East Africa struggles to capitalise on cheap oil

Expectations of benefits from a lower oil price are being tested

Source: Bloomberg, Energy Regulatory Commission (Kenya), Ibrahim Index of African Governance

Outlook

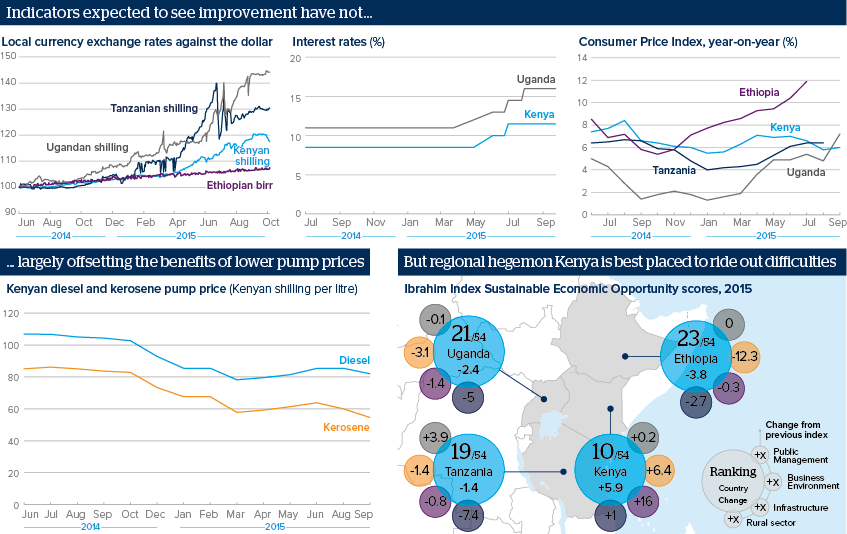

The gains for East Africa's oil importers from the oil price crash have not been as strong as expected. Currency depreciation, rising inflation and tightened monetary policy are hurting the profits of local businesses and curbing domestic demand, offsetting cheaper energy and fuel costs.

External factors such as China's slowdown and the anticipation of US rate rises exacerbate the weak buffers of regional economies where imports rise and exports lag.

However, for a longer-term outlook, the latest Ibrahim Index of African Governance offers a better sense of which economies are making headway on the fundamentals, in particular infrastructure. Regional hegemon, Kenya, continues to lead the pack.

Impacts

- Despite Kenya's relative resilience to economic headwinds, its propensity to political violence is the main vulnerability.

- If El Nino threatens agricultural output, the regional costs of damage to crops and infrastructure may be significant.

- Uganda and Tanzania, both of which have seen large influxes of FDI on the back of new oil discoveries, may face disruptions to those flows.