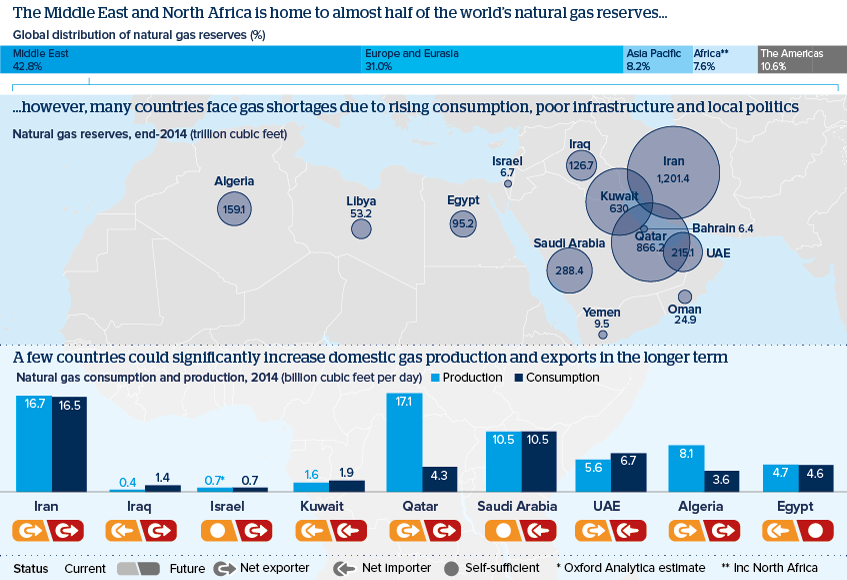

Gas outlook will reshape Middle East energy balance

The region's gas sector is set for major change over the coming decade

Source: BP Statistical Review of World Energy 2015; Oxford Analytica; US EIA

Outlook

Leading exporters such as Qatar and Algeria will face increased competition from North America and Australia. The major internal challenge comes from rising domestic demand, stoked by government subsidies, which is eroding gas volumes available for export and forcing many countries to import extra gas (UAE, Egypt).

Production is below potential due to poor infrastructure (Iraq), bureaucratic hurdles (Algeria) and local political disputes (Kuwait/Saudi Arabia/Iran). However, some countries are experiencing an upturn. Offshore discoveries should make Egypt gas self-sufficient and Israel a regional exporter in coming years, while post-sanctions Iran could attract the foreign investment needed to exploit its massive reserves and become a significant exporter.

Impacts

- Gas shortages will hamper the Gulf's industrialisation and diversification drive.

- Chronic infrastructure and local power supply issues will constrain Iraq's massive export potential.

- Saudi Arabia may import gas to reduce the burning of oil for domestic power generation.

- Algeria's gas export outlook will depend upon increased investment, and economic growth in Europe.

- Israel's export potential will be hampered by political disputes with Turkey.

See also

- LNG imports set to rise in Middle East - Aug 10, 2016

- Qatar can ride out gas price collapse - Jan 22, 2016

- Iran gas can diversify European supplies in long term - Aug 24, 2015

- More graphic analysis