Inheritance tax is poor answer to raising revenues

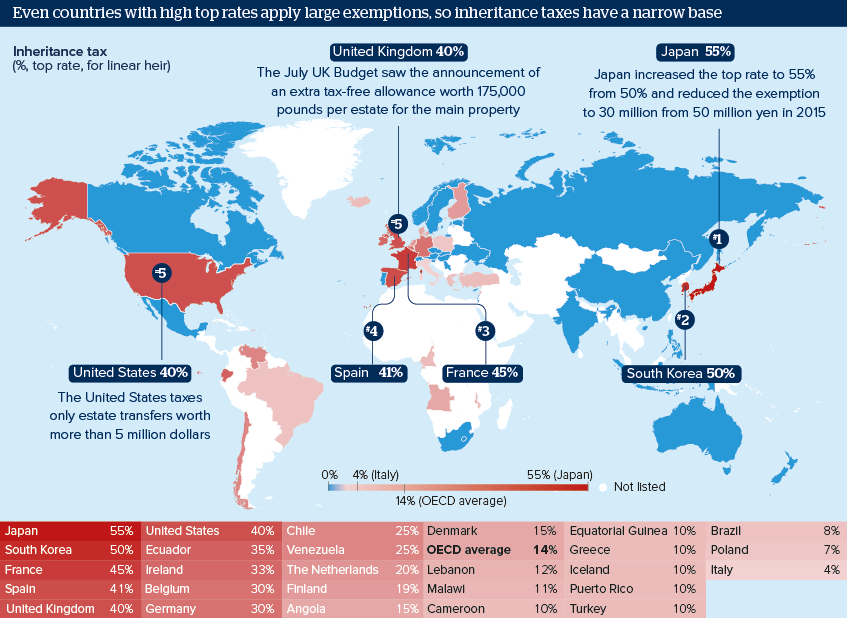

Within the OECD, 16 countries levy no taxes on assets passed to linear heirs, while the average top rate is 14%

Source: EY, The Tax Foundation, Global Property Guide, Oxford Analytica

Outlook

Inheritance taxes fall almost exclusively on domesticly accumulated wealth and generally account for a small share of a state's fiscal revenues. For this reason, many countries have repealed them: Canada in 1972; India in 1985; and Austria in 2008. Norway and Sweden also abolished them, in 2014 and 2004 respectively, despite their traditions of progressive taxation.

Repealing the US estate tax could help create 150,000 new jobs and increase fiscal federal receipts by 8 billion dollars yearly, according to the US Tax Foundation, a conservative-leaning think tank. Japan remains the country with the highest top rate; inheritance tax there is seen as instrumental to reduce wealth inequality.

Impacts

- Inheritance tax will raise less than 1% of US federal revenue in 2015, according to the Office of Management and Budget.

- High compliance and enforcement costs will further shrink the appeal of inheritance taxes.

- However, Thailand is considering introducing a 10% inheritance tax levied on estates worth more than 1.5 million dollars.