US Fed remains on track to hike rates in December

Rates stayed on hold in September, but strong fundamentals and reduced uncertainty should support a rise by year end

Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg, Oxford Analytica

Outlook

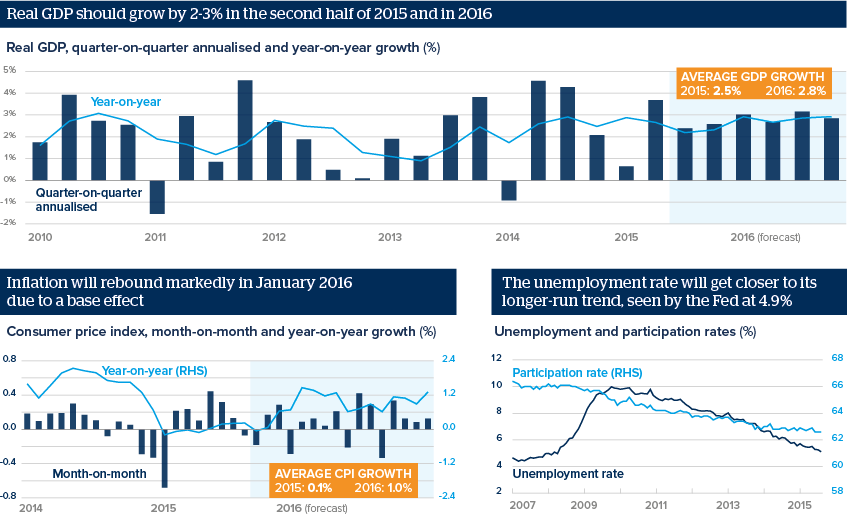

Growth will be supported by strong private consumption and a rebound in business investment as the drag from the 2014 oil price drop on the energy sector and from the strong dollar fades. Housing will give a positive, steady contribution to growth.

If growth meets expectations, the output gap -- the difference between actual and potential output -- will close by 2017. Above-potential growth will produce further job gains of around 200,000 per month, driving the unemployment rate even lower.

Inflation will rebound, also due to the fading impact of the strong dollar and low oil prices. As the output gap narrows, core inflation should gradually trend higher. The Fed is likely to start hiking rates this year, most probably in December.

Impacts

- Net trade will be a near-term drag on growth due to the dollar's strength outweighing improving demand for exports.

- Risks to the outlook are geopolitical uncertainty, slower global growth, a strong dollar and tighter financial conditions.

- From 2016, supply constraints and higher policy rates will gradually slow the economy towards its potential growth rate, estimated at 2%.