Cheap oil will persist despite international talks

Beyond the hype, OPEC and Russia will struggle to agree an output freeze

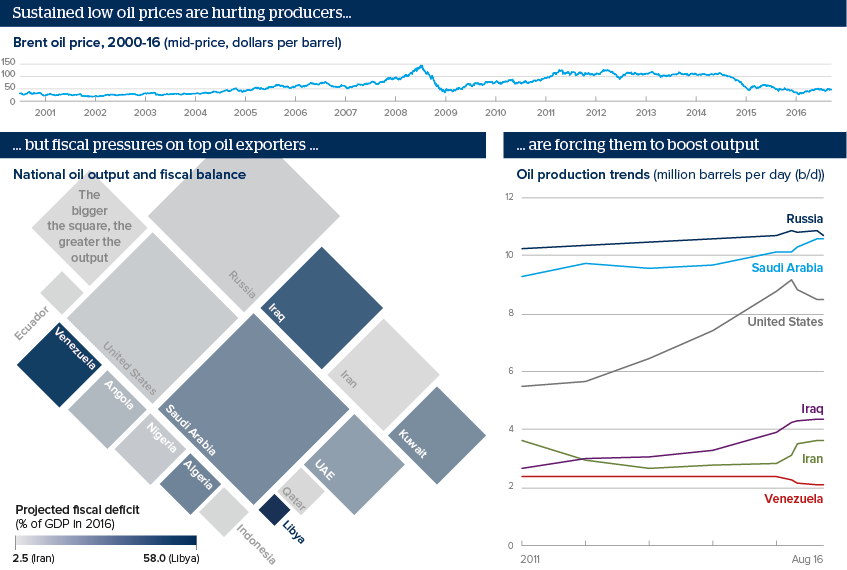

Source: Bloomberg, OPEC, US Energy Information Administration, IMF World Economic Outlook

Outlook

An informal 'OPEC-plus' meeting, including Russia, will be held in Algiers at the end of the month to discuss how to manage oil prices. A meaningful agreement is unlikely.

Russia, with limited scope to boost output and facing fiscal pressure, urgently needs higher prices and is pushing for an output freeze. Saudi Arabia also prefers higher prices, but has low production costs and financial reserves to cope with a large fiscal deficit. It is more concerned to quash its geopolitical rival, Iran, which wants to be exempted from any freeze as it aims to reach its pre-sanctions production levels (it needs another 400,000 b/d).

With world production at record highs, including from non-OPEC producers such as the United States, the oil price is likely to remain range-bound in 2016-17.

Impacts

- With reduced oil revenues and systemic resistance to reform, Russia can expect low growth rates and difficult budget spending choices.

- Saudi Arabia will rein in fiscal spending but struggle to diversify into non-oil sectors.

- Iran could meet its 4 million b/d output target by early 2017.

- With oil at 95% of export revenues and the state oil company near default, cheap oil and falling output could tip Venezuela over the edge.

- Creditors' bad memories of the mid-2014 price collapse will discourage US shale drillers from taking a bold approach to production growth.

See also

- OPEC deal would encourage US shale producer rally - Nov 17, 2016

- Saudi oil policy will hold firm to market-led approach - Jun 8, 2016

- More graphic analysis