Output cuts will not relieve OPEC oil dependency risks

Lack of detail on production cap leaves uncertainty high, keeping prices low and some countries in macroeconomic peril

Source: OPEC

Outlook

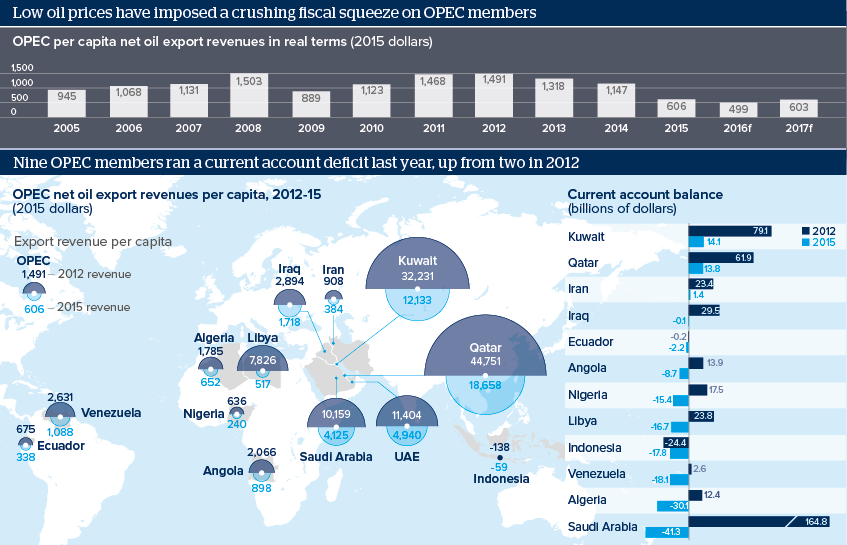

OPEC members and Russia agreed to cap oil production yesterday. Prices rose although they are still only around half their 2012 peak. Much of the rise was likely speculation. Until country specific details are agreed, prices will stay under pressure, reducing the revenues of national oil companies and governments.

Oil accounts for almost half the value of total OPEC exports. For Angola, Libya, Nigeria and Venezuela, the share is around 95%. Net oil export revenues for the group declined from 1.2 trillion dollars in 2012 to 413 billion dollars in 2015, swinging OPEC last year from a collective 483-billion-dollar current account surplus in 2012 to its first deficit since 1998.

OPEC members assume an oil price of 35 dollars a barrel in their 2016 budgets (73 dollars in 2015). Last year, net oil export revenues typically declined between 40% and 50%, reducing the scope of member governments to invest in public services and raising risks of instability.

Impacts

- Despite the deal, the oil price outlook remains uncertain; unwinding risks are very high and current prices ranges are forecast to persist.

- Low oil prices underscore the need for structural reform to foster diversification but this is harder the more oil dependent a country is.

- Oil exporters with large fiscal buffers will have more time to make budgetary adjustments, but many still face large medium-term deficits.

- Fiscally or externally vulnerable exporters may be forced into currency devaluation.

See also

- 2017 may see economic upturn in Colombia - Dec 14, 2016

- OPEC quotas may have small impact - Oct 10, 2016

- Global oil stock overhang will not abate soon - Aug 30, 2016

- More graphic analysis