Commodity price slump boosts India's energy security

India's energy demand is rising in the context of a buyer's market

Source: IEA World Energy Outlook 2014, Indiastat, Coal Directory of India 2013-14, Sen (2014)

Outlook

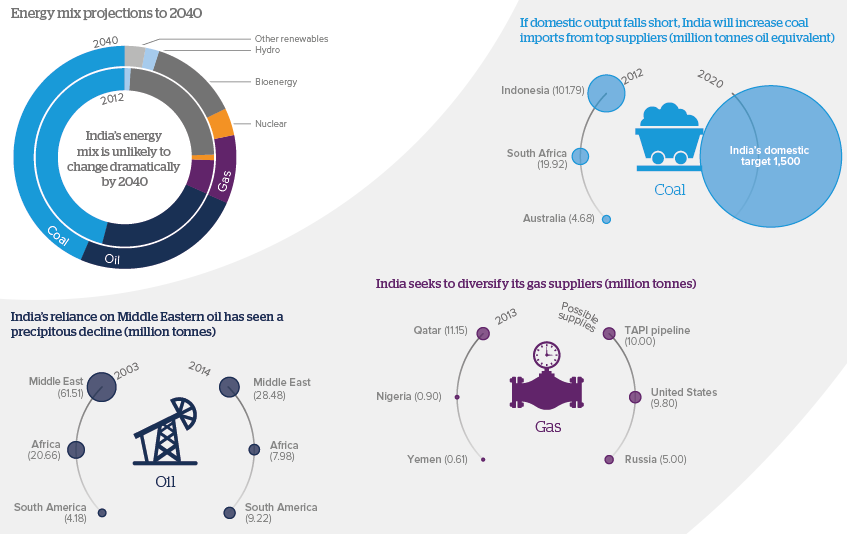

Amid a relatively constant energy mix, the big policy change will be government attempts to end steam coal imports by 2020 by tripling domestic coal production to 1.5 billion tonnes.

Although coal production has begun showing double-digit growth, this target could be achieved by perhaps two-thirds, provided coal reforms are implemented and there is no climate constraint.

Gas imports will increase as domestic production falls, and expectations of new global supplies indicate soft prices to at least 2020. India wants to continue reducing its dependence on volatile Middle Eastern oil supplies by increasing Latin American imports. However, with Latin America's oil output falling, this may prove unrealistic in the near-term.

Impacts

- India will be able to import coal at favourable prices to 2020 as European, Chinese and US demand for the commodity falls.

- India's growing coal reliance will be controversial, but the government will cite its renewables target to mollify critics.

- The inability of gas to compete domestically implies a limited market for it relative to other fuels.

- Soft global prices risk freezing investment in new oil and gas assets.

See also

- Coking coal producers will face extended strain - Jun 29, 2016

- India's renewables target will not lower coal reliance - Mar 31, 2015

- More graphic analysis