Africa's anticipated internet boom could disappoint

Lacklustre investor interest, lack of electricity and poor network infrastructure could hamper mobile internet growth

Source: WEF, Deloitte, ITU, FT Analyse Africa, McKinsey, Ericsson

Outlook

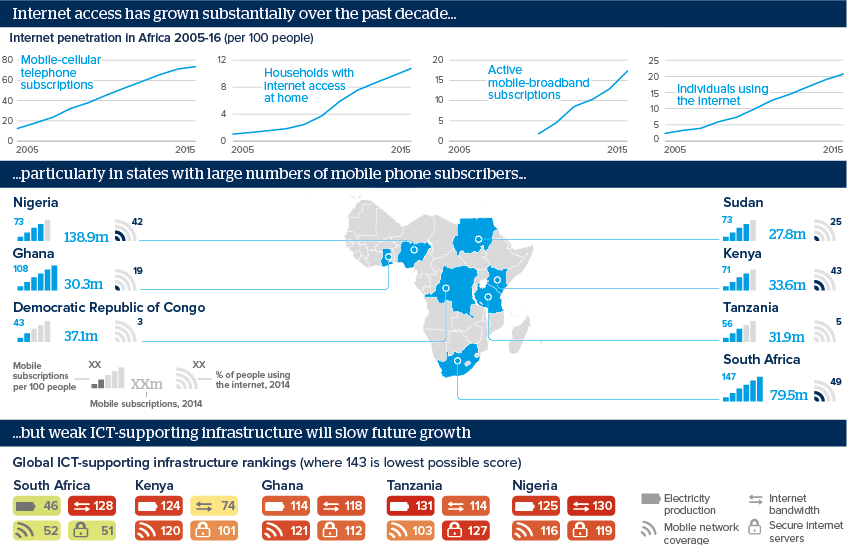

Several forecasts are bullish on the sub-Saharan Africa (SSA) communications sector. Telecoms firm Ericsson expects mobile penetration to reach 100% by 2021, supporting a 15-fold increase in mobile data traffic. McKinsey says internet penetration will triple to around 50% by 2025, mainly via smartphones.

Such projections trigger enthusiastic speculation on the development potential -- from boosting financial inclusion using mobile banking to delivering education and health sevices remotely to rural areas. Yet even SSA's best-connected economies face critical deficits in infrastructure necessary for underpinning telecoms expansion.

Foreign investor appetite is lagging. Communications projects accounted for only 7% of FDI in capital investments in 2014; software and IT services investment was unchanged.

Impacts

- Nigeria's 5.2-billion-dollar fine on operator MTN will heighten business risk perceptions, potentially dissuading foreign investment.

- Ethiopia's vast unbanked population will attract interest from mobile banking firms, but strict regulation will prevent rapid expansion.

- Low internet penetration (under 5%) in states such as Benin and Guinea will stymie services sectors, exacerbating reliance on commodities.

- In South Africa's Western Cape province, the ruling Democratic Alliance will prioritise free Wi-Fi to boost its 2016 local polls chances.