US Ex-Im Bank restrictions will aid competitors abroad

Political battles in Washington will cost big-ticket US exporters sales overseas

Source: US Export-Import Bank Annual Reports, Congressional Research Service, Oxford Analytica

Outlook

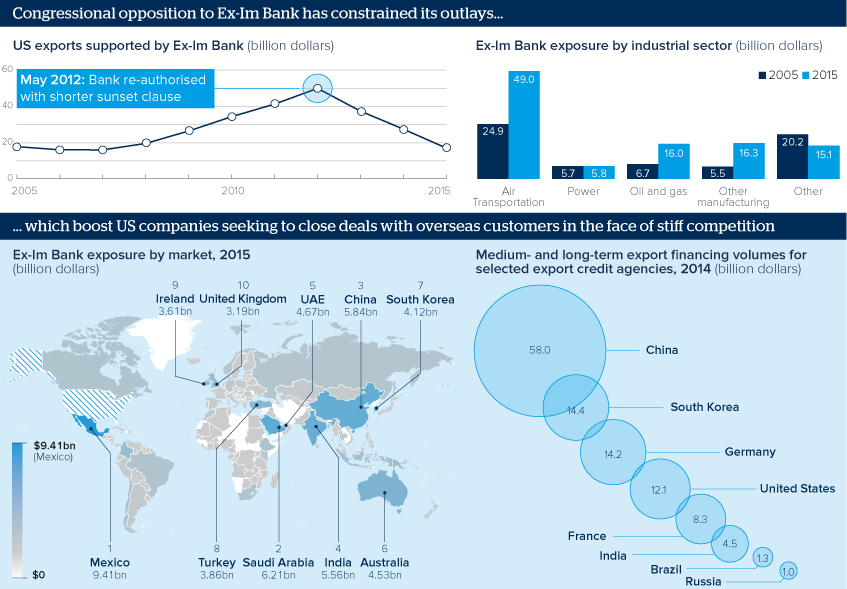

The US Export-Import (Ex-Im) Bank supported more than 17 billion dollars of sales by US firms overseas in the 2015 fiscal year by providing export insurance, guaranteeing US exporter lending to foreign customers and issuing loans outright to overseas purchasers of US goods.

However, anti-Bank Senate Republicans have blocked President Barack Obama's appointee to fill the third seat of the bank's five-member board. Without a quorum, Ex-Im Bank cannot approve outlays of 10 million dollars or more, severely constraining its operations.

Should allies of Ex-Im Bank not win both a filibuster-proof Senate majority and the White House in 2016, the vacancy is likely to blunt the competitive edge abroad of US firms supplying aircraft, extractives equipment, infrastructure components and other items in the near term.

Impacts

- Mexico's Pemex -- the bank's largest obligator -- is caught between mounting pension obligations and the need to upgrade ageing facilities.

- Airbus will be the prime beneficiary of lost Boeing commercial aircraft sales as low-cost carriers expand their fleets.

- US manufacturers may relocate production overseas to benefit from foreign export credit.

- OECD negotiations on reducing government-backed export credit are unlikely to progress without buy-in from non-OECD countries.