Swiss growth may accelerate, but franc is key risk

Growth is subdued, as the impact of the strong currency offsets any stimulus provided by negative interest rates

Source: Federal Statistics Office of Switzerland, Swiss National Bank, State Secretariat for Economic Affairs, Bloomberg, Oxford Analytica

Outlook

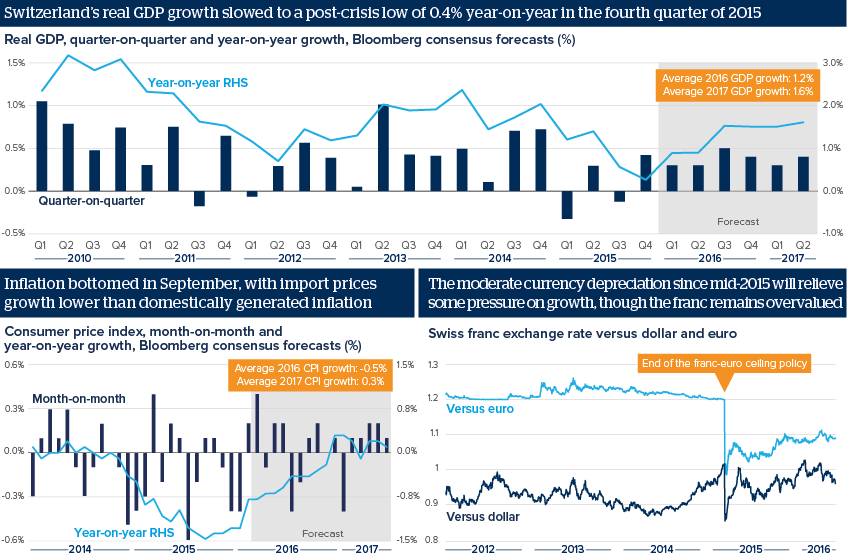

Switzerland's overall 2015 growth was 0.9%, slowing at yearend due to weak private consumption and investment. This was partly offset by upbeat export growth, up 9.5% year-on-year in the fourth quarter, thanks to a moderate depreciation of the franc in the second half of 2015.

The unemployment rate, at 3.4%, is low by global standards, but up from a low of 2.7% in mid-2011, contrasting with job-rich recoveries in other developed countries.

Interest rates have been on hold since January 2015, with the three-month Libor target between minus 1.25% and minus 0.25%. The sight deposit rate is minus 0.75%. The Swiss National Bank (SNB) still judges the franc as overvalued. Rates will stay unchanged this year.

Impacts

- Business and consumer surveys suggest growth will accelerate in early 2016.

- The franc's strength could hit margins as firms cut prices to stay competitive.

- An 'out' vote at the Brexit referendum in June would cause another bout of franc appreciation, as demand for safe-haven assets would surge.

- To prevent the franc from appreciating strongly, the SNB will not cut rates, but use alternative tools, such as forex market intervention.