US Fed will hike rates very gradually in 2016

Growth is likely to have slowed at end-2015, raising uncertainties about business momentum heading into 2016

Updated: May 19, 2016

Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg, Oxford Analytica

Outlook

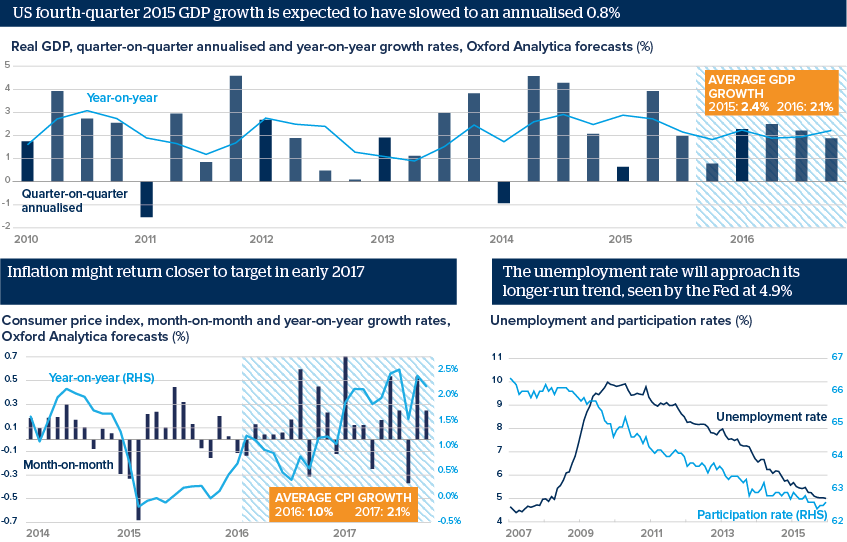

GDP growth will accelerate slightly above 2%, before slowing down again closer to potential growth. Risks are to the downside and relate to the renewed oil price drop, which is likely to hold down business investment further in the oil and gas sector. The strong dollar and weak global growth prospects are also likely to weigh down US growth through their impact on net exports.

Private consumption remains the bright spot again, likely to be the main source of growth in 2016, as in 2015, helping offset weakness in the industrial and trade sectors. Job growth rebounded strongly in the fourth quarter of 2015. It is likely to decelerate again in 2016, as growth approaches potential, estimated at 2%.

Impacts

- Residential investment will keep growing, supported by favourable demographic trends.

- As the output gap narrows, core inflation will accelerate gradually.

- After the December rates lift-off, the next hike is more likely at the June meeting than in March.

See also

- June US interest rate hike is more likely - May 19, 2016

- 'Brexit' fallout could hit EU financial assets widely - May 10, 2016

- US June rate hike remains on the cards - May 6, 2016

- A June US rate hike is a close call, but likely - Apr 28, 2016

- Yen surge to question global monetary easing's effects - Apr 12, 2016

- Full employment will boost US wage growth - Mar 30, 2016

- US Fed will stay dovish despite Evans rethink - Mar 23, 2016

- Dovish Fed will hike US rates more gradually this year - Mar 17, 2016

- EMs will stay fragile despite improving sentiment - Mar 8, 2016

- Service sector will drive US growth in 2016 - Mar 4, 2016

- US Fed will hike rates gradually despite Beige Book - Mar 3, 2016

- Cheap oil will not bridge Turkey's external gap - Feb 29, 2016

- US FOMC will stay cautious - Feb 24, 2016

- Weaker dollar will support global gold demand - Feb 19, 2016

- Negative rates hold few positives for stock investors - Feb 16, 2016

- Yellen sounds cautious on pace of US rate rises - Feb 11, 2016

- Slow job growth supports gradual US rate hikes - Feb 8, 2016

- US Fed will struggle to raise rates much in 2016 - Jan 6, 2016

- More graphic analysis