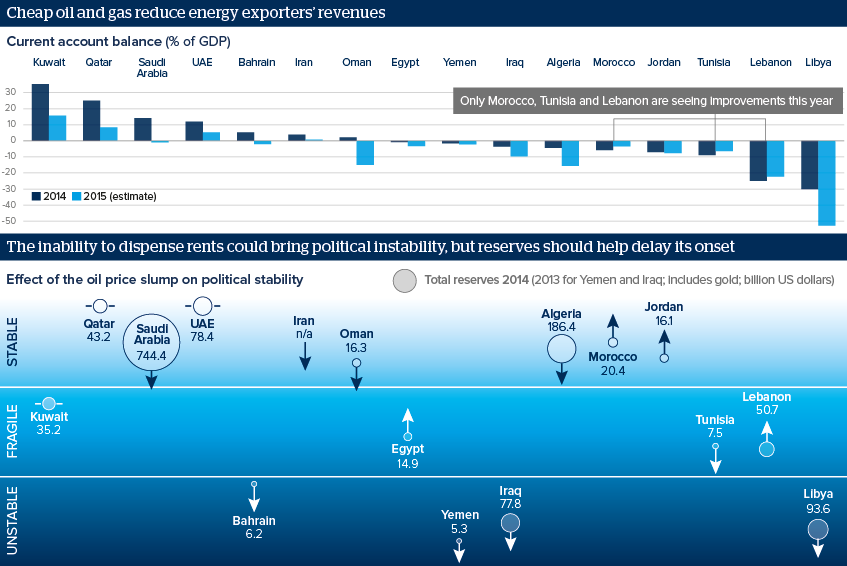

Cheap oil risks long-term Middle East stability

The oil price slump is straining finances across most of the region, raising the potential for instability down the line

Source: IMF, World Bank, Oxford Analytica

Outlook

Cheap oil has proved a boon for some Middle Eastern energy importers following the sharp drop in prices in the second half of 2014; however, it is straining the fiscal positions of the region's hydrocarbon exporters. The gains made by the energy importers (Morocco, Tunisia and Lebanon) are much less than the exporters' losses. This indicates that most states in the Middle East and North Africa will experience rising fiscal pressures.

Although wealthier exporters in the Gulf have enough reserves to avoid a crunch for the next decade, they will nonetheless reduce spending. Essential infrastructure spending could be squeezed and subsidy reductions are already on the table. However, any changes to the social contract will raise discontent with the ruling elites, and increase the prospect of political instability.

Impacts

- Bahrain and Oman will be bellwethers of fiscal trends for richer oil-exporting states.

- Saudi Arabia's deep reserves will allow it to sustain high spending until at least 2020.

- Spending cuts to oil field investment programmes will damage Iraq's long-term production targets.

- Reduced spending on fuel subsidies will ease pressure on budgets in Egypt and Morocco.

- Tunisia's gains from cheap oil have been offset by terrorist attacks that hurt its tourism sector.