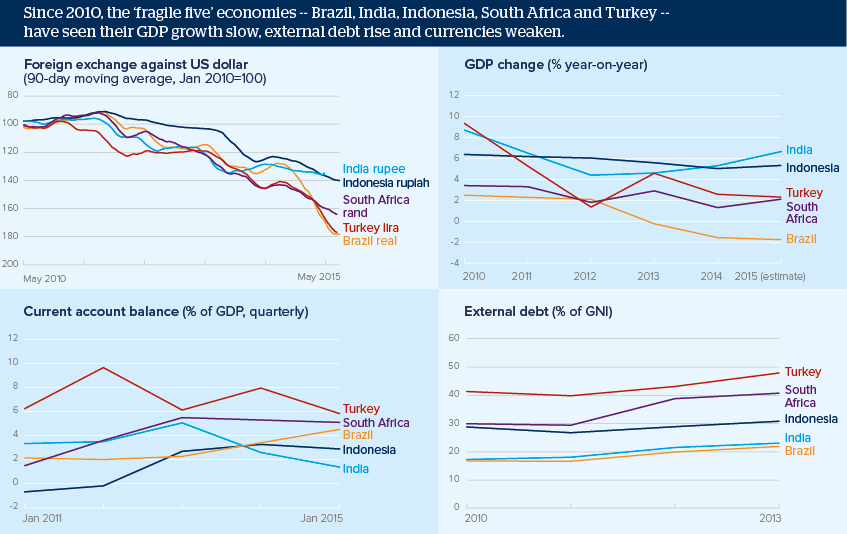

US rate rise to affect 'fragile five' differently

Key emerging markets are bracing for a rise in US interest rates

Source: Bloomberg, World Bank, Oxford Analytica

Outlook

All fragile five economies are likely to suffer capital flight and currency depreciation when US rates rise, likely before end-2015. In the longer term, this could boost manufactured exports and local currency revenue from dollar-denominated commodity exports.

However, the burden on corporates of dollar-denominated debt would intensify as would the cost of imports, despite the cushion of subdued oil prices for India, Indonesia, Turkey and South Africa.

With regard to sovereign risk, Brazil, South Africa and Turkey face the greatest risk from the hike. Their current account deficits are close to -- or over in the case of Turkey -- the 'danger threshold' of 5% of GDP. Gloomy growth prospects make matters worse: Brazil is in recession, South Africa and Turkey are headed for tepid GDP growth of around 2% this year. Robust, if sub-par, growth and stable external accounts promise relief to India and Indonesia.

Impacts

- Regionally, this will be of greatest benefit to East Asia and of greatest detriment to the Gulf.

- Currency depreciation may encourage import substitution, especially in Brazil.

- The corruption scandal and oil slump have undercut Petrobras's ability to attract new investment.

- India, Indonesia and Turkey finance their trade deficits with 'hot money', but the last is most at risk from capital flight.

- Capital flight from investment hungry Indonesia and India will highlight their structural constraints.