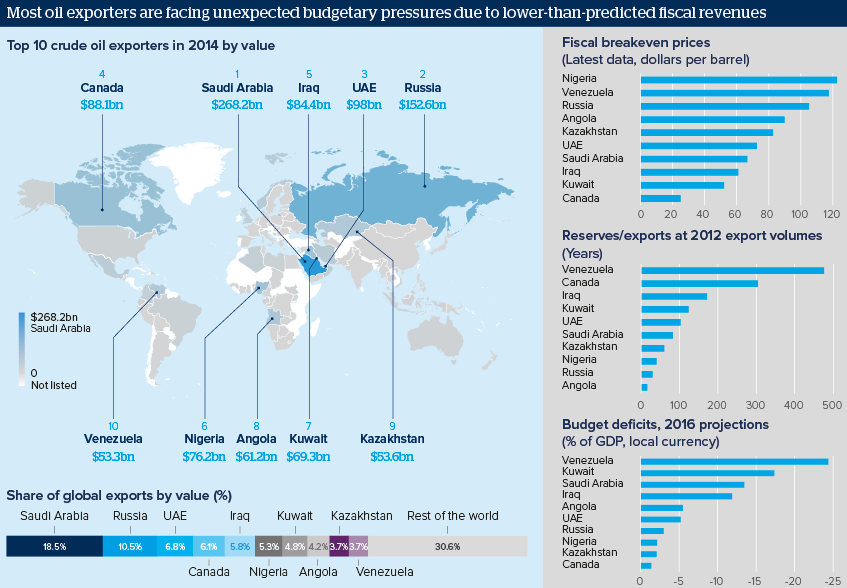

Cheap oil will weigh long-term on top exporters

OPEC members have so far failed to agree output cuts to boost prices

Source: IMF, World Bank, Bloomberg, US EIA, International energy statistics, OPEC, Saudi official preliminary estimates, Trading Economics, Reuters, Central Bank of Nigeria, Kuwait Times, Arab Times, allAfrica, Interfaz-Kazakhstan, Economist, Rystad Energy, Deutsche Bank, IHS Global Insight, Wall Street Journal, The World Factbook, Oxford Analytica

Outlook

Saudi Arabia, the largest oil exporter, is facing severe budget strains. It needs oil at 67 dollars per barrel in order to balance its fiscal budget, currently projected at a 13.5% of GDP deficit this year after a 15% deficit in 2015.

To increase revenues, the kingdom is looking into the privatisation of Saudi Aramco, the national oil company. Poorer countries have been forced to cut subsidies and welfare programmes.

Saudi Arabia has large reserves, able to cover up to 83 years of exports at 2012 export volumes. Other countries, such as Venezuela and Canada, have centuries of reserves. However, these contain heavy oil and tar sands deposits that may not be recoverable under present prices.

Impacts

- Venezuela will be the most affected country as it has the highest oil export revenue dependency at more than 90%.

- With low reserves and a high breakeven price, Nigeria will also be hit hard.

- High fiscal deficits will cause government expenditure cuts in various OPEC countries, possibly prompting social unrest.