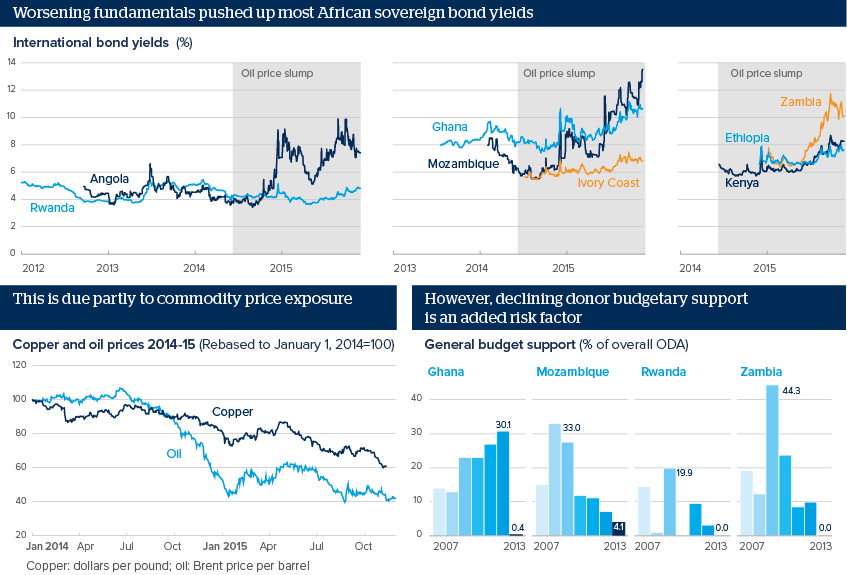

Aid effect heightens Africa sovereign bond risks

Declining donor support further undermines sovereign liquidity

Source: IMF, Bloomberg

Outlook

Yields on African sovereign euro-bonds rose as investors sold off riskier assets. African economies are exposed to falling commodity prices, China's slowdown and the anticipated US interest rate rise.

A less well-recognised risk comes from declines in general budgetary support since the 2008 global financial crisis. Donor aid is being re-directed into funding of imports for capital projects. This seeks to boost overall growth, and reduce donor exposure to abuse of aid funds.

However, this shift removes implicit guarantees for investors that donors have enough influence to keep fiscal policy -- and thus development capacity -- on track.

Impacts

- Africa's small, illiquid debt markets will remain disproportionately vulnerable to volatile foreign investor interest.

- Debt-to-GDP ratios look favourable but remain a poor indicator of the risks for debt distress.

- A slowdown in capital flows makes it more difficult and expensive to service foreign debt commitments.

- Aid flows from China are significant, but lack the transparency needed to act as a stabiliser.