Coal supply glut will squeeze high-cost producers

Indian and Chinese producers will weather extended global low prices better than export-oriented mines elsewhere

Source: Bloomberg, BP Statistical Review of World Energy (June 2015), Oxford Analytica

Outlook

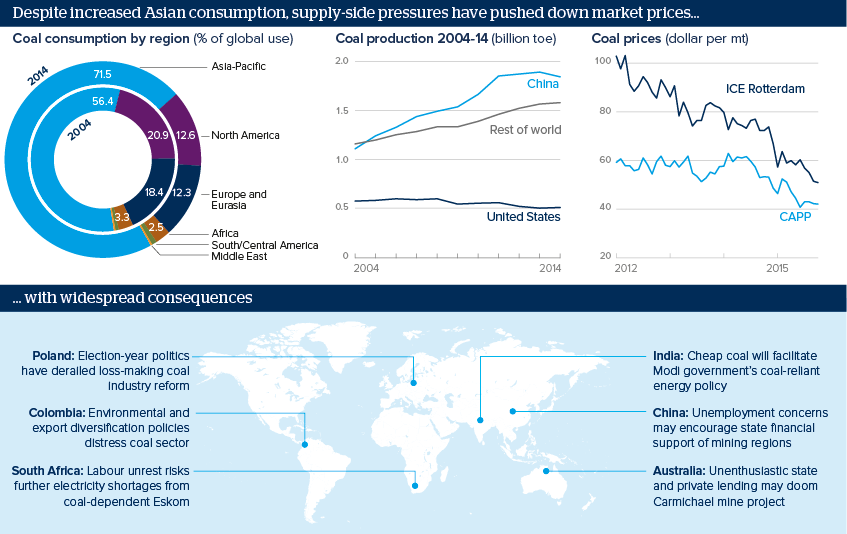

Commodities prices are in an extended slump due to oversupply and weak global demand -- coal is no exception. Global coal production rose 38.8% between 2004 and 2014, from 2.83 billion tonnes oil equivalent (toe) to 3.93 billion toe.

Although Asian coal consumption has grown over the past decade -- particularly in India and China -- demand for imported coal has proven lacklustre. Rising domestic production in India and protectionist tendencies in China will further expose coal producers abroad to the consequences of overexpansion.

The strong dollar, high labour costs, and stricter environmental regulations from the Obama administration -- together with cheap energy substitutes available in oil and natural gas as a result of the shale boom -- present a bleak outlook for US coal producers.

Impacts

- High-cost coal producers will cut investment and hiring plans in the short-to-medium term due to weak sector prospects.

- Cheap oil, gas and coal will hinder investment in Generation III and Generation IV advanced nuclear reactors.

- Pressure from beleaguered US coal states may lead President Barack Obama's successor to backtrack on Paris climate conference pledges.

See also

- Port approval will not improve Australia coal outlook - Dec 22, 2015

- Prospects for global gas and coal markets in 2016 - Nov 19, 2015

- Global coal market will stay oversupplied - Sep 15, 2015

- More graphic analysis