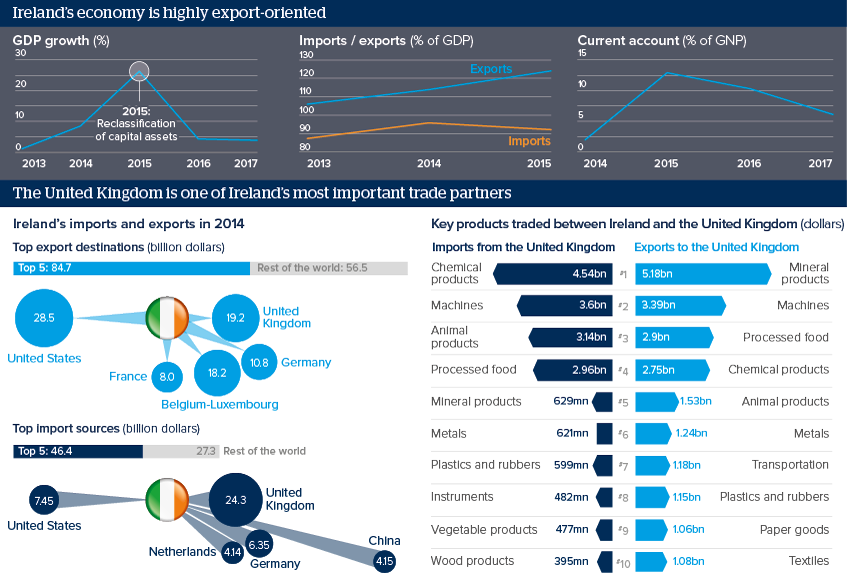

Ireland's economy will suffer after Brexit

Alongside the border and migration, trade is a key concern for Ireland

Source: The Economic and Social Research Institute, Eurostat, The Observatory of Economic Complexity

Outlook

As a small, open economy with close trade links to the United Kingdom, Ireland will be hit hard by Brexit. The full impact will depend on whether the United Kingdom remains a member of the single market; currently UK Prime Minister Theresa May appears to prioritise control over EU migration over economic concerns.

Short-term risks for Ireland include the impact of sluggish growth across the EU on trade, currency volatility -- the depreciation of the pound against the euro could hurt Irish exporters -- as well as declining investor confidence. Long-term risks are driven by the continued uncertainty over the United Kingdom’s future relationship with the EU.

Impacts

- A study by the Irish Economic and Social Research Institute suggests that Irish-UK trade flows could fall by 20% as a result of Brexit.

- Agriculture is likely to be hit hardest by the depreciation of the pound, due to its low profit margins.

- The future status of the internal Irish border is uncertain; suggestions include shifting migration controls to the external border.

- Ireland could attract some financial or insurance companies based in London, especially if the United Kingdom loses its passporting rights.