Nigeria will not divert FDI from South Africa

Divergent strengths and weakness will determine how Africa's largest economies emerge from the recent growth wobble

Source: IMF, World Bank, McKinsey, World Economic Forum, Transparency International, US EIA, UNCTAD, NSE, JSE, Stats SA, NBS, Times Higher Education Supplement

Outlook

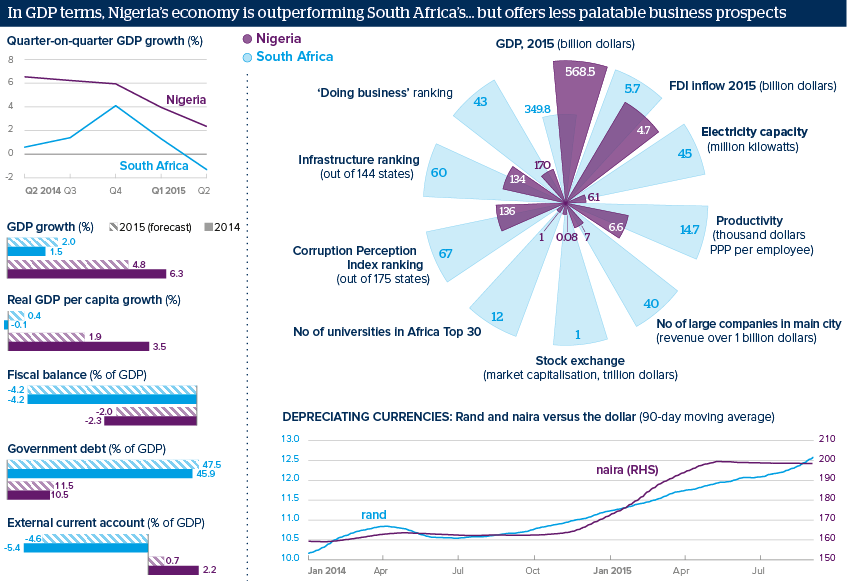

Nigeria and South Africa are experiencing slowing GDP growth and deteriorating fiscal imbalances. Both suffer from lower commodity prices, structural problems -- notably power deficits -- and policy uncertainty. On the surface, anticipation of a reformist cabinet in Nigeria and stronger headline data appears to make it a better investment prospect than South Africa, where anti-business policies and labour unrest could plausibly spell recession.

However, like much of the hype around the continent's economic prospects, Nigeria's case focuses on its unmet potential. South Africa boasts a better business environment, deeper capital markets, higher productivity and wealthier consumers, meaning it is unlikely to lose its 'business powerhouse' status in the foreseeable future.

Impacts

- The Nigerian central bank's import bans, aimed at saving foreign exchange, will create input shortages, stymying manufacturing.

- Despite sharp currency falls, external debt distress risks remain low for both states; most public debt is held domestically.

- Poor performance by South Africa's state enterprises, which monopolise key sectors, eg electricity, will reduce its global competitiveness.

- Downturns will be mild in reformist subnational authorities with good implementation capacity, eg Lagos and Cape Town.