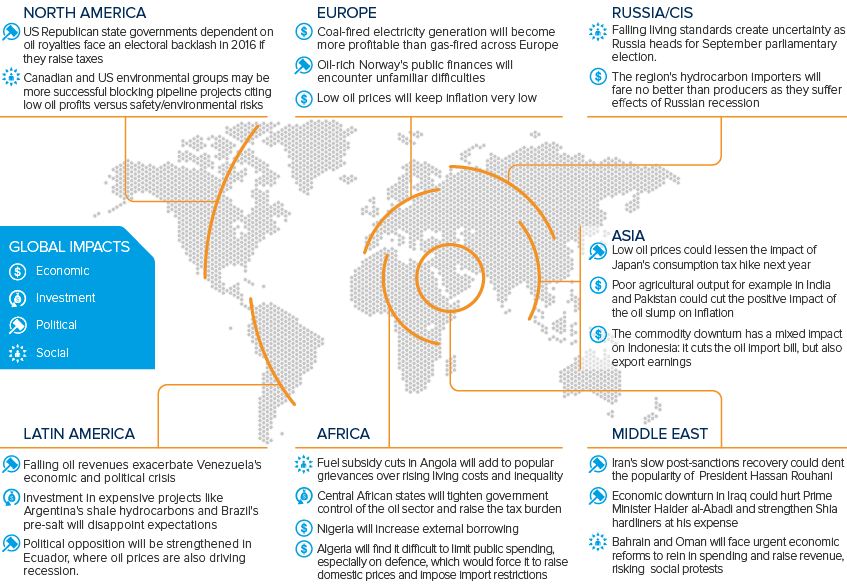

Ripple effects of cheap oil will reach far and wide

With oil prices set to remain subdued in 2016, their impact will start to bite

Source: Bloomberg EIA Oxford Analytica

Outlook

The slump in oil prices has repercussions throughout globe, with oil producers feeling the greatest impact. With its vast energy stores, the Middle East is the first to feel the impact.

However, the effect will be more pronounced in states that rely on hydrocarbons exports for a significant portion of their revenues and lack significant buffers to plug revenue holes. For example, in Nigeria and Angola, high oil prices had allowed them to maintain high expenditure, but without building significant reserves. This means they now face a spike in debt.

Ripple effects will also reach further afield, from reducing prospects for investment in fracking in Europe to forcing Colombia's economic diversification.

Impacts

- The Gulf will make cutbacks to expat benefits and employment, and to larger infrastructure projects.

- If Saudi economic reforms are seen as failing, this could damage the credibility of Prince Mohammed bin Salman.

- Import restrictions in Nigeria and Angola to shore up foreign reserves will create shortages of consumer products and industrial inputs.

- In Russia, the hit to oil export revenues exacerbates the recession and Moscow