Political risks dampen Middle East investment outlook

Investors are looking for safe destinations, but pickings in the region are slim

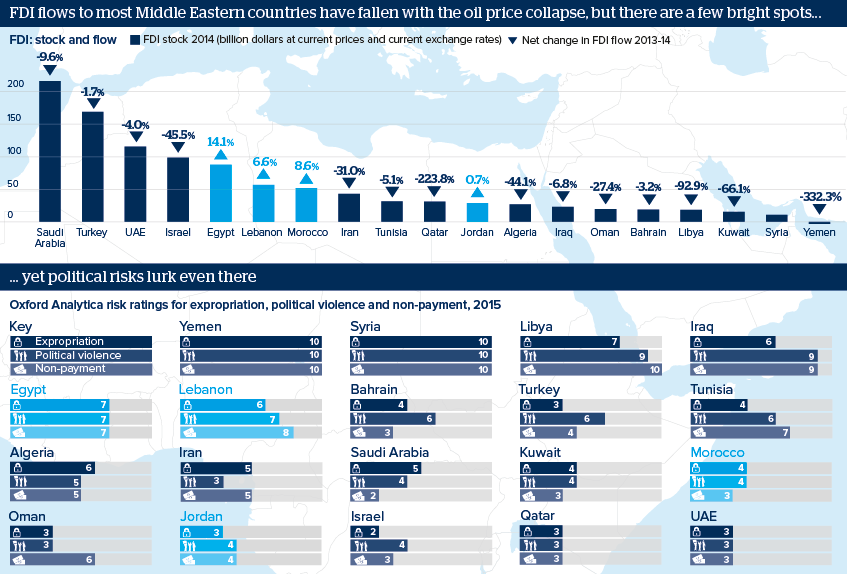

Source: UNCTAD, Oxford Analytica

Outlook

With last year's collapse of oil prices, foreign investment flows to most Middle Eastern countries fell. However, oil importers Egypt, Lebanon, Morocco and Jordan have attracted increased investment, benefitting from the lower oil prices, and from being perceived as stable states relative to other parts of the region.

However, even there political risks lurk. Lebanon's political paralysis elevates the risk of sovereign non-payment. In Egypt, support from the Gulf mitigates potential expropriation and non-payment risks, but they remain high. Morocco has been the poster-child for investment, but its sensitivity around the Western Sahara dispute in September blocked the opening of an IKEA store. Only in Jordan political risks are subdued, but any FDI there will take time to trickle down to the real economy.

Impacts

- Turkey's political troubles further raise the risk of political violence this year.

- Despite the security crisis, FDI in Iraq fell by only 6.8%, but a deeper decline may occur next year, owing to the government's cash crunch.

- The UAE is one of the best investment prospects, but it is vulnerable to fluctuations in global capital flows.