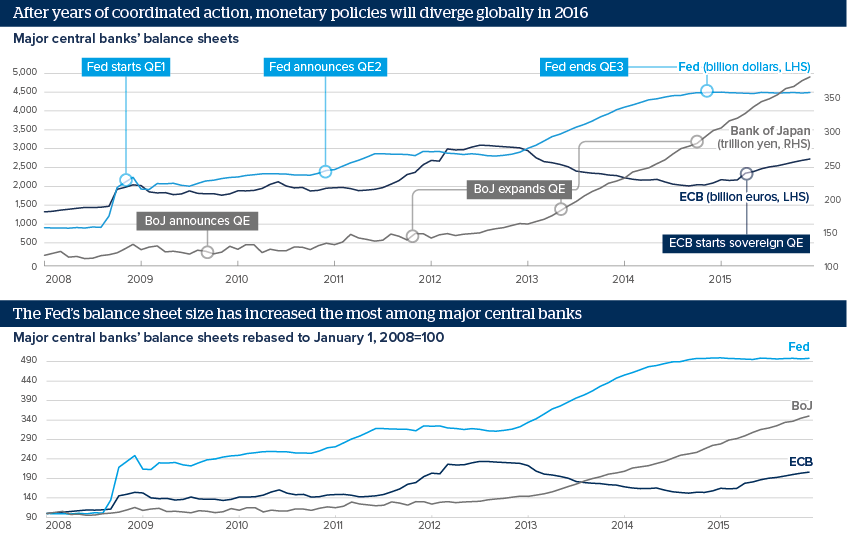

Global monetary policy divergence will be key in 2016

The Fed has just hiked rates for the first time in nine years, while both the ECB and the BoJ have eased policy further

Source: Bloomberg, Fed, ECB, BoJ, Oxford Analytica

Outlook

On December 16, the US Federal Reserve (Fed) hiked its Fed Funds target rate for the first time since 2006. On December 3, the ECB cut its deposit rate by ten basis points and extended its quantitative easing (QE) programme by six months until at least March 2017. On December 18, the Bank of Japan (BoJ) announced additional purchases within its quantitative and qualitative easing programme.

Both the ECB and the BoJ's balance sheet will expand further, keeping their respective currencies weak. The Fed's balance sheet size will stabilise and not rise further, as the Fed keeps reinvesting principal payments from its portfolio holdings. Despite this, the overall US monetary stimulus remains the largest among the three central banks to date.

Impacts

- The Fed's balance sheet will remain about 4.5 times its 2008 size.

- A stronger dollar will help the ECB achieve its inflation goal, through a weaker euro.

- The ECB's balance sheet will be on track to overtake its early 2012 size.

- The ECB could ease monetary policy further in 2016, to anchor inflation expectations.

See also

- Emerging Europe markets will be strong in 2016 - Dec 31, 2015

- Global liquidity risks a heavy slump in EMs - Dec 23, 2015

- Global monetary policy divergence will emerge in 2016 - Dec 16, 2015

- More graphic analysis