ECB will ease monetary policy further on March 10

Downside risks, tightening of financial conditions and weak inflation dynamics

Updated: May 20, 2016

ECB account confirms focus on euro-area inflation · All Updates

Source: Eurostat, ECB, Bloomberg, Oxford Analytica

Outlook

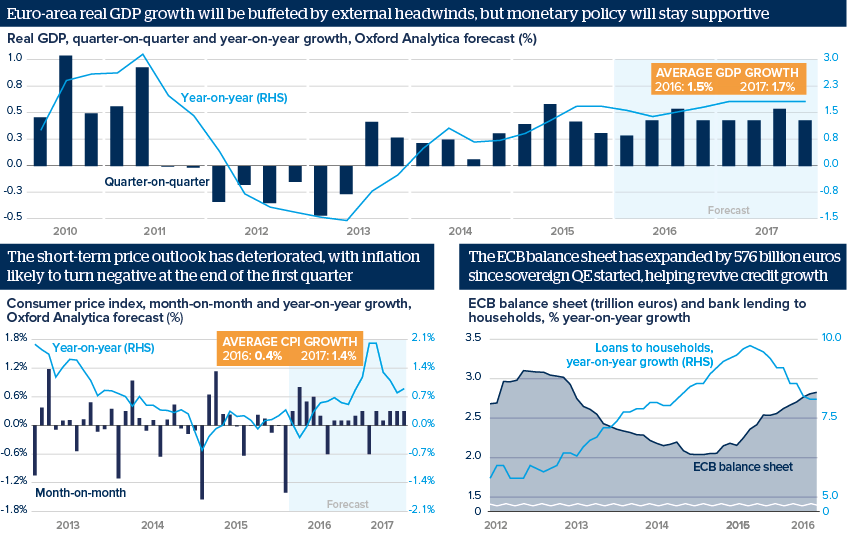

Euro-area growth failed to accelerate at end-2015, but confirmed that the recovery remains on track. Higher-frequency indicators available for the first quarter of 2016 suggest a continuing upswing in consumption, thanks to rising disposable incomes, the pass-through of monetary policy accommodation and neutral (or slightly expansionary) fiscal policy. Net trade will prove a drag on growth, due to cooling emerging markets.

The swing factor will be the outlook for inflation, which weakened significantly due to the latest fall in oil prices. The 2% inflation target will not be met even next year. Meanwhile, the lackluster recovery will drive up core inflation only mildly as the output gap gradually closes.

Impacts

- Downside risks to the recovery may materialise if consumers save most of the income gains from lower oil prices.

- The ECB will cut its deposit rate deeper into negative territory, likely by at least 10 basis points, and speed up asset purchases.

- After its recent rebound, the euro should weaken again, as the ECB eases monetary policy further, possibly giving some boost to exports.

See also

- Euro-area QE adjustments are likely before year-end - Aug 19, 2016

- ECB account confirms focus on euro-area inflation - May 20, 2016

- Euro-area's industrial sector is set to rebound ahead - May 12, 2016

- Monetary easing efficacy is decreasing globally - May 3, 2016

- ECB is unlikely to cut rates again soon - Apr 22, 2016

- Yen surge to question global monetary easing's effects - Apr 12, 2016

- Euro-area inflation will accelerate gradually in 2016 - Mar 31, 2016

- ECB will pursue its fight against euro-area deflation - Mar 11, 2016

- Renzi may shift EU macroeconomic narrative - Mar 9, 2016

- Low euro-area growth supports case for ECB action - Feb 16, 2016

- More graphic analysis