Oil exporters share fiscal troubles, not resilience

Leading exporters prioritise market share over fiscal considerations -- for now

Source: IMF, World Bank, Bloomberg, US EIA, International energy statistics, OPEC, Saudi official preliminary estimates, Trading Economics, Central Bank of Nigeria, Interfaz-Kazakhstan, Rystad Energy, Deutsche Bank, media reports, Oxford Analytica

Outlook

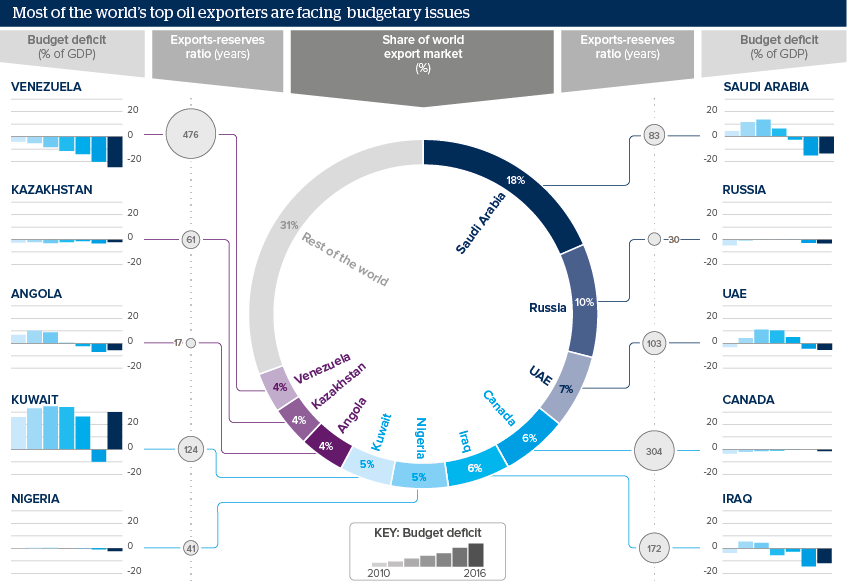

Most oil producers share fiscal troubles and large budget deficits, which they are trying to address. Saudi Arabia, the largest oil exporter, is considering diversifying its economy, together with broad-based taxation and capital spending cuts. Most countries are cutting subsidies.

However, the top ten world producers differ on ‘resilience’, that is how long they could keep up their export pace if they stopped pumping and only used their reserves. Despite having the largest budget deficit, Venezuela’s proven oil reserves as of 2014 could cover 476 years of exports as of 2012 volumes. Angola’s reserves can cover only 17 years of exports.

‘Brexit’ will increase political uncertainty and could prevent the balancing of oil demand and supply by early 2017, as previously expected, slowing global oil demand.

Impacts

- Saudi Arabia has stepped back from its market-balancing role for now, but may return to a sort of ‘stewardship’ under the new oil minister.

- Iraqi output growth is likely to slow due to imminent infrastructure bottlenecks, most notably inadequate water reinjection.

- Iran has front-loaded its return to the market and its production is likely to slow over the next few months.

See also

- Prospects for fossil fuels to end-2016 - Jun 10, 2016

- More graphic analysis