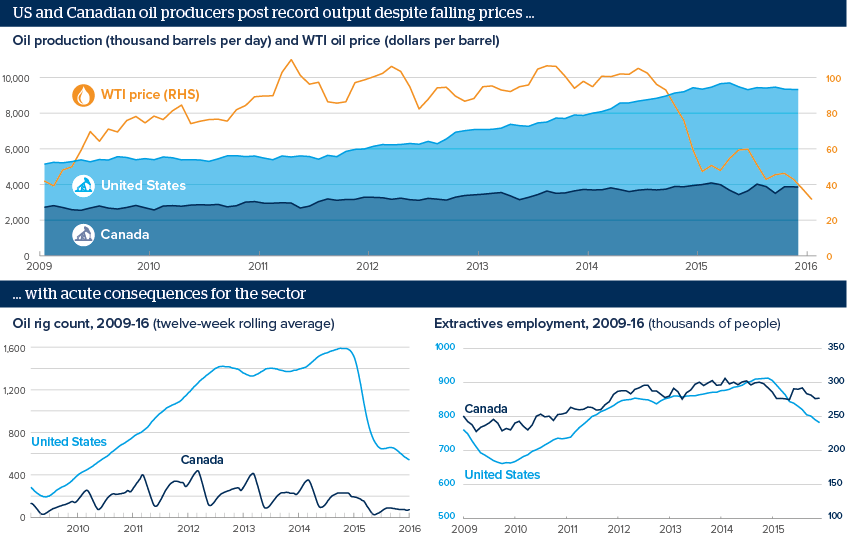

US and Canadian oil producers face bleak 2016

Sectoral pressures have acute regional and political implications

Source: US Energy Information Administration, National Energy Board (Canada), Baker Hughes, Statistics Canada, US Bureau of Labor Statistics, Bloomberg, Oxford Analytica

Outlook

As global oil producers compete for market share in a low-price environment, the US and Canadian energy sectors have struggled with tepid demand, high operating costs, regulation-friendly administrations in Washington and Ottawa and tightened conditions of lending.

With prices dropping by 66.9% over the past 18 months and continued overhang from swollen inventories muting the short-term effects of any potential decreases in production, North American energy companies face a bleak outlook through the second half of 2016.

If oil prices remain below 40 dollars per barrel, defaults of heavily-indebted shale producers are to be expected and the Albertan oil sands may suffer permanent damage, with knock-on effects for industry-dependent manufacturing and transport.

Impacts

- Increased energy efficiency in heating and vehicles will blunt the boost to consumption from low oil prices.

- Large, diversified states, such as Texas and California, will weather the glut better than oil-dependent Alaska and North Dakota.

- Sectoral job losses and the rejection of the Keystone XL project will envenom Canadian climate policy and pipeline debates.

- Policymakers may opt to delay or soften Paris climate agreement implementation in light of market-driven headwinds.