Post-sanctions opening could transform Iran's economy

Sanctions have limited Iran's huge growth potential for decades

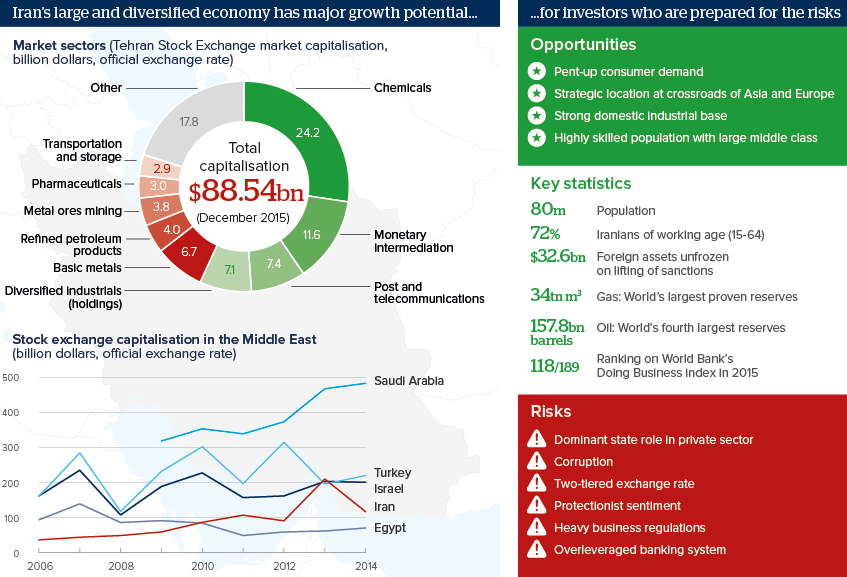

Source: Tehran Stock Exchange, World Bank

Outlook

Foreign investors are poised to return to Iran after the United States and EU lifted stringent sanctions on its financial and oil sectors on January 16. The most lucrative openings for foreign investors will initially be found in the oil and gas sector, but Iran also offers opportunities in mining, aviation, telecoms, financial services, and construction, as well as the capital and consumer goods sectors.

With most sanctions lifted, focus will return to the systemic problems within the Iranian economy -- notably strong protectionist sentiment, cumbersome bureaucracy and regulation, and the pervasive role of informal political networks in business. In addition, many privatised companies still have strong state connections, including to figures within the Iranian military. This creates a particular hazard for foreign investors who could fall foul of US and EU sanctions legislation that remains in place on certain military-linked figures and activities.

Impacts

- European companies stand to gain most from oil and gas sector opportunities.

- Successful foreign investment in Iran will depend on selection of the right 'on-the-ground' broker.

- Iranian steel mills, auto producers and consumer goods firms will likely lobby for protective tariffs.

- Gulf banks will be in pole position for foreign partnership opportunities in the financial sector.

- Turkey is seeking to diversify its energy sources with Iranian oil and gas.

See also

- Iran's SME sector set for growth - Mar 14, 2016

- Investors will return slowly to Iran despite potential - Jul 20, 2015

- More graphic analysis