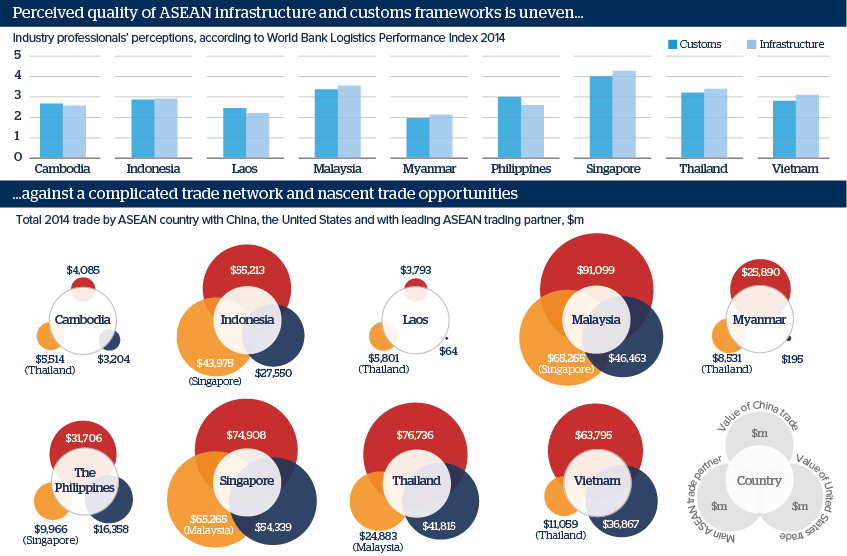

ASEAN infrastructure imbalances will spur competition

Uneven trade-related infrastructure across ASEAN implies investment possibilities and geopolitical competition

Source: World Bank, International Monetary Fund, Oxford Analytica

Outlook

Alongside customs services, port, railway and other commerce-related infrastructure varies across ASEAN; members that can trade efficiently gain competitive advantage, and foreign investors' confidence.

Infrastructure laggards risk falling behind: free trade agreements including the ASEAN Economic Community (AEC, launching in late 2015), the China-led Regional Comprehensive Economic Partnership and the US-led Trans-Pacific Partnership (both under negotiation) are forthcoming. ASEAN states are deepening bilateral ties.

In March, the Asian Development Bank forecast that ASEAN economies would grow 5.3% in 2016 with the AEC's arrival, and says that 60 billion dollars of infrastructure investment is needed annually. This offers foreign investment opportunities, but challenges ASEAN states to improve perceptions of their infrastructure and trade regimes.

Impacts

- ASEAN states will seek international aid to remedy infrastructure and regulatory gaps, and will offer public-private partnerships.

- Aid will be subject to geopolitical competition, particularly between China and the United States and Japan.

- This will see favourable terms for ASEAN states, but also growing pressure to 'choose' between Beijing and Tokyo and Washington.

- Infrastructure growth areas will include roads, railways, seaports and airlines/airports.

See also

- Cambodia will see development challenges in 2016 - Jan 13, 2016

- Vietnam eyes PPPs to plug infrastructure gap - Jun 15, 2015

- More graphic analysis