Saudi instability risk will rise if reforms fail

The kingdom's eroding public finances raise questions over its long-term resilience

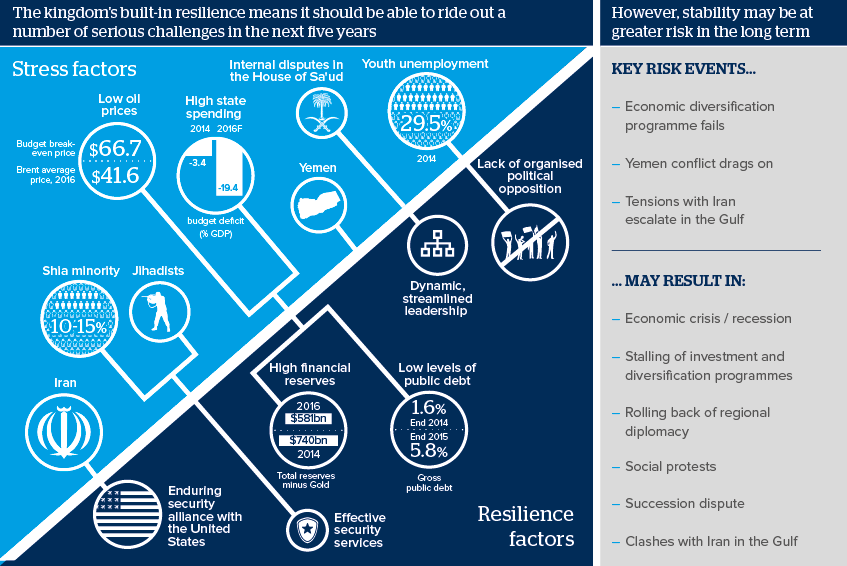

Source: IMF, Bank Audi, Oxford Analytica, World Bank, ILO, US EIA

Outlook

The Saudi state has used popular redistribution to maintain internal stability in a turbulent environment of leadership succession, low oil prices, the Yemen intervention and regional upheavals.

With financial reserves still high and public debt low, the kingdom can continue spending at current levels until 2020. This makes serious civil unrest unlikely in the short term, and gives the government the political space it needs to attempt to reduce the economy's dependence on oil.

However, if economic reforms fail and not enough private sector jobs are created for the growing number of young Saudi graduates, then the instability risk will rise substantially in the 5-10 year timeframe.

Impacts

- The most likely instability event is an employment or social crisis leading to mass protests.

- A deep economic crisis could galvanise youth activists into a movement that can challenge the regime.

- The House of Sa'ud's rule is secure - but economic crisis could move the kingdom towards constitutional monarchy.

- Fiscal pressures will compel the Saudi leadership to negotiate a peace in Yemen in 2017.

- Saudi Arabia will step back from its 'activist' role in regional politics and security.