Wages in EU's East will not catch up with West soon

EU11 labour costs have climbed in the past decade but at current rates will not reach the EU28 average until the 2040s

Source: Eurostat

Outlook

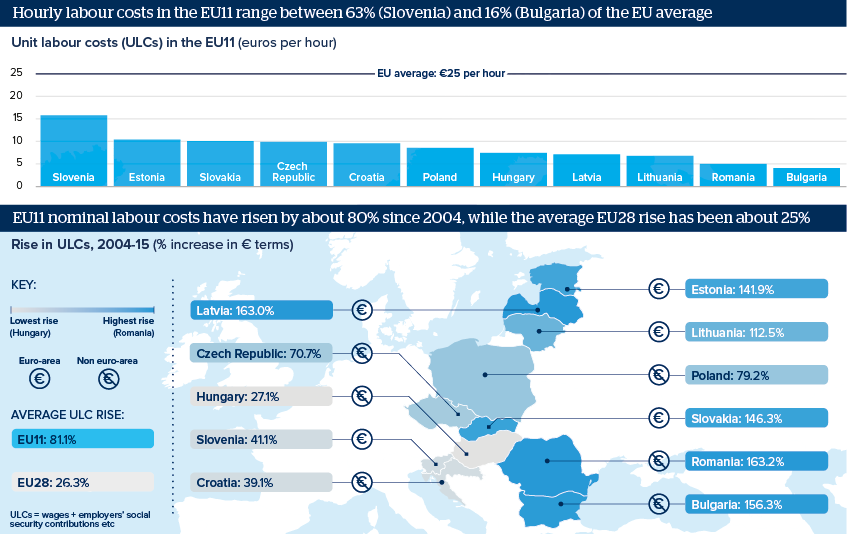

Sharp recent rises in average hourly euro ULCs suggest that the relatively low-wage ex-communist EU11 are converging slowly with higher-wage economies. Romania's costs were 8.2% higher year-on-year in 2015 (in stagnating Slovenia and Croatia, the rise was below the 2.0% EU28 average). Lower costs will make the EU11 competitive for years to come, although relatively meagre inward foreign direct investment (FDI) stocks suggest wages are not the only factor for employers considering moving East.

The EU11 will prosper, but at varying rates. Those starting nearest EU28 levels in 2004 have converged more slowly (GDP per capita at PPP in the Czech Republic in 2014 was 85% of the EU average, 6pp higher) than those that started furthest off (47% in Bulgaria, 12pp higher).

Impacts

- Exchange-rate factors obscure some comparisons: Hungary's labour costs rose by 27.1% in euro terms during 2004-15, but by 57.6% in forints.

- Being 'in' the euro is not a factor: the two lowest-wage economies (Bulgaria and Romania) are out but Bulgaria's lev is pegged to the euro.

- The two next-lowest (Latvia and Lithuania) are 'in'.

- Joining the euro would reduce exchange rate risk yet there is no enthusiasm among the 'outs' to adopt the euro any time soon.

- Higher Western wages will continue to pull emigration from the East.

See also

- Czech-Chinese MoU may mark FDI turning point - May 3, 2016

- Central-East Europe will retain competitive advantage - Jan 13, 2015

- More graphic analysis