slowly, but divergences remain

Most continental housing markets are recovering thanks to better growth prospects, while the UK boom is cooling

Source: Eurostat, OECD, Oxford Analytica

Outlook

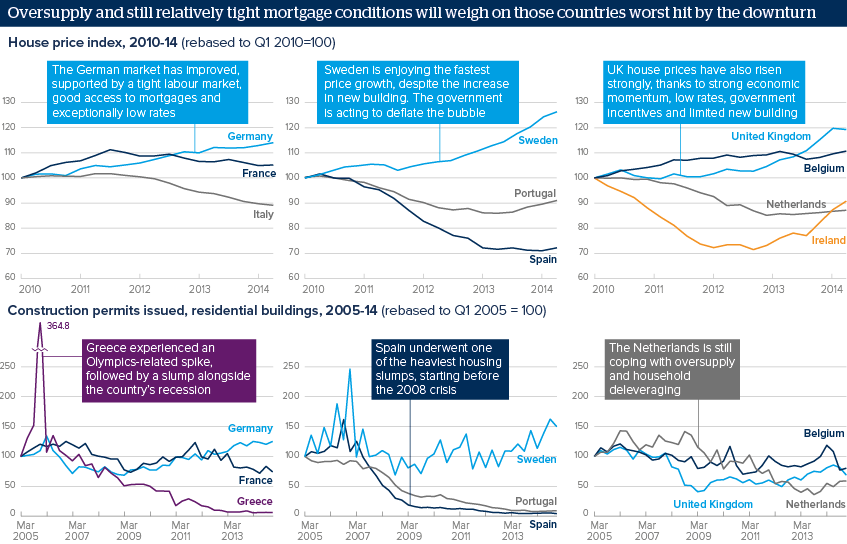

The improving growth outlook will support the EU housing market. Most countries will see higher prices and stronger building activity. Unlike the neighbouring Netherlands, Belgium's housing market remains resilient, thanks to cautious bank lending, no supply overhang and an influx of French nationals moving out of their country to avoid the 'solidarity tax', a rare wealth tax. Despite this outflow, France is also proving to be a resilient housing market, as building activity remains limited.

Ireland's house prices bottomed in 2013 and are recovering, though still well below their 2010 level. The United Kingdom is an exception. Its housing market spurt has likely peaked and price growth is likely to slow. The United Kingdom did not experience massive building pre-2008, helping to limit the extent of the subsequent downturn.

Impacts

- Persistent oversupply will cap the recovery in former bubble countries, such as Spain, Ireland and the Netherlands.

- Italy's house prices may stabilise after a prolonged slump, as the economy recovers gradually and credit conditions ease.

- Portugal's house prices are recovering more quickly than Spain's, as construction activity has tumbled. More rises are likely.

- Spain's house prices have bottomed and will now continue to accelerate, supported by international investors' demand.

See also

- High house prices may be global systemic risk - Jan 28, 2016

- European housing markets set to soften outside Germany - Nov 12, 2014

- More graphic analysis