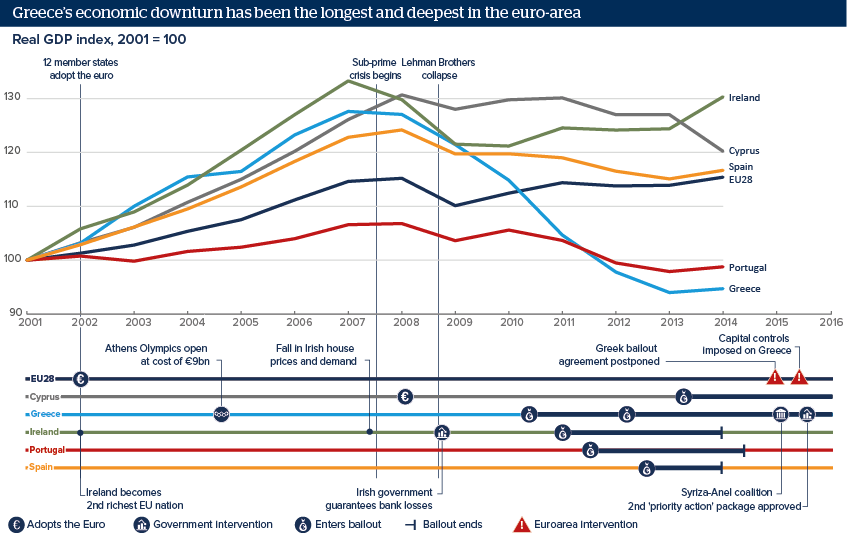

Resisting reform will make Greece the bailout laggard

Ireland, Cyprus, Spain have left Greece well behind in emerging from crisis and Portugal has outperformed it since 2012

Source: Eurostat, Oxford Analytica

Outlook

The risk of Greece leaving the euro-area has receded since the agreement with the country's creditors to negotiate a third bailout. The 'prior actions' votes in parliament show Prime Minister Alexis Tsipras able to push through necessary structural reforms although his party could yet split by September between pragmatists and those wedded to its original anti-austerity policy.

Significant debt relief would in the longer term make Greece's debt more sustainable. In the short term, the relaxation in the reform drive even before Syriza took office, its own attempts to avoid further austerity, the reversal of some reforms and July's three-week bank closures will continue the quarter-onquarter contraction into which Greece relapsed late last year, after three successive quarters of growth.

Impacts

- Greece's resistance to structural reform will continue to hold it back, behind other bailout economies -- even underperforming Portugal

- The IMF expects the other four bailout countries to grow but "unfolding developments" in Greece to "take a much heavier toll" than expected

- Business sees no improvement; the Eurostat index for business confidence for Greece, under 100 since December, was the EU's lowest in June

- Hungary and Poland will overtake Greece in GDP per capita, leaving only Bulgaria, Romania and Croatia poorer in the EU by this measure